Page 125 - 34-2

P. 125

NTU Management Review Vol. 34 No. 2 Aug. 2024

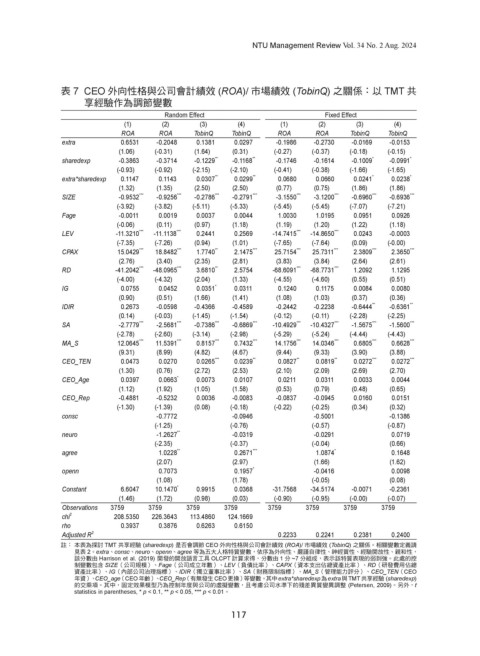

表 7 CEO 外向性格與公司會計績效 (ROA)/ 市場績效 (TobinQ) 之關係:以 TMT 共

享經驗作為調節變數

Random Effect Fixed Effect

(1) (2) (3) (4) (1) (2) (3) (4)

ROA ROA TobinQ TobinQ ROA ROA TobinQ TobinQ

extra 0.6531 -0.2048 0.1381 0.0297 -0.1986 -0.2730 -0.0169 -0.0153

(1.06) (-0.31) (1.64) (0.31) (-0.27) (-0.37) (-0.18) (-0.15)

sharedexp -0.3863 -0.3714 -0.1229 ** -0.1168 ** -0.1746 -0.1614 -0.1009 * -0.0991 *

(-0.93) (-0.92) (-2.15) (-2.10) (-0.41) (-0.38) (-1.66) (-1.65)

extra*sharedexp 0.1147 0.1143 0.0307 ** 0.0299 ** 0.0680 0.0660 0.0241 * 0.0238 *

(1.32) (1.35) (2.50) (2.50) (0.77) (0.75) (1.86) (1.86)

SIZE -0.9532 *** -0.9256 *** -0.2786 *** -0.2791 *** -3.1550 *** -3.1200 *** -0.6960 *** -0.6936 ***

(-3.92) (-3.82) (-5.11) (-5.33) (-5.45) (-5.45) (-7.07) (-7.21)

Fage -0.0011 0.0019 0.0037 0.0044 1.0030 1.0195 0.0951 0.0926

(-0.06) (0.11) (0.97) (1.18) (1.19) (1.20) (1.22) (1.18)

LEV -11.3210 *** -11.1138 *** 0.2441 0.2569 -14.7415 *** -14.8650 *** 0.0243 -0.0003

(-7.35) (-7.26) (0.94) (1.01) (-7.65) (-7.64) (0.09) (-0.00)

CPAX 15.0429 *** 18.8482 *** 1.7740 ** 2.1475 *** 25.7154 *** 25.7311 *** 2.3809 *** 2.3650 ***

(2.76) (3.40) (2.35) (2.81) (3.83) (3.84) (2.64) (2.61)

RD -41.2042 *** -48.0965 *** 3.6810 ** 2.5754 -68.6091 *** -68.7731 *** 1.2092 1.1295

(-4.00) (-4.32) (2.04) (1.33) (-4.55) (-4.60) (0.55) (0.51)

IG 0.0755 0.0452 0.0351 * 0.0311 0.1240 0.1175 0.0084 0.0080

(0.90) (0.51) (1.66) (1.41) (1.08) (1.03) (0.37) (0.36)

IDIR 0.2673 -0.0598 -0.4366 -0.4589 -0.2442 -0.2238 -0.6444 ** -0.6361 **

(0.14) (-0.03) (-1.45) (-1.54) (-0.12) (-0.11) (-2.28) (-2.25)

SA -2.7779 *** -2.5681 *** -0.7386 *** -0.6869 *** -10.4929 *** -10.4327 *** -1.5675 *** -1.5600 ***

(-2.78) (-2.60) (-3.14) (-2.98) (-5.29) (-5.24) (-4.44) (-4.43)

MA_S 12.0645 *** 11.5391 *** 0.8157 *** 0.7432 *** 14.1756 *** 14.0346 *** 0.6805 *** 0.6628 ***

(9.31) (8.99) (4.82) (4.67) (9.44) (9.33) (3.90) (3.88)

CEO_TEN 0.0473 0.0270 0.0265 *** 0.0239 ** 0.0827 ** 0.0819 ** 0.0272 *** 0.0272 ***

(1.30) (0.76) (2.72) (2.53) (2.10) (2.09) (2.69) (2.70)

CEO_Age 0.0397 0.0663 * 0.0073 0.0107 0.0211 0.0311 0.0033 0.0044

(1.12) (1.92) (1.05) (1.58) (0.53) (0.79) (0.48) (0.65)

CEO_Rep -0.4881 -0.5232 0.0036 -0.0083 -0.0837 -0.0945 0.0160 0.0151

(-1.30) (-1.39) (0.08) (-0.18) (-0.22) (-0.25) (0.34) (0.32)

consc -0.7772 -0.0946 -0.5001 -0.1386

(-1.25) (-0.76) (-0.57) (-0.87)

neuro -1.2627 ** -0.0319 -0.0291 0.0719

(-2.35) (-0.37) (-0.04) (0.66)

agree 1.0228 ** 0.2671 *** 1.0874 * 0.1648

(2.07) (2.97) (1.66) (1.62)

openn 0.7073 0.1957 * -0.0416 0.0098

(1.08) (1.78) (-0.05) (0.08)

Constant 6.6047 10.1470 * 0.9915 0.0368 -31.7568 -34.5174 -0.0071 -0.2361

(1.46) (1.72) (0.98) (0.03) (-0.90) (-0.95) (-0.00) (-0.07)

Observations 3759 3759 3759 3759 3759 3759 3759 3759

chi 2 208.5350 226.3643 113.4860 124.1669

rho 0.3937 0.3876 0.6263 0.6150

Adjusted R 2 0.2233 0.2241 0.2381 0.2400

註: 本表為探討 TMT 共享經驗 (sharedexp) 是否會調節 CEO 外向性格與公司會計績效 (ROA)/ 市場績效 (TobinQ) 之關係。相關變數定義請

見表 2。extra、consc、neuro、openn、agree 等為五大人格特質變數,依序為外向性、嚴謹自律性、神經質性、經驗開放性、親和性,

該分數由 Harrison et al. (2019) 開發的開放語言工具 OLCPT 計算求得,分數由 1 分 ~7 分組成,表示該特質表現的弱到強。此處的控

制變數包含 SIZE(公司規模)、Fage(公司成立年數)、LEV(負債比率)、CAPX(資本支出佔總資產比率)、RD(研發費用佔總

資產比率)、IG(內部公司治理指標)、IDIR(獨立董事比率)、SA(財務限制指標)、MA_S(管理能力評分)、CEO_TEN(CEO

年資)、 CEO_age (CEO年齡)、 CEO_Rep (有無發生CEO更換)等變數。其中extra*sharedexp為extra與TMT共享經驗 (sharedexp)

的交乘項。其中,固定效果模型乃為控制年度與公司的虛擬變數,且考慮公司水準下的殘差異質變異調整 (Petersen, 2009)。另外,t

statistics in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01。

117