Page 157 - 34-1

P. 157

NTU Management Review Vol. 34 No. 1 Apr. 2024

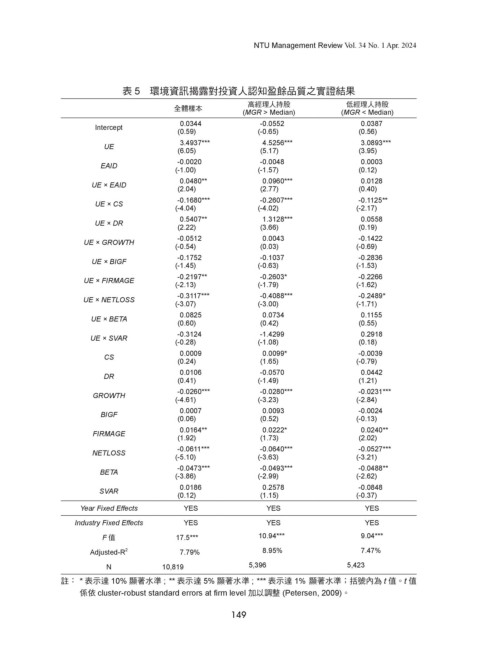

表 5 環境資訊揭露對投資人認知盈餘品質之實證結果

高經理人持股 低經理人持股

全體樣本

(MGR > Median) (MGR < Median)

0.0344

0.0387

-0.0552

Intercept (0.59) (-0.65) (0.56)

3.4937*** 4.5256*** 3.0893***

UE

(6.05) (5.17) (3.95)

-0.0020 -0.0048 0.0003

EAID (-1.00) (-1.57) (0.12)

UE × EAID 0.0480** 0.0960*** 0.0128

(2.04) (2.77) (0.40)

-0.1680*** -0.2607*** -0.1125**

UE × CS (-4.04) (-4.02) (-2.17)

UE × DR 0.5407** 1.3128*** 0.0558

(2.22) (3.66) (0.19)

-0.0512 0.0043 -0.1422

UE × GROWTH (-0.54) (0.03) (-0.69)

-0.1752 -0.1037 -0.2836

UE × BIGF (-1.45) (-0.63) (-1.53)

-0.2197** -0.2603* -0.2266

UE × FIRMAGE

(-2.13) (-1.79) (-1.62)

-0.3117*** -0.4088*** -0.2489*

UE × NETLOSS (-3.07) (-3.00) (-1.71)

0.0825 0.0734 0.1155

UE × BETA

(0.60) (0.42) (0.55)

-0.3124 -1.4299 0.2918

UE × SVAR (-0.28) (-1.08) (0.18)

0.0009 0.0099* -0.0039

CS

(0.24) (1.65) (-0.79)

0.0106 -0.0570 0.0442

DR (0.41) (-1.49) (1.21)

-0.0260*** -0.0280*** -0.0231***

GROWTH

(-4.61) (-3.23) (-2.84)

0.0007 0.0093 -0.0024

BIGF (0.06) (0.52) (-0.13)

FIRMAGE 0.0164** 0.0222* 0.0240**

(1.92) (1.73) (2.02)

-0.0611*** -0.0640*** -0.0527***

NETLOSS (-5.10) (-3.63) (-3.21)

BETA -0.0473*** -0.0493*** -0.0488**

(-3.86) (-2.99) (-2.62)

0.0186 0.2578 -0.0848

SVAR (0.12) (1.15) (-0.37)

Year Fixed Effects YES YES YES

Industry Fixed Effects YES YES YES

F 值 17.5*** 10.94*** 9.04***

Adjusted-R 2 7.79% 8.95% 7.47%

N 10,819 5,396 5,423

註: * 表示達 10% 顯著水準 ; ** 表示達 5% 顯著水準 ; *** 表示達 1% 顯著水準;括號內為 t 值。t 值

係依 cluster-robust standard errors at firm level 加以調整 (Petersen, 2009)。

149