審計人員之產業專精與客戶租稅規避:中國實證研究

28

coefficient estimates from Model (4), this study constructs an inverse Mills ratio (

IMR

) and

include it as an additional explanatory variable in Model (1), (2), and (3).

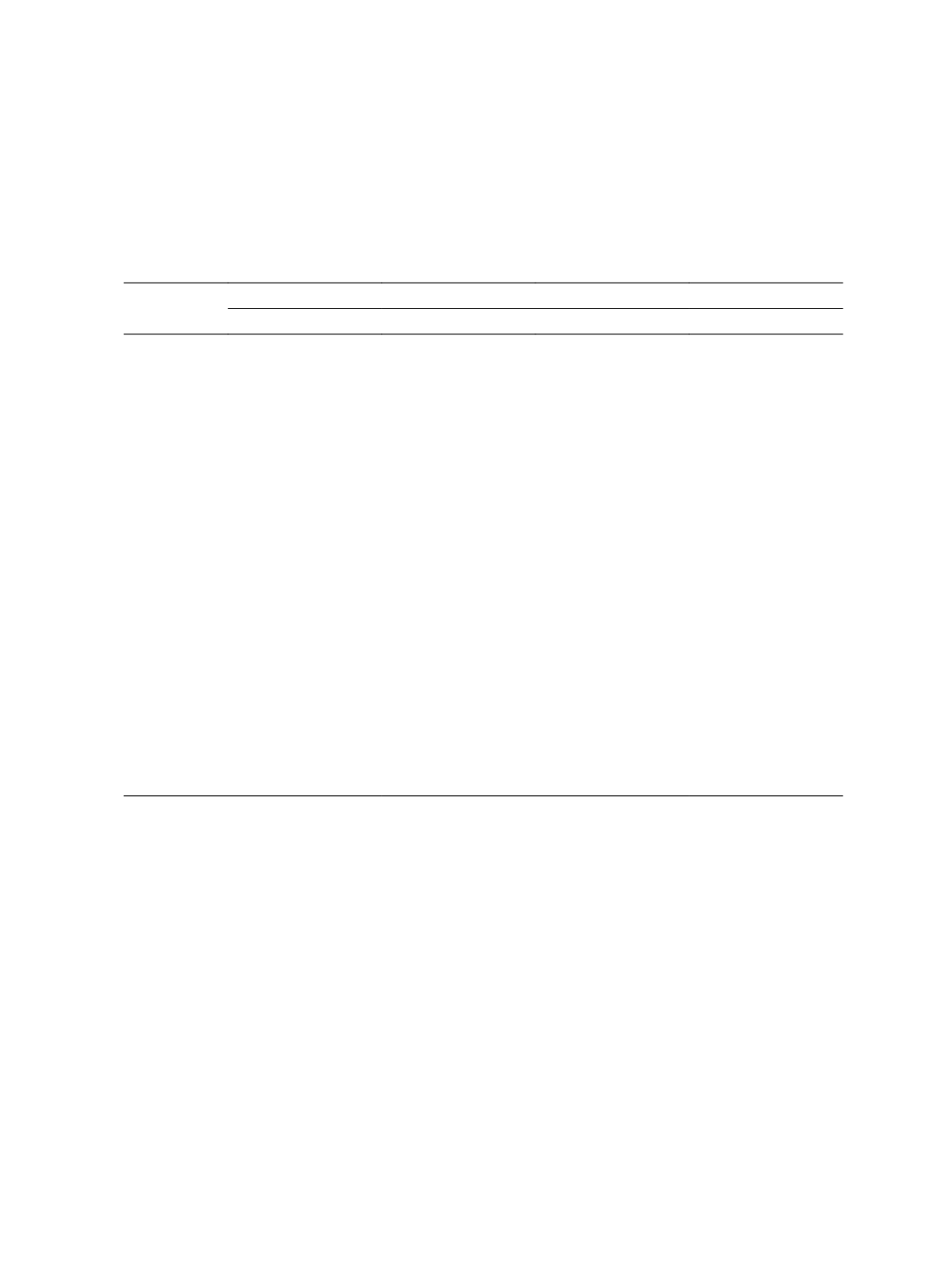

Table 11 First-stage Model: Probability of Choosing Industry Expert as Auditor

Variables

(1)

Spec = IMS_D

(2)

Spec = IPS_D

Coefficient

Z-Stat

Coefficient

Z-Stat

Constant

-7.3525***

-17.21

-8.7839

-0.13

Tenure

0.0189**

2.16

0.0046

0.56

Lnauditfee

0.0562***

2.65

-0.0053

-0.27

Tax-ratio

0.5069*

1.73

0.5993*

1.72

Sales

0.2243***

5.80

0.1048***

2.93

Lnage

-0.0039

-0.92

-0.0108**

-2.16

Local

0.0297

0.59

0.1114**

2.24

Big10

1.3786***

24.66

0.2020***

4.26

Soe

0.0680

1.33

-0.0370

-0.72

Size

0.2299***

10.74

0.1621***

7.31

ROA

-0.4667

-1.48

-0.1656

-0.47

Lev

0.2815**

2.14

0.0679

0.51

CFO

0.1925

0.69

-0.1934

-0.68

IND

Controlled

Controlled

Year

Controlled

Controlled

Chi-Square

1881.74***

842.08***

Pseudo R

2

0.3810

0.2754

N

7660

7133

Note: This table presents the first-stage Probit regression result of determinants of firm choosing

industry expert as auditor. Regression (1) use industry market share (

IMS_D

) to proxy industry

expert, regression (2) use industry portfolio share (

IPS_D

) to proxy industry expert. The sample

includes 7,660 firm-year observations for the period 2008-2012 in regression (1), and 7,133 firm-

year observations in model (2). Z-statistics are presented in the column next to coefficient. ***, **,

* stand for a statistical significant level of 1%, 5%, and 10% respectively.

Table 12 reports the second-stage OLS regression results of auditor industry expertise

on tax avoidance. Consistent with the industry expertise of auditor being associated with

higher levels of tax avoidance, this study finds a negative and significant coefficient of

Spec

in the regression of

Spec

(measured by

IMS_D

) on

CETR

, and a positive and significant

coefficient of

Spec

in the regression of

Spec

(measured by

IPS_D

) on

BTD

. In addition, a

negative association between interaction variables (

Spec

*

Fee

and

Spec

*

Tenure

) and efficient

tax ratio (

BETR

and

CETR

) is found in most of these regressions, as well as a positive