臺大管理論叢

第

26

卷第

2

期

25

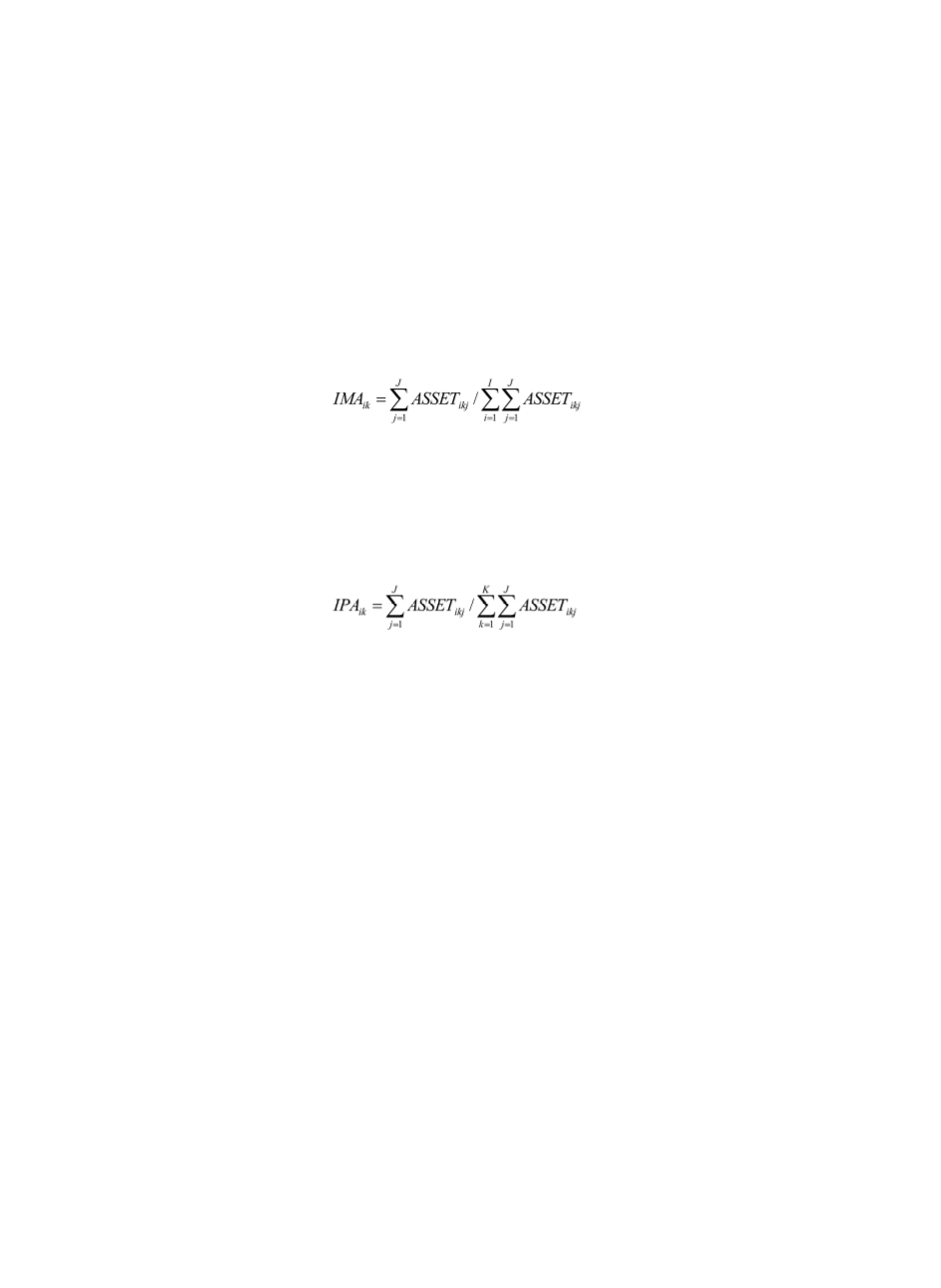

4.4.2 Alternative Measure of Auditor Industry Expertise

This study investigates whether our results are sensitive to the measure of auditor

industry expertise used. Prior studies also use clients’ assets to calculate auditors’ market

share and portfolio share (Dunn and Mayhew, 2004; Chen et al., 2007). This study uses

alternative measures

IMA

and

IPA

to proxy auditor industry expertise.

IMA

and

IPA

are

calculated as follows:

where

ASSET

is clients’ total assets and the numerator is the sum of assets of all

J

ik

clients of audit firm

i

in industry

k

. The denominator is the assets of

J

ik

clients in industry

k

summed over all

I

k

audit firms in the sample with clients (

J

ik

) in industry

k

.

where

ASSET

is clients’ total assets and the numerator is the sum of the assets of all

J

ik

clients of audit firm

i

in industry

k

. The denominator is assets of all clients of audit firm

i

summed over all

k

industries.

The difference between

IMA

(

IPA

) and

IMS

(

IPS

) is clients’ sales revenue is replaced by

asset, so the calculation of

IMA

(

IPA

) is similar to

IMS

(

IPS

). Table 10 reports the regression

results of newly-defined auditor industry expertise (

IMA

and

IPA

) on tax avoidance (

BETR

,

CETR

and

BTD

). The coefficient of key independent variable (

Spec

) is still negative and

significant at 1% level in Model (1) and Model (2), and positive and significant at 1% level

in Model (3). These results confirm the positive association between auditor industry

expertise and tax avoidance. The coefficient of interactive variables is similar to our early

finding in Table 9.

Spec

*

Fee

and

Spec

*

Tenure

are negatively associated with efficient tax

rate (

BETR

and

CETR

) and negatively associated with book-tax difference (

BTD

) in most of

these regressions.

Taken together, our results are qualitatively unchanged when we repeat the analyses

using the alternative measure of auditor industry expertise.