審計人員之產業專精與客戶租稅規避:中國實證研究

22

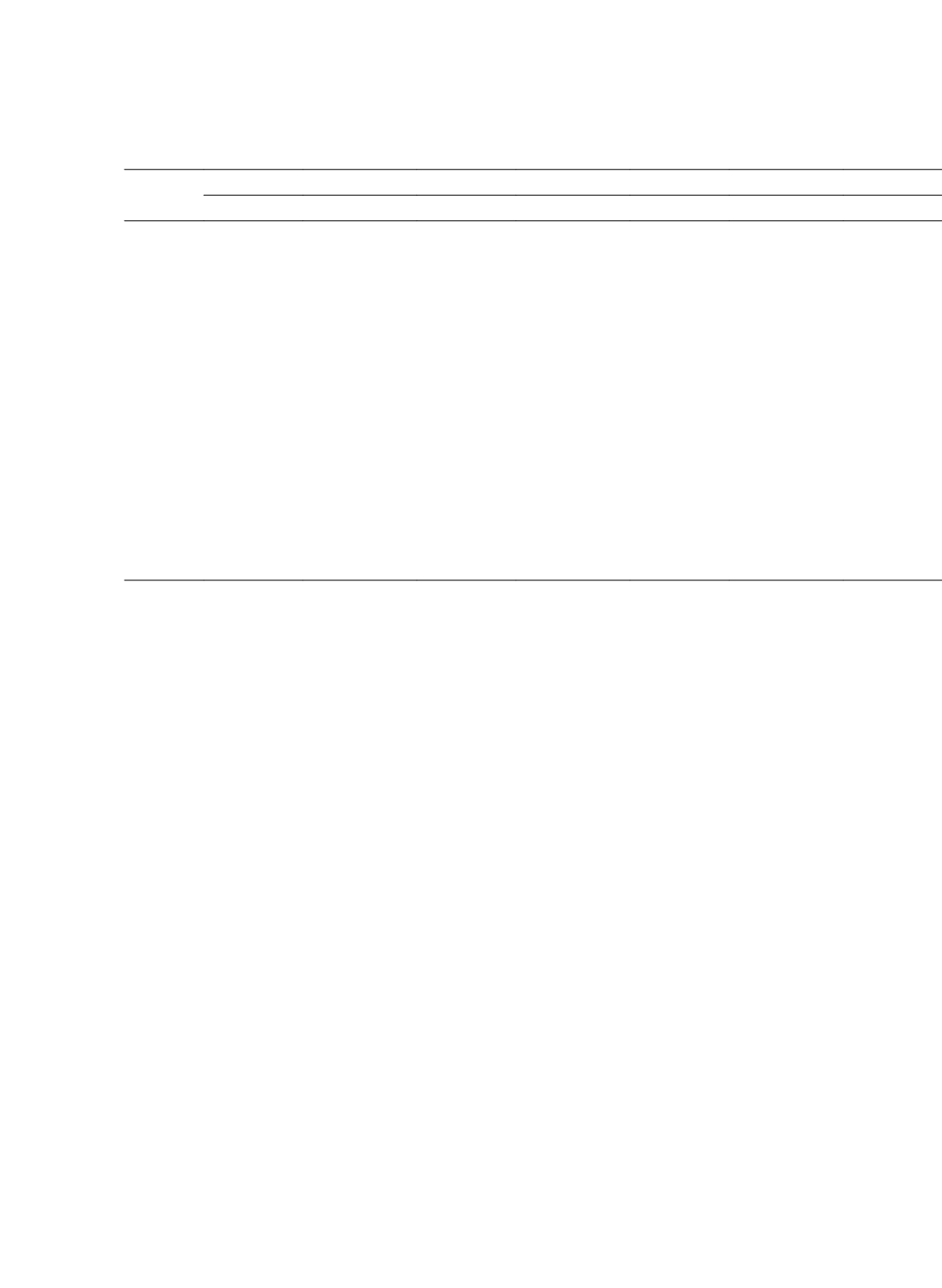

Variables

(1)

Tax-avoidance = BETR

(2)

Tax-avoidance = CETR

Spec = IMS Spec = IMS_D Spec = IPS Spec = IPS_D Spec = IMS Spec = IMS_D

(1.25)

(1.26)

(1.25)

(1.22)

(1.67)

(1.61)

Size

0.0092***

0.0088***

0.0089***

0.0079***

0.0172***

0.01633***

(9.41)

(9.26)

(9.20)

(8.44)

(15.79)

(15.28)

Roa

0.0331**

0.0332**

0.0333**

0.0334**

0.0874***

0.0876***

(2.57)

(2.58)

(2.58)

(2.59)

(6.05)

(6.06)

Lev

-0.0153***

-0.0151***

-0.0158***

-0.0156***

-0.0414***

-0.0416***

(-2.79)

(-2.74)

(-2.87)

(-2.83)

(-6.72)

(-6.74)

CFO

0.0421***

0.0416***

0.0416***

0.0416***

0.0152

0.0149

(3.45)

(3.41)

(3.41)

(3.40)

(1.11)

(1.08)

Year

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Industry

Controlled Controlled Controlled Controlled Controlled Controlled

N

7692

7692

7692

7692

7692

7692

F Value

38.37

38.41

38.32

37.80

27.01

26.76

Adjusted R

2

0.1463

0.1455

0.1452

0.1435

0.1029

0.1017

Note: This table presents the OLS regression results of auditor industry expertise on tax avoidance

conditional on auditor independence. The dependent variable tax avoidance is measured by

BETR

, the key independent variable auditor industry expertise is measured by

IMS

,

IMS_D

,

IPS,

and

IPS_D

, and the condition variable auditor independence is measured by

Fee

and

Tenure

.

Spec

*

Fee

and

Spec

*

Tenure

are two interaction variables used to capture the joint effect of

auditor industry expertise and auditor independence. In Model (1), we use

BETR

as a proxy for

tax avoidance. In Model (2), we use

CETR

as a proxy for tax avoidance. In Model (3), we use

BTD

as a proxy for tax avoidance. The sample includes 7,692 firm-year observations for the

period 2008-2012. T-statistics are in the parentheses. ***, **, * stand for a statistical significant

level of 1%, 5%, and 10% respectively.

4.4 Robustness Tests

4.4.1 Separate Analysis of Big 4 Sample

This study treats the Big 4 clients as a special sample. From the descriptive statistics in

Table 4 and Table 5, this study finds that the Big 4 are more likely to identify as industry

experts under the measurement of industry market share and industry portfolio share. Hence,

the proxies of auditor industry expertise may mainly capture the relative scale or resource

advantages of Big 4. In order to avoid the specificity of Big 4 samples affecting the

reliability of our findings, this study examines the association between auditor industry