103

臺大管理論叢

第

28

卷第

1

期

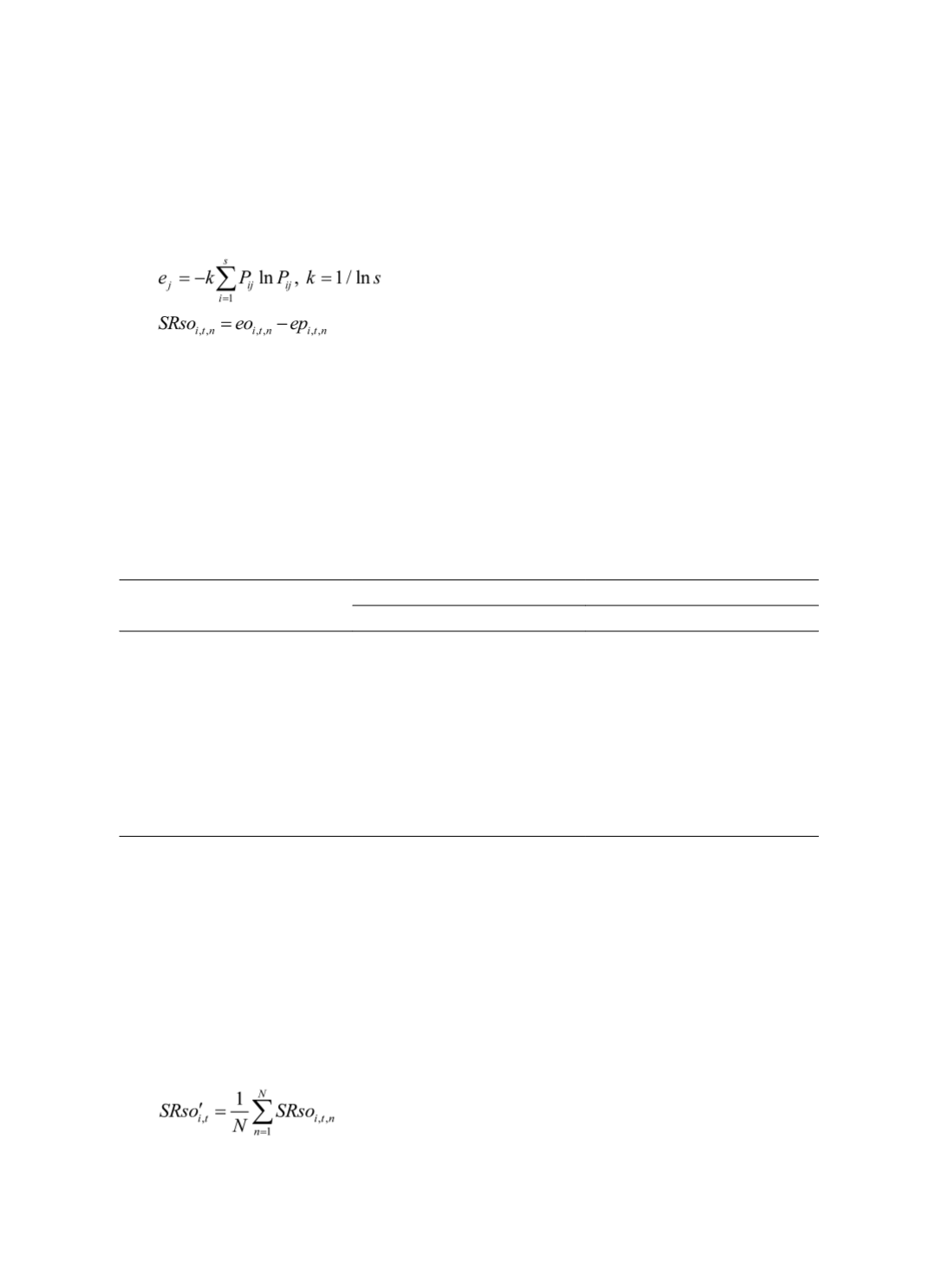

in the news item and the sentiment ratio are then calculated using entropy, as expressed in

Equations (8) and (9), with the results being reported in Table 5.

(8)

(9)

where

e

j

is the entropy of the

j

th

sentiment state;

P

ij

is the weight of the

i

th

paragraph in

the

j

th

sentiment state; and

s

refers to the number of paragraphs in the news item.

SRso

i,t,n

is

the sentiment ratio of the

i

th

firm for the

n

th

news on day

t

;

eo

i,t,n

is the optimism entropy of

the

i

th

firm for the

n

th

news on day

t

; and

ep

i,t,n

is the pessimism entropy of the

i

th

firm for

the

n

th

news on day

t

.

Table 5 Degree of Optimism and Pessimism in Media Reports Using Entropy

Paragraph

State

Optimism

Pessimism

1

–0.3290

0.0000

2

–0.2554

–0.1125

3

0.0000

0.0000

4

0.0000

0.0000

5

–0.3658

0.0000

Totals

–0.9502

–0.1125

–k

–0.6213

–0.6213

e

j

0.5904

0.0699

Note:

e

j

is the entropy of different states, including ‘optimism’ and ‘pessimism’ and

k

is equal to 1/

ln(

s

), where s is the number of paragraphs in the news.

By referring to the process from Tables 3 to 5 and Equations (8) and (9), the example

shows that optimism entropy is equal to 0.5904 and the pessimism entropy is equal to

0.0699. The sentiment ratio calculated by the semantic orientation method is equal to

0.5205; using Equations (10) and (11), the ratio is standardized for all stocks in the market

in order to exclude the impact of the market sentiment cycle:

(10)