Page 104 - 35-1

P. 104

The Effects of Economic Substance Act on Offshore Investment Structures and Tax Avoidance

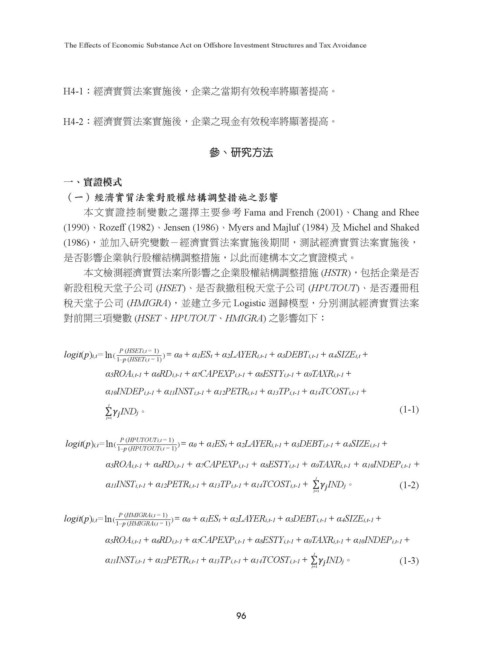

H4-1:經濟實質法案實施後,企業之當期有效稅率將顯著提高。

H4-2:經濟實質法案實施後,企業之現金有效稅率將顯著提高。

參、研究方法

一、實證模式

(一)經濟實質法案對股權結構調整措施之影響

本文實證控制變數之選擇主要參考 Fama and French (2001)、Chang and Rhee

P (HSETi,t = 1)

logit(p)i,t= ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t +

1–p (HSETi,t = 1)

(1990)、Rozeff (1982)、Jensen (1986)、Myers and Majluf (1984) 及 Michel and Shaked

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 +

(1986),並加入研究變數-經濟實質法案實施後期間,測試經濟實質法案實施後,

α10INDEPi,t-1 + α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 +

是否影響企業執行股權結構調整措施,以此而建構本文之實證模式。

∑ INDj。

本文檢測經濟實質法案所影響之企業股權結構調整措施 (HSTR),包括企業是否

新設租稅天堂子公司 (HSET)、是否裁撤租稅天堂子公司 (HPUTOUT)、是否遷冊租

稅天堂子公司 (HMIGRA),並建立多元 Logistic 迴歸模型,分別測試經濟實質法案

P (HSETi,t = 1)

logit(p)i,t= ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t +

對前開三項變數 (HSET、HPUTOUT、HMIGRA) 之影響如下:

1–p (HSETi,t = 1)

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 +

P (HPUTOUTi,t = 1)

logit(p)i,t=ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t-1 +

1–p (HPUTOUTi,t = 1)

α10INDEPi,t-1 + α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 +

P (HSETi,t = 1)

logit(p)i,t= ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t +

1–p (HSETi,t = 1)

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 + α10INDEPi,t-1 +

∑ INDj。

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 +

α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 + ∑ INDj。

α10INDEPi,t-1 + α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 +

∑ INDj。 (1-1)

P (HPUTOUTi,t = 1)

logit(p)i,t=ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t-1 +

1–p (HPUTOUTi,t = 1)

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 + α10INDEPi,t-1 +

P (HPUTOUTi,t = 1)

logit(p)i,t=ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t-1 + (1-2)

α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 + ∑ INDj。

1–p (HPUTOUTi,t = 1)

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 + α10INDEPi,t-1 +

P (HMIGRAi,t = 1)

logit(p)i,t=ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t-1 +

1–p (HMIGRAi,t = 1)

α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 + ∑ INDj。

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 + α10INDEPi,t-1 +

α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 + ∑ INDj。 (1-3)

P (HMIGRAi,t = 1)

96

logit(p)i,t=ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t-1 +

1–p (HMIGRAi,t = 1)

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 + α10INDEPi,t-1 +

P (HMIGRAi,t = 1)

logit(p)i,t=ln ( ) = α0 + α1ESt + α2LAYERi,t-1 + α3DEBTi,t-1 + α4SIZEi,t-1 +

α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 + ∑ INDj。

1–p (HMIGRAi,t = 1)

α5ROAi,t-1 + α6RDi,t-1 + α7CAPEXPi,t-1 + α8ESTYi,t-1 + α9TAXRi,t-1 + α10INDEPi,t-1 +

α11INSTi,t-1 + α12PETRi,t-1 + α13TPi,t-1 + α14TCOSTi,t-1 + ∑ INDj。