審計人員之產業專精與客戶租稅規避:中國實證研究

18

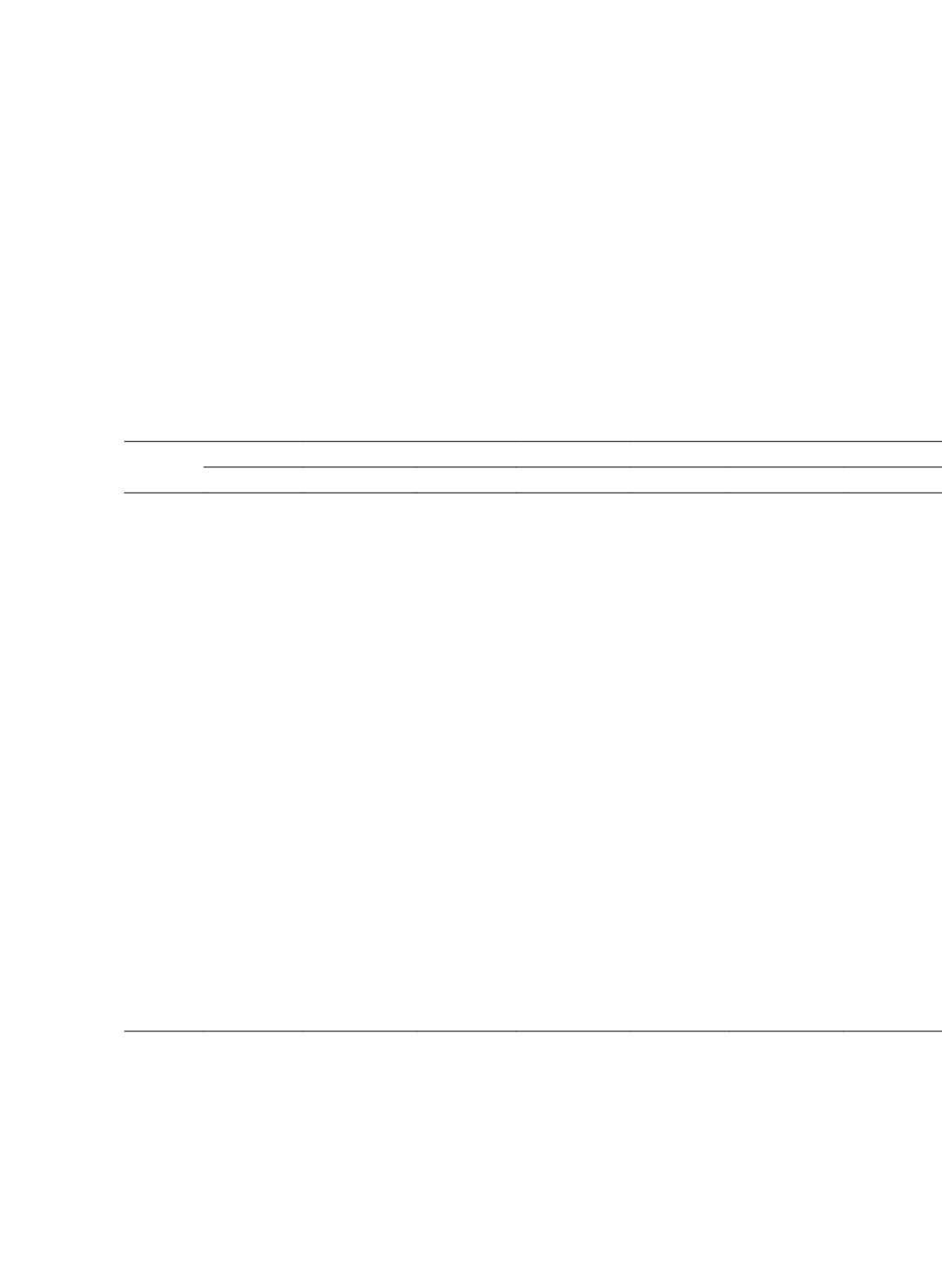

4.3 Multivariate Regression Analysis

Table 7 reports the OLS regression results of auditor industry expertise on tax

avoidance. This study uses

BETR

,

CETR,

and

BTD

to measure tax avoidance, and

IMS

,

IMS_

D

,

IPS

and

IPS_D

as proxies for auditor industry expertise in Model (1), (2), and (3). Table 7

suggests that auditor industry expertise (

Spec

) based on industry market share (

IMS

and

IMS_D

) is negatively associated with

BETR

and

CETR

in most of these regressions and

positively associated with

BTD

. This result indicates that auditors who are industry experts

Table 7 Association between Auditor Industry Expertise and Tax Avoidance

Variables

(1)

Tax-avoidance = BETR

(2)

Tax-avoidance = CETR

Spec = IMS Spec = IMS_D Spec = IPS Spec = IPS_D Spec = IMS Spec = IMS_D

Constant

-0.0834***

-0.0789***

-0.0681***

-0.0671***

-0.2007***

-0.1889***

(-4.03)

(-3.86)

(-3.32)

(-3.30)

(-8.65)

(-8.23)

Spec

-0.0743***

-0.0142***

-0.0046

-0.0005

-0.0571***

-0.0019

(-3.82)

(-4.01)

(-0.39)

(-0.13)

(-2.61)

(-1.23)

Big10

-0.0054**

-0.0063***

-0.0093***

-0.0092***

-0.0041

0.0014

(-2.25)

(-2.73)

(-4.14)

(-4.15)

(-1.52)

(0.55)

Soe

0.0031

0.0031

0.0029

0.0029

0.0044*

0.0044*

(1.29)

(1.29)

(1.22)

(1.23)

(1.67)

(1.67)

Size

0.0090***

0.0087***

0.0081***

0.0081***

0.0167***

0.0160***

(9.43)

(9.31)

(8.65)

(8.70)

(15.60)

(15.24)

Roa

0.0329**

0.0331**

0.0335***

0.0334***

0.0875***

0.0878***

(2.56)

(2.57)

(2.60)

(2.59)

(6.05)

(6.07)

Lev

-0.0149***

-0.0147***

-0.0154***

-0.0154***

-0.0418***

-0.0422***

(-2.73)

(-2.69)

(-2.81)

(-2.83)

(-6.82)

(-6.87)

CFO

0.0424***

0.0421***

0.0419***

0.0418***

0.0146

0.0141

(3.48)

(3.45)

(3.43)

(3.42)

(1.06)

(1.03)

Year

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Industry

Controlled Controlled Controlled Controlled Controlled Controlled

N

7692

7692

7692

7692

7692

7692

F Value

43.22

43.28

42.68

42.67

29.08

27.85

Adjusted R

2

0.1454

0.1456

0.1438

0.1438

0.1021

0.1013

Note: This table presents results of an OLS regression of auditor industry expertise on clients’ tax

avoidance. The dependent variable tax avoidance is measured by

BETR

, and the key independent

variable auditor industry expertise is measured by

IMS

,

IMS_D

,

IPS,

and

IPS_D

. In Model (1), we

use

BETR

as a proxy for tax avoidance. In Model (2), we use

CETR

as a proxy for tax avoidance.

In Model (3), we use

BTD

as a proxy for tax avoidance. The sample includes 7,692 firm-year

observations for the period 2008-2012. T-statistics are in the parentheses. ***, **, * stand for a

statistical significant level of 1%, 5%, and 10% respectively.