媒體聲譽對企業社會責任得獎企業其股市表現與財務績效之影響

112

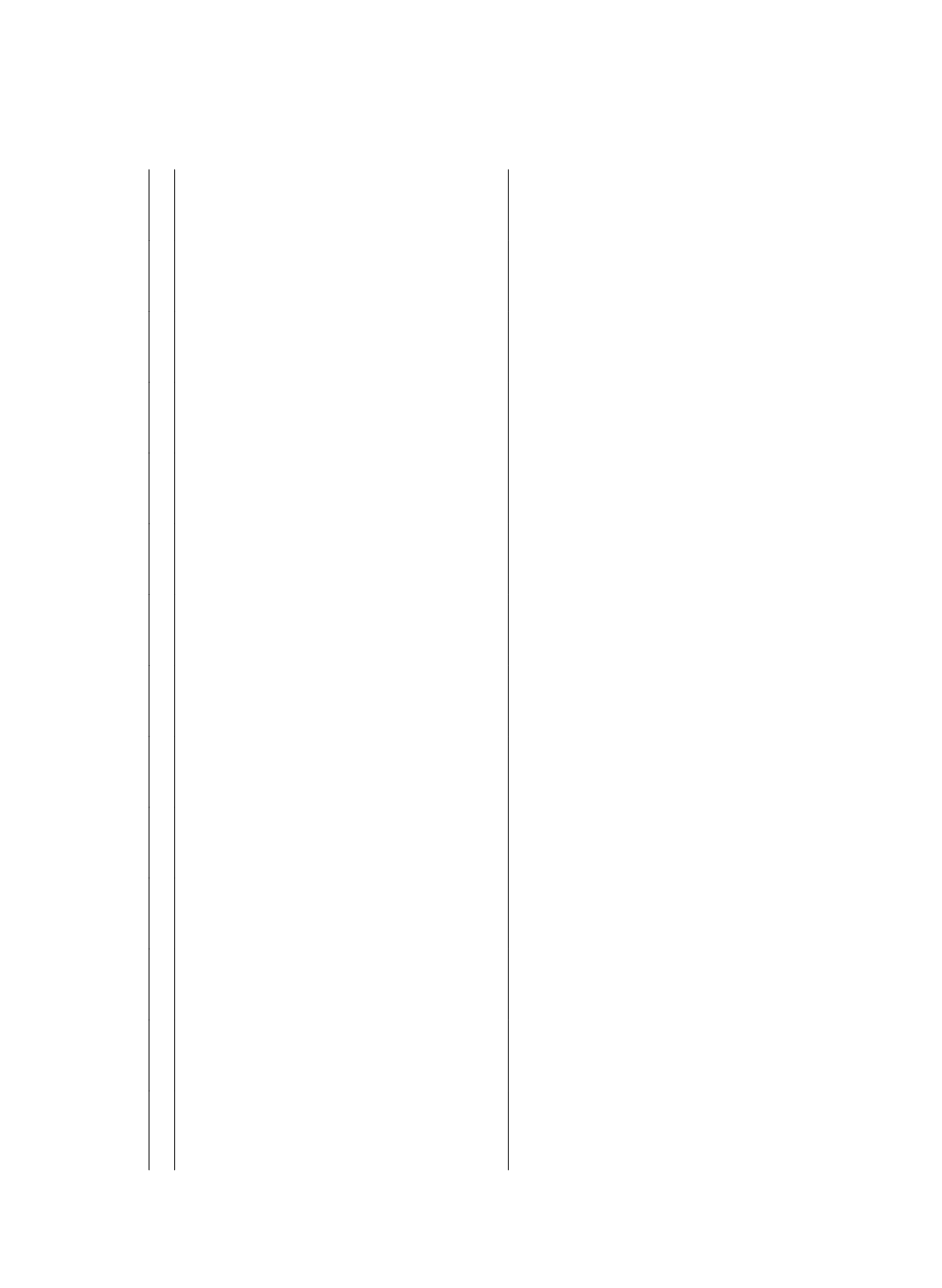

Table 7 Correlation Analysis

Variables

CSR MEDIA SRso ROA GPM EPS TAT TA DR RET CAR TURN MV

MEDIA

0.34***

SRso

–0.02 -0.08

ROA

0.07 0.12*** 0.02

GPM

0.04 0.04 –0.02 0.48***

EPS

0.08 0.28*** 0.04 0.58*** 0.31***

TAT

0.10*** 0.08 0.10*** 0.00 –0.29*** 0.17***

TA

0.52*** 0.58*** –0.01 0.08 –0.21*** 0.19*** 0.14***

DR

0.10 0.15*** 0.11*** –0.13*** –0.35*** 0.06 0.46*** 0.40***

RET

–0.03 –0.05 –0.05 –0.08 –0.09 –0.09 –0.07 –0.05 –0.11***

CAR

–0.10 –0.03 0.05 0.03 –0.02 0.00 0.05 –0.05 0.03 0.06

TURN

–0.16*** –0.02 0.11*** 0.10*** 0.01 0.10 0.01 –0.10 0.03 0.25*** 0.04

MV

0.52*** 0.62*** 0.02 0.30*** –0.02 0.36*** 0.13*** 0.93*** 0.25*** –0.13*** –0.05 –0.05

P/B

0.20*** 0.33*** 0.12*** 0.51*** 0.31*** 0.54*** 0.24*** 0.18*** 0.19*** –0.16*** 0.01 0.13*** 0.45***

Note: This table reports the correlations between the CSR, media proxies, financial performance, firm characteristics and market

characteristics, with the data period running from January 2009 to December 2012. CSR is at time

T

0

;

MEDIA, SRso, ROA, EPS, GPM,

TAT, TA

and

DR

are at time

T

2

;

RET, CAR, TURN, MV

and

P/B

are at time

T

4

. Time

T

2

refers to the quarterly financial statement

announcement period after CSR award announcements; Time

T

4

refers to the 90 day period after CSR award announcements. The

abbreviation of variables refers to Table 2. * indicates significance at the 10% level; ** indicates significance at the 5% level; and ***

indicates significance at the 1% level.