媒體聲譽對企業社會責任得獎企業其股市表現與財務績效之影響

106

5-day trading period prior to CSR award announcements; time –

T

4

refers to the 90-day

trading period prior to CSR award announcements;

T

1

refers to the 5-day trading period

after CSR award announcements; and

T

4

refers to the 90-day trading period after CSR

award announcements.

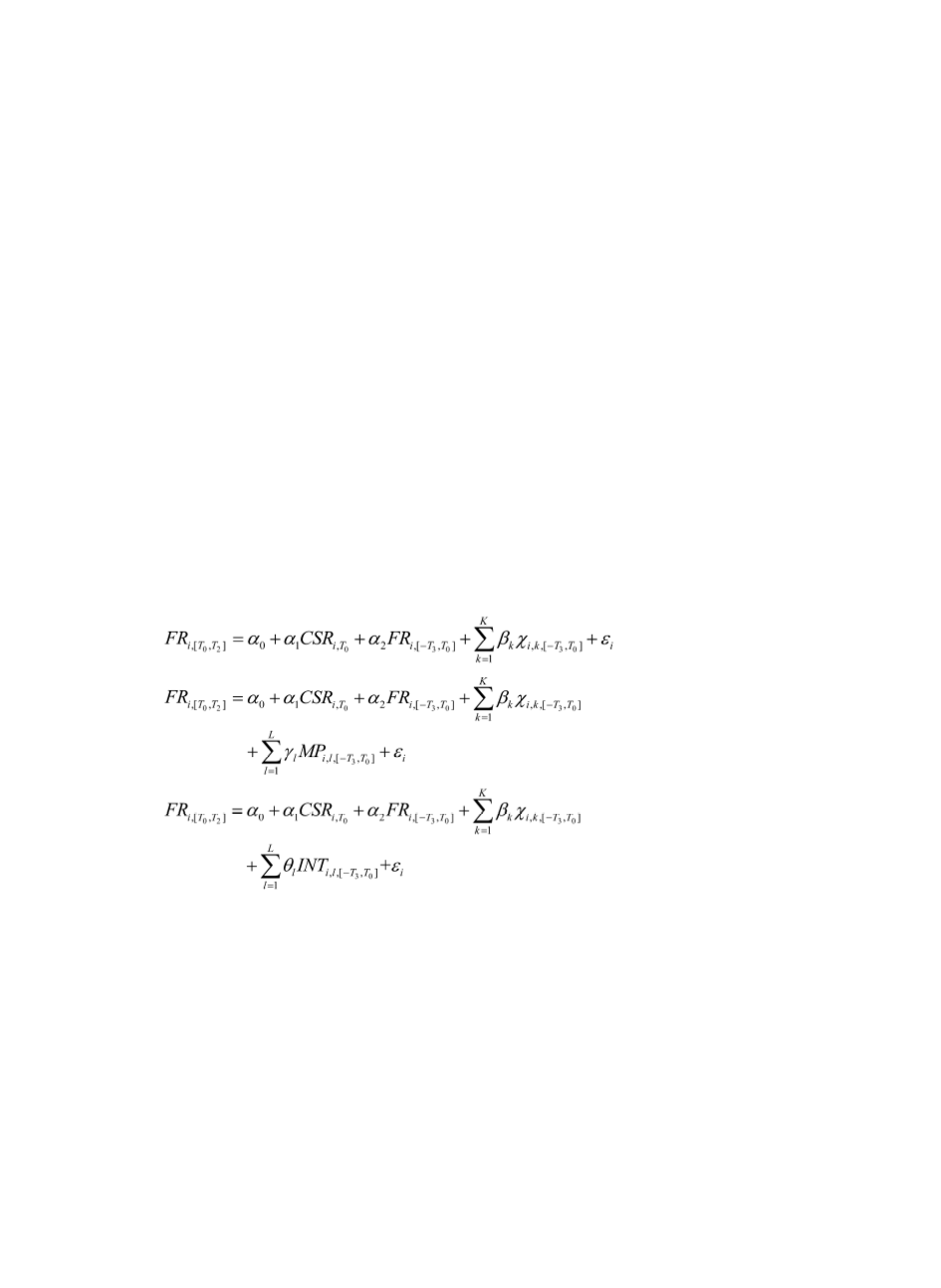

Preston and O’Bannon (1997) hypothesized that CSR performance positively affects

financial performance, whilst Deephouse (2000) argued that the higher the reputation, the

greater the likelihood of improved financial performance. Hence, we investigate the

relationship between CSR and financial performance from the viewpoint of media

reputation (Hypothesis 5) based upon the following regression models.

Model 4 (M4) examines whether CSR winners promote financial performance, whilst

Model 5 (M5) examines whether media reputation around a CSR award announcement

period similarly promotes financial performance, with Model 6 (M6) including the

interaction term between media reputation and the CSR dummy to examine whether

media reputation strength is enhanced, particularly for CSR winners.

(17)

(18)

(19)

where

FR

i

refers to the financial performance variables of the

i

th

firm (comprising of

ROA, ROE, GPM

and

EPS

) during the period from the CSR announcement date (

T

0

) to

T

2

days after the CSR announcement date.

CSR

i,T

0

denotes the CSR dummy for the

i

th

firm in

the current year; this dummy is equal to 1 if the firm is a CSR award recipient, otherwise 0.

X

i,k

is a control variable for the

i

th

firm which includes

TAT, TA

and

DR

during the

period from

T

3

days prior to the CSR announcement date to the CSR announcement date

(

T

0

). K refers to the number of control variables.

MP

i,l

are the

l

th

media proxies for the

i

th

firm, which include

MEDIA, SRso

and

MR

during the period from

T

3

days prior to the