媒體聲譽對企業社會責任得獎企業其股市表現與財務績效之影響

108

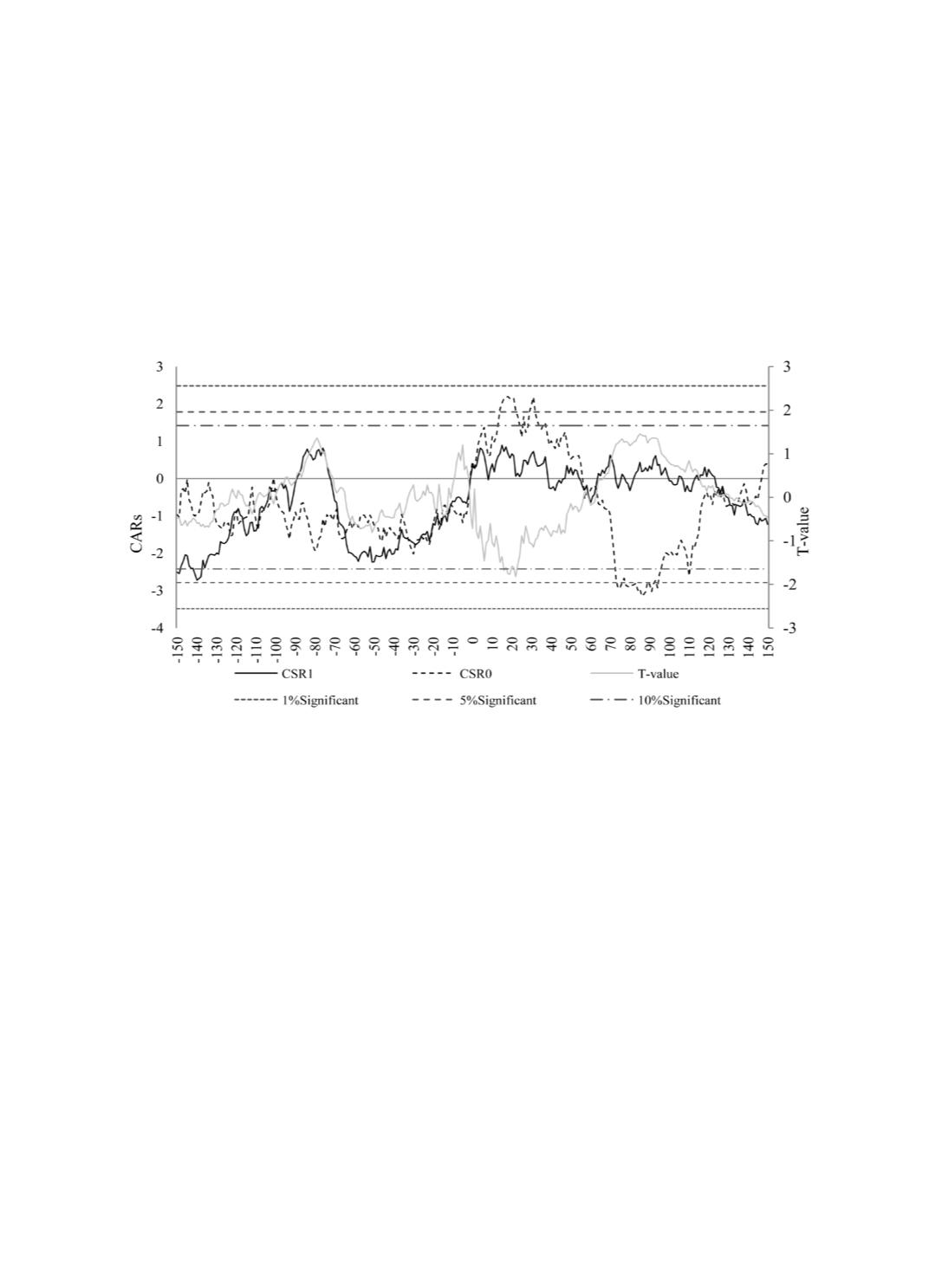

Figure 4 reveals no significant difference between the two sample groups; however,

the CARs of CSR winners tend to be higher than those of non-CSR firms from the CSR

award announcement date to three months afterwards, a finding which is consistent with

that for stock returns. We argue that investors can follow CSR award signals to hold on to

the stocks of such firms for longer periods.

Figure 4 Evolution and t Test of Cumulative Abnormal Returns

Note: This figure illustrates the cumulative abnormal returns (CARs) for 150 trading days prior to and

after the announcement of CSR awards. CSR1 refers to the CARs of CSR winners; and CSR0

refers to the CARs of non-CSR firms. The t value is a sample t test of CSR1 and CSR0.

Our empirical results indicate that CSR winners will earn better returns than non-

CSR firms, thereby providing support for Hypothesis 1. Our findings are also consistent

with those of Gao et al. (2012) and Kong (2012) —CSR awards can have positive effects

on stock market performance over longer periods.

The summary statistics of both the CSR and non-CSR firms are presented in Table 6.

The financial performance of CSR winners is generally found to be superior to that of

non-CSR firms, which is consistent with Preston and O’Bannon (1997) and also provides

support for our Hypothesis 2. The

ROA

and

EPS

variables are all found to achieve

significance, whilst the

TA, TAT, DR

and

MV

variables of CSR winners are generally

found to be higher than those of non-CSR firms, thereby indicating that the scale of CSR