臺大管理論叢

第

26

卷第

2

期

23

(2)

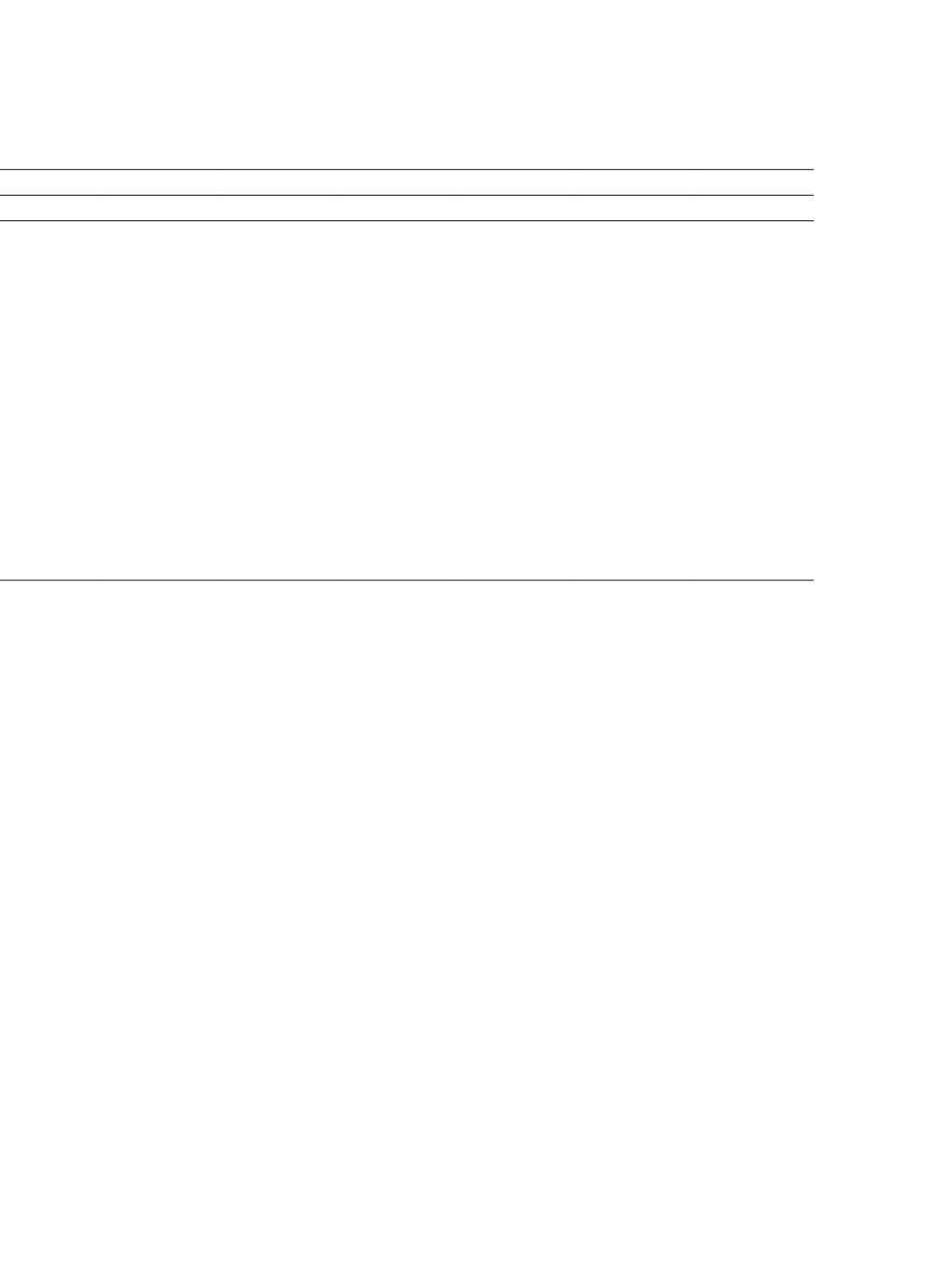

Tax-avoidance = CETR

(3)

Tax-avoidance = BTD

Spec = IPS Spec = IPS_D Spec = IMS Spec = IMS_D Spec = IPS Spec = IPS_D

(1.64)

(1.61)

(0.73)

(0.71)

(0.72)

(0.68)

0.0171***

0.0165***

0.6999***

0.7049***

0.7050***

0.7106***

(15.71)

(15.63)

(45.71)

(47.00)

(46.05)

(47.98)

0.0875***

0.0880***

0.2038

0.2028

0.2043

0.1959

(6.05)

(6.09)

(1.01)

(1.00)

(1.01)

(0.97)

-0.0416

-0.0416***

1.5411***

1.5361***

1.5525***

1.5496***

(-6.76)

(-6.76)

(17.81)

(17.74)

(17.94)

(17.90)

0.0150

0.0153

0.2996

0.2968

0.3129*

0.3049

(1.09)

(1.12)

(1.56)

(1.54)

(1.67)

(1.58)

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

7692

7692

7692

7692

7692

7692

26.09

26.97

128.40

128.26

128.42

127.99

0.1029

0.1025

0.3677

0.3674

0.3677

0.3669

expertise and tax avoidance in the Big 4 samples separately. Table 9 presents the main

results. It seems that the positive association between auditor industry expertise and tax

avoidance is still there, but the coefficients of interactive variables are not significant in most

of these regressions, which means that the Big 4 were less affected by independence problem

compared to other audit firms.