105

臺大管理論叢

第

28

卷第

1

期

coverage, since the information content of news reports may affect the trading behavior of

investors through the media channel (Hypothesis 4); the alternative models are examined

below.

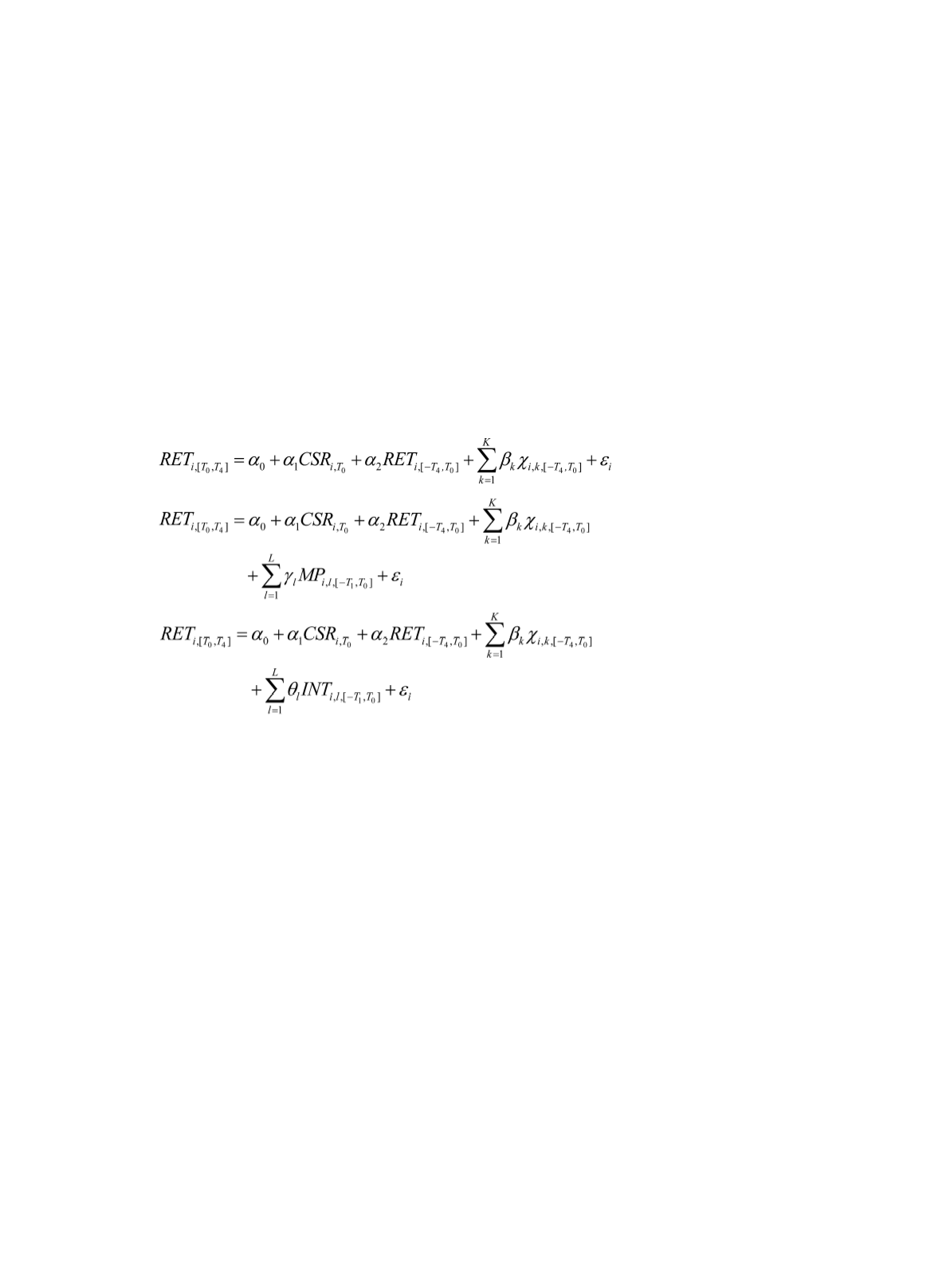

Model 1 (M1) examines whether CSR winners can promote stock market

performance, whilst Model 2 (M2) similarly examines whether media reputation around

CSR award announcement periods can promote stock market performance, with Model 3

(M3) subsequently further examining whether the media reputation of CSR winners can

promote stock market performance.

(14)

(15)

(16)

where

RET

i

are the stock returns and CARs of the

i

th

firm during the period from the

CSR announcement date (

T

0

) to

T

4

days afterwards;

CSR

i,T

0

is the CSR dummy for the

i

th

firm in the current year; the CSR dummy is equal to 1 if the firm is a CSR award

recipient; otherwise 0;

X

i,k

are control variables for the

i

th

firm, including

TURN, MV

and

P/

B

, during the period from

T

4

days prior to the CSR announcement date to the CSR

announcement date (

T

0

), where

K

is the total number of control variables.

MP

i,l

are the

l

th

media proxies for the

i

th

firm during the CSR award announcement period, which include

MEDIA, SRso

and

MR

during the period from

T

1

days prior to the CSR announcement date

to the CSR announcement date (

T

0

) and we also incorporate

MP

i,l,[T

0

,T

1

]

from

T

0

to

T

1

days

afterwards;

l

equals 1 to

L

,

L

is the total number of media proxies.

INT

i,l

is the interaction term which includes three variables, with

CSR

i,T

0

interacting

with

MP

i,l

during the period from

T

1

days prior to the CSR announcement date to the CSR

announcement date (

T

0

) and we also incorporate

INT

i,l,[T

0

,T

1

]

from

T

0

to

T

1

days afterwards.

Time

T

0

refers to CSR award announcements in the current year; time –

T

1

refers to the