美國產險業

CEO

更迭與再保險需求

272

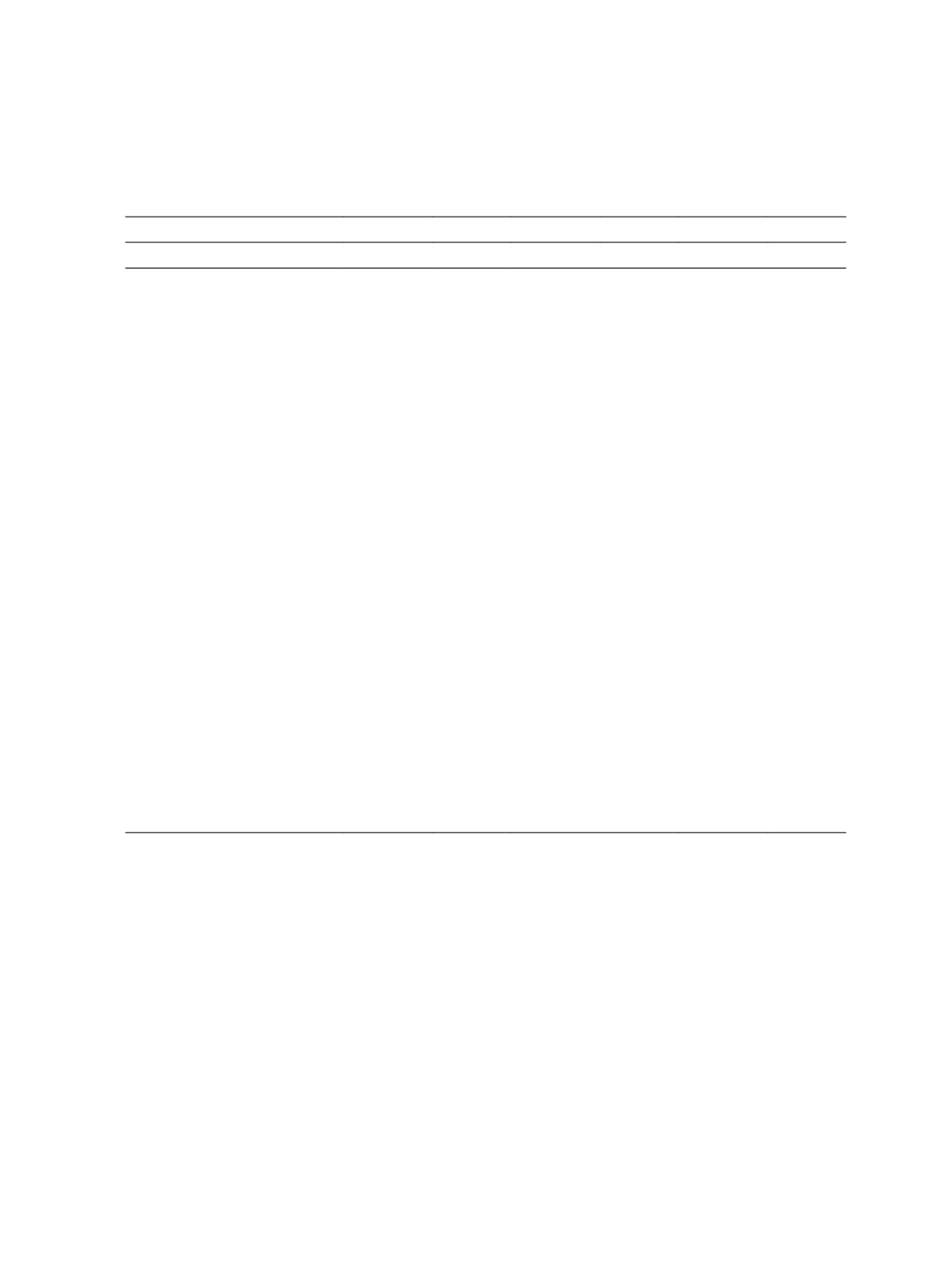

Table 6 Regressions of Reinsurance Demand on CEO Turnover with Interaction

Effect of Organizational Structure

Dependent variables

∆

Reins ratio

∆

Reins_aff_ratio

∆

Reins_nonaff_ratio

Independent Variables

Estimate P value Estimate P value Estimate P value

Turnover (t-1)

0.034

0.452

0.018

0.687

0.015

0.342

Mutual (t-1)

0.015

0.823

0.030

0.662

-0.015

0.543

Turnover (t-1)

×

Mutual (t-1)

-0.057*

0.064

-0.047

0.125

-0.009

0.410

Duality (t-1)

-0.047**

0.018

-0.034*

0.088

-0.013*

0.074

∆ Board size

0.000

0.901

0.000

0.989

0.000

0.761

∆ Independent director

0.033

0.437

0.007

0.872

0.026*

0.088

Big 4 auditor (t-1)

0.002

0.925

-0.007

0.734

0.009

0.224

∆ Ln(na)

-0.277***

0.000

-0.287***

0.000

0.010

0.502

∆ Herfindahl

0.026

0.763

0.074

0.401

-0.048

0.127

∆ Geoherfindahl

-0.486***

0.000

-0.501***

0.000

0.015

0.689

∆ Leverage

0.030

0.798

-0.168

0.154

0.198***

0.000

∆ Underwriting risk

-0.303***

0.000

-0.224***

0.005

-0.079***

0.006

∆ 2yearLossDevelopment

0.089**

0.013

0.140***

0.000

-0.052***

0.000

∆ Coastal prem

-0.371**

0.012

-0.308**

0.041

-0.064

0.234

∆ Long-tail

0.254***

0.006

0.243***

0.010

0.011

0.737

∆ Tax_ex

-0.022

0.394

-0.024

0.352

0.002

0.799

∆ ROA

0.067

0.657

-0.015

0.923

0.081

0.133

Group (t-1)

0.014

0.676

0.029

0.387

-0.015

0.202

Intercept

0.032

0.625

0.025

0.705

0.007

0.770

Hausman Test

15.08

14.05

28.27

R-Square

0.089

0.089

0.128

N

2,772

2,772

2,772

Note: The table shows the regression results of reinsurance demand on CEO turnover with interaction

terms of organizational structure. “

∆

x

” means change in

x

. Specifically it sugggets that

∆

x

i,t

means

x

i,t

minus

x

i,t

-1

. Please see definition of all variables in Appendix A. ***significant at 1%, **

significant at 5%, * significant at 10%.

Tables 7 (8) shows empirical results of change in reinsurance demand on the interaction

effect between routine CEO turnover, non-routine CEO turnover

vs

. non CEO turnover

(voluntary CEO turnover, forced CEO turnover vs. non CEO turnover) and organizational

structure. The coefficient of interaction term of non-routine CEO turnover and mutual form

is negative and significant in Models ∆Reins_ratio and ∆Reins_aff_ratio of Table 7. The

result suggests that mutual insurers with non-routine CEO turnover are more likely to

purchase less reinsurance after CEO turnovers. This finding suggests that the positive

relation between insurers with non-routine CEO turnover and change in total reinsurance