審計人員之產業專精與客戶租稅規避:中國實證研究

30

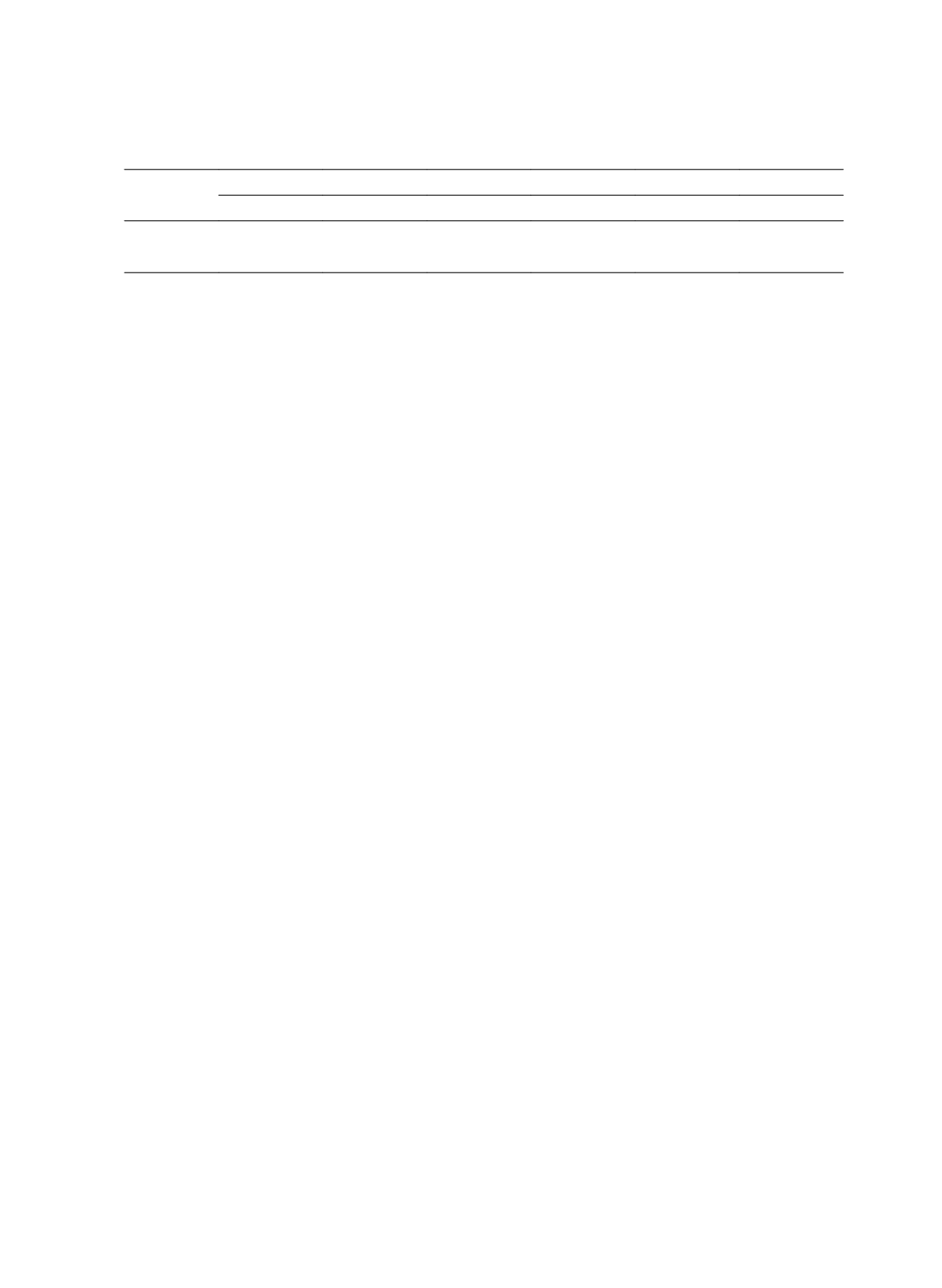

Variables

(1)

Tax-avoidance = BETR

(2)

Tax-avoidance = CETR

(3)

Tax-avoidance = BTD

Spec = IMS_D Spec = IPS_D Spec = IMS_D Spec = IPS_D Spec = IMS_D Spec = IPS_D

F Value

37.47

40.28

24.37

24.72

125.02

132.23

Adjusted R

2

0.1463

0.1498

0.1032

0.1002

0.3690

0.3711

Note: This table presents the second-state OLS regression results of auditor industry expertise on tax

avoidance. Consistent with the first-stage model, the sample includes 7,660 firm-year

observations for the period 2008-2012 when using

IMS_D

to proxy auditor industry expertise and

7,133 firm-year observations when using

IPS_D

to proxy auditor industry expertise. T-statistics

are in the parentheses. ***, **, * stand for a statistical significant level of 1%, 5%, and 10%

respectively.

5. Conclusion

Auditor industry expertise is an important embodiment of auditor professional

competence and a determinant of audit quality (De Angelo, 1981). Auditor industry

expertise, including industry-specific knowledge and experiences, helps auditor improve

professional judgment and audit efficiency, thus improving audit quality. In addition,

industry expertise helps audit firms increase the demand for audit and non-audit services,

improve audit efficiency through economics of scale, and affects client-relevant audit

outcomes like audit fee. Therefore, developing industry expertise is also an efficient market

strategy for audit firms to gain competitive advantage. From these perspectives, prior studies

examined the influence of auditor industry expertise on audit quality or audit fee. Unlike

these studies, this paper connects auditor industry expertise with clients’ tax avoidance,

extends the consequences of auditor industry expertise, and also sheds light on the

determinants of corporate tax avoidance.

Using A-share listed companies on the Shanghai and Shenzhen Stock Exchange in

2008-2012 as the research sample, this paper demonstrated that an auditor who is an industry

expert is more likely to help its clients engage in tax avoidance activity, especially when

auditor independence is lower (proxied by audit fee and audit tenure). This result indicates

that in case of poor auditor independence, auditor industry expertise may encourage clients’

tax avoidance instead of constraining it.

These findings have some implications for policy makers. On one hand, the competition

in the Chinese audit market is relatively fierce compared to that in developed countries, but

most of China’s local CPA firms have not yet developed their own industry expertise.

Chinese regulators should encourage local CPA firms to develop industry expertise and

further facilitate policies to make local CPA firms bigger and stronger. On the other hand,

since our findings suggest that auditor industry expertise is positively associated with clients’