Page 130 - 34-2

P. 130

CEO Extraversion, Management Team Characteristics, and Firm Operating Performance

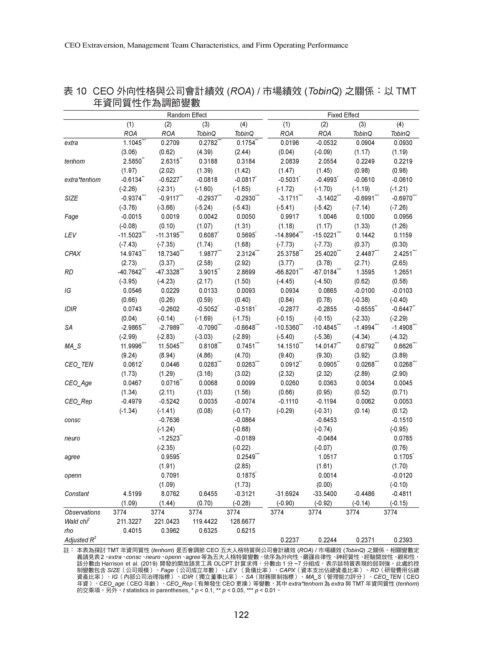

表 10 CEO 外向性格與公司會計績效 (ROA) / 市場績效 (TobinQ) 之關係:以 TMT

年資同質性作為調節變數

Random Effect Fixed Effect

(1) (2) (3) (4) (1) (2) (3) (4)

ROA ROA TobinQ TobinQ ROA ROA TobinQ TobinQ

extra 1.1045 *** 0.2709 0.2782 *** 0.1754 ** 0.0196 -0.0532 0.0904 0.0930

(3.06) (0.62) (4.39) (2.44) (0.04) (-0.09) (1.17) (1.19)

tenhom 2.5850 ** 2.6315 ** 0.3188 0.3184 2.0839 2.0554 0.2249 0.2219

(1.97) (2.02) (1.39) (1.42) (1.47) (1.45) (0.98) (0.98)

extra*tenhom -0.6134 ** -0.6227 ** -0.0818 -0.0817 * -0.5031 * -0.4993 * -0.0610 -0.0610

(-2.26) (-2.31) (-1.60) (-1.65) (-1.72) (-1.70) (-1.19) (-1.21)

SIZE -0.9374 *** -0.9117 *** -0.2937 *** -0.2930 *** -3.1711 *** -3.1402 *** -0.6991 *** -0.6970 ***

(-3.76) (-3.66) (-5.24) (-5.43) (-5.41) (-5.42) (-7.14) (-7.26)

Fage -0.0015 0.0019 0.0042 0.0050 0.9917 1.0046 0.1000 0.0956

(-0.08) (0.10) (1.07) (1.31) (1.18) (1.17) (1.33) (1.26)

LEV -11.5023 *** -11.3195 *** 0.6087 * 0.5695 * -14.8964 *** -15.0221 *** 0.1442 0.1159

(-7.43) (-7.35) (1.74) (1.68) (-7.73) (-7.73) (0.37) (0.30)

CPAX 14.9743 *** 18.7340 *** 1.9877 *** 2.3124 *** 25.3758 *** 25.4020 *** 2.4487 *** 2.4251 ***

(2.73) (3.37) (2.58) (2.92) (3.77) (3.78) (2.71) (2.65)

RD -40.7642 *** -47.3328 *** 3.9015 ** 2.8699 -66.8201 *** -67.0184 *** 1.3595 1.2651

(-3.95) (-4.23) (2.17) (1.50) (-4.45) (-4.50) (0.62) (0.58)

IG 0.0546 0.0229 0.0133 0.0093 0.0934 0.0865 -0.0100 -0.0103

(0.66) (0.26) (0.59) (0.40) (0.84) (0.78) (-0.38) (-0.40)

IDIR 0.0743 -0.2602 -0.5052 * -0.5181 * -0.2877 -0.2855 -0.6555 ** -0.6447 **

(0.04) (-0.14) (-1.69) (-1.75) (-0.15) (-0.15) (-2.33) (-2.29)

SA -2.9865 *** -2.7989 *** -0.7090 *** -0.6648 *** -10.5360 *** -10.4845 *** -1.4994 *** -1.4908 ***

(-2.99) (-2.83) (-3.03) (-2.89) (-5.40) (-5.36) (-4.34) (-4.32)

MA_S 11.9996 *** 11.5045 *** 0.8108 *** 0.7451 *** 14.1510 *** 14.0147 *** 0.6792 *** 0.6626 ***

(9.24) (8.94) (4.86) (4.70) (9.40) (9.30) (3.92) (3.89)

CEO_TEN 0.0612 * 0.0446 0.0283 *** 0.0263 *** 0.0912 ** 0.0905 ** 0.0268 *** 0.0268 ***

(1.73) (1.29) (3.16) (3.02) (2.32) (2.32) (2.89) (2.90)

CEO_Age 0.0467 0.0716 ** 0.0068 0.0099 0.0260 0.0363 0.0034 0.0045

(1.34) (2.11) (1.03) (1.56) (0.66) (0.95) (0.52) (0.71)

CEO_Rep -0.4979 -0.5242 0.0035 -0.0074 -0.1110 -0.1194 0.0062 0.0053

(-1.34) (-1.41) (0.08) (-0.17) (-0.29) (-0.31) (0.14) (0.12)

consc -0.7636 -0.0864 -0.6453 -0.1510

(-1.24) (-0.68) (-0.74) (-0.95)

neuro -1.2523 ** -0.0189 -0.0484 0.0785

(-2.35) (-0.22) (-0.07) (0.76)

agree 0.9595 * 0.2549 *** 1.0517 0.1705 *

(1.91) (2.85) (1.61) (1.70)

openn 0.7091 0.1875 * 0.0014 -0.0120

(1.09) (1.73) (0.00) (-0.10)

Constant 4.5199 8.0762 0.6455 -0.3121 -31.6924 -33.5400 -0.4486 -0.4811

(1.09) (1.44) (0.70) (-0.28) (-0.90) (-0.92) (-0.14) (-0.15)

Observations 3774 3774 3774 3774 3774 3774 3774 3774

Wald chi 2 211.3227 221.0423 119.4422 128.6677

rho 0.4015 0.3962 0.6325 0.6215

Adjusted R 2 0.2237 0.2244 0.2371 0.2393

註: 本表為探討 TMT 年資同質性 (tenhom) 是否會調節 CEO 五大人格特質與公司會計績效 (ROA) / 市場績效 (TobinQ) 之關係。相關變數定

義請見表2。 extra、 consc、 neuro、 openn、 agree等為五大人格特質變數,依序為外向性、嚴謹自律性、神經質性、經驗開放性、親和性,

該分數由 Harrison et al. (2019) 開發的開放語言工具 OLCPT 計算求得,分數由 1 分 ~7 分組成,表示該特質表現的弱到強。此處的控

制變數包含 SIZE(公司規模)、Fage(公司成立年數)、LEV (負債比率)、CAPX(資本支出佔總資產比率)、RD(研發費用佔總

資產比率)、IG(內部公司治理指標)、IDIR(獨立董事比率)、SA(財務限制指標)、MA_S(管理能力評分)、CEO_TEN(CEO

年資)、CEO_age(CEO 年齡)、CEO_Rep(有無發生 CEO 更換)等變數,其中 extra*tenhom 為 extra 與 TMT 年資同質性 (tenhom)

的交乘項。另外,t statistics in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01。

122