美國產險業

CEO

更迭與再保險需求

276

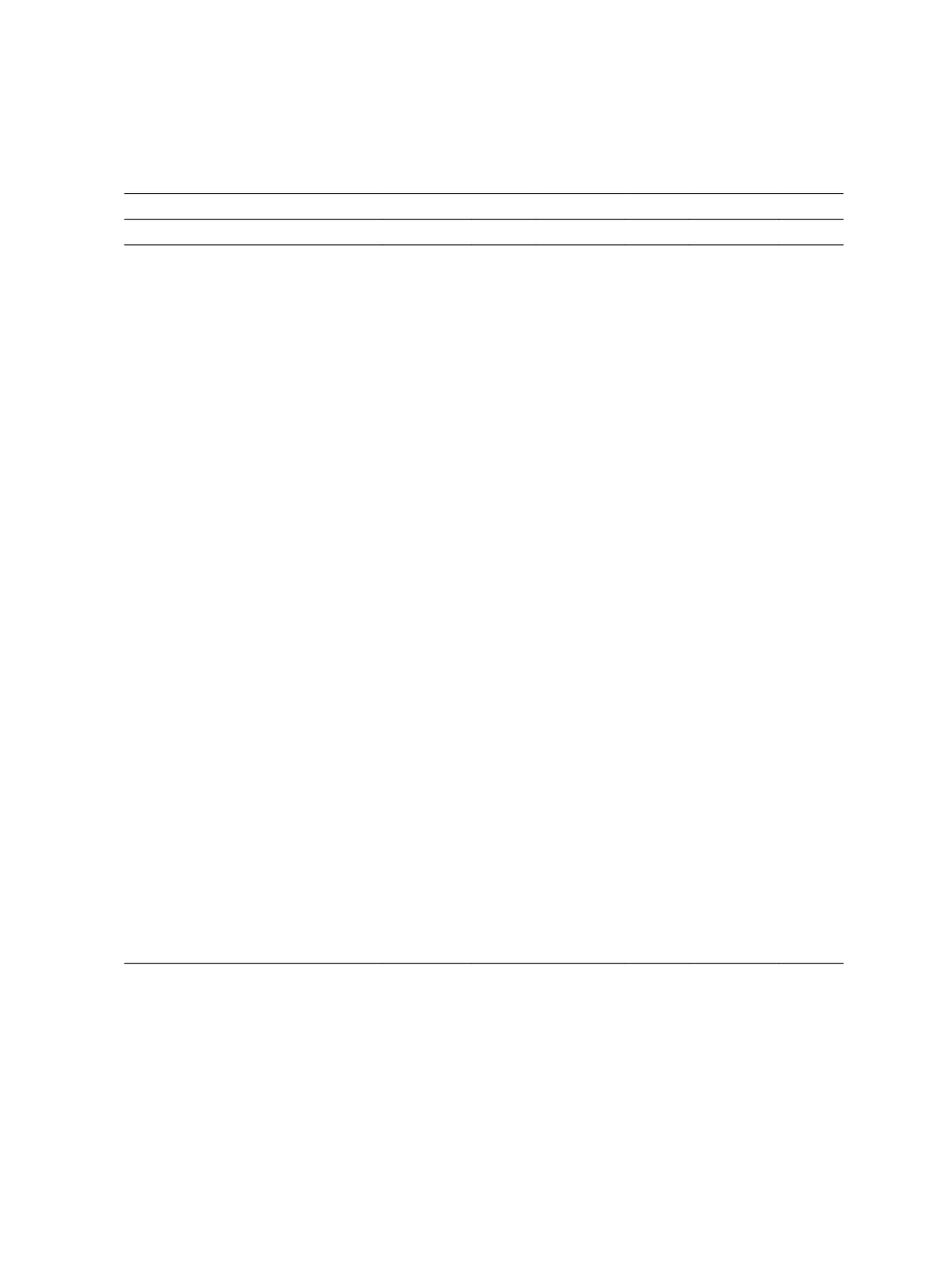

Table 9 Regressions of Reinsurance Demand on CEO Turnover with SOX Act

Dependent variables

∆

Reins ratio

∆

Reins_aff_ratio

∆

Reins_nonaff_ratio

Independent Variables

Estimate P value Estimate P value Estimate P value

SOX

-0.007

0.738 -0.018

0.408

0.011

0.162

Turnover (t-1)

0.027

0.285

0.012

0.646

0.015*

0.095

SOX

×

Turnover (t-1)

0.019

0.523

0.025

0.403 -0.006

0.562

Mutual (t-1)

-0.001

0.984

0.017

0.801 -0.018

0.445

SOX

×

Mutual (t-1)

0.000

0.995

0.000

0.991

0.000

0.989

Duality (t-1)

-0.035*

0.090 -0.022

0.303 -0.013*

0.073

SOX

×

Duality (t-1)

-0.041*

0.054 -0.050**

0.023

0.008

0.287

∆ Board size

0.002

0.570

0.002

0.650

0.000

0.765

SOX

×

∆ Board size

-0.003

0.285 -0.004

0.259

0.000

0.834

∆ Independent director

0.072

0.147

0.016

0.752

0.056*** 0.002

SOX

×

∆ Independent director

-0.071

0.202 -0.019

0.731 -0.051*** 0.010

Big 4 auditor (t-1)

0.011

0.643

0.003

0.883

0.007

0.385

SOX

×

Big 4 auditor (t-1)

-0.017

0.545 -0.018

0.518

0.001

0.886

∆ Ln(na)

-0.278*** 0.000 -0.288*** 0.000

0.009

0.521

∆ Herfindahl

0.019

0.826

0.067

0.448 -0.048

0.127

∆ Geoherfindahl

-0.473*** 0.000 -0.483*** 0.000

0.011

0.775

∆ Leverage

0.033

0.780 -0.168

0.155

0.201*** 0.000

∆ Underwriting risk

-0.306*** 0.000 -0.225*** 0.005 -0.081*** 0.005

∆ 2yearLossDevelopment

0.090**

0.012

0.136*** 0.000 -0.046*** 0.000

∆ Coastal prem

-0.355**

0.017 -0.304**

0.043 -0.051

0.339

∆ Long-tail

0.249*** 0.007

0.235**

0.012

0.014

0.673

∆ Tax_ex

-0.021

0.405 -0.024

0.350

0.003

0.748

∆ ROA

0.048

0.747 -0.043

0.778

0.092*

0.092

Group (t-1)

0.010

0.769

0.024

0.472 -0.014

0.227

Intercept

0.027

0.678 -0.018

0.408

0.011

0.162

Hausman Test

13.07

12.08

36.79

R-Square

0.090

0.088

0.128

N

2,772

2,772

2,772

Note: The table shows the regression results of reinsurance demand on CEO turnover, organizational

structure and corporate governance variables with SOX Act. “

∆

x

” means change in

x

. Specifically

it sugggets that

∆

x

i,t

means

x

i,t

minus

x

i,t

-1

. Please see definition of all variables in Appendix A.

***significant at 1%, ** significant at 5%, * significant at 10%.