臺大管理論叢

第

26

卷第

2

期

19

(2)

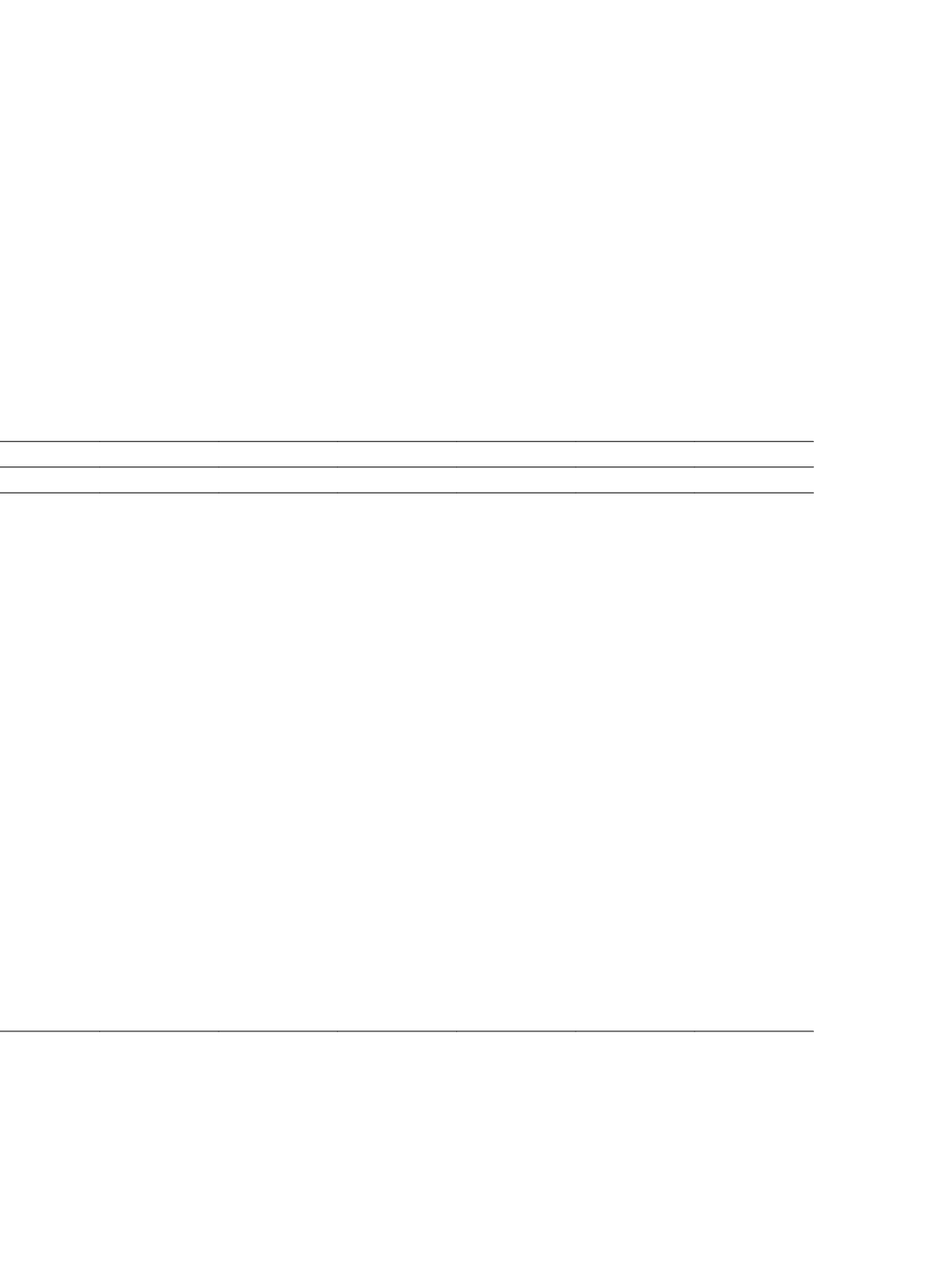

Tax-avoidance = CETR

(3)

Tax-avoidance = BTD

Spec = IPS Spec = IPS_D Spec = IMS Spec = IMS_D Spec = IPS Spec = IPS_D

-0.1913***

-0.1891***

2.1018***

2.0749***

1.9291***

1.9509***

(-8.33)

(-8.29)

(6.43)

(6.42)

(5.96)

(6.07)

-0.0217*

-0.0018

0.5892*

0.1223**

0.1545

0.0371

(-1.89)

(-0.43)

(1.92)

(2.18)

(0.84)

(0.62)

0.0008

0.0012

0.1074***

0.1126***

0.1311***

0.1359***

(0.32)

(0.48)

(2.83)

(3.09)

(3.70)

(3.91)

0.0042

0.0042

0.0311

0.0309

0.0319

0.0319

(1.55)

(1.56)

(0.82)

(0.82)

(0.85)

(0.85)

0.0161***

0.0160***

0.7099***

0.7115***

0.7196***

0.7181***

(15.32)

(15.40)

(47.29)

(48.26)

(48.61)

(49.18)

0.0881***

0.0879***

0.1908

0.1899

0.1897

0.1871

(6.09)

(6.08)

(0.94)

(0.94)

(0.93)

(0.92)

-0.0421***

-0.0422***

1.5633***

1.5606***

1.5700***

1.5685***

(-6.85)

(-6.88)

(18.14)

(18.11)

(18.21)

(18.20)

0.0143

0.0141

0.3265*

0.3292*

0.3349*

0.3316*

(1.05)

(1.03)

(1.70)

(1.71)

(1.74)

(1.73)

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

Controlled

7692

7692

7692

7692

7692

7692

27.88

27.86

144.15

144.21

144.00

143.98

0.1014

0.1013

0.3666

0.3667

0.3663

0.3663

are more likely to help their clients engage in tax avoidance activity. The association

between auditor industry expertise and clients’ tax avoidance is not significant in most of

these regressions when using industry portfolio share to proxy auditor industry expertise.

Overall, this study finds evidence that auditor industry expertise is associated with increased

tax avoidance, but only when using industry market share to measure auditor industry

expertise. These results are in line with the prediction of H2.

This study also finds that audit firm size (proxied by

Big10

) is positively associated