美國產險業

CEO

更迭與再保險需求

270

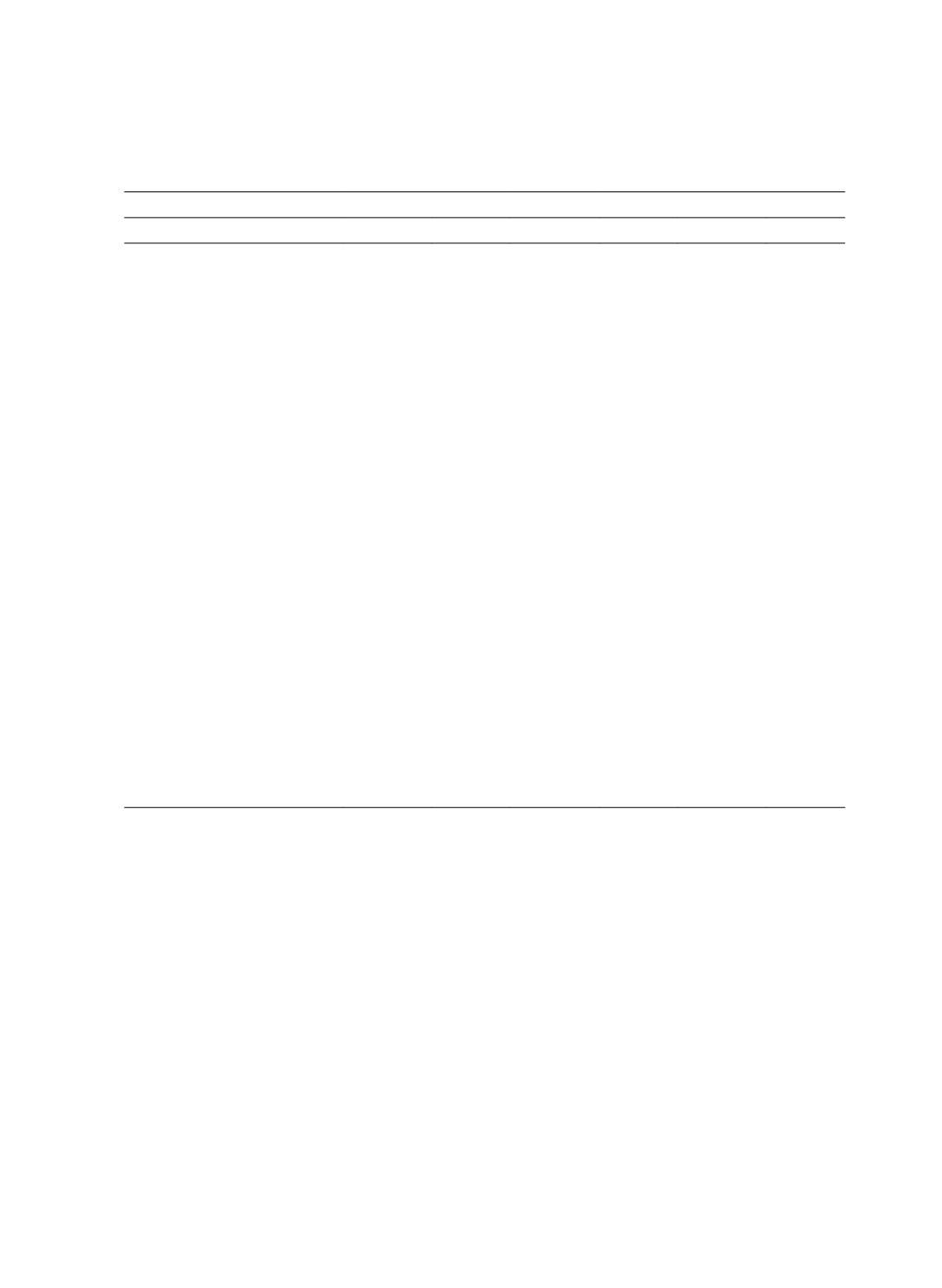

Table 4 Regressions of Reinsurance Demand on Routine CEO, Non-Routine CEO

vs. Non CEO Turnover

Dependent variables

∆

Reins ratio

∆

Reins_aff_ratio

∆

Reins_nonaff_ratio

Independent Variables

Estimate P value Estimate P value Estimate P value

Routine CEO (t-1)

0.019

0.426

0.025

0.314

-0.005

0.530

Non-Routine CEO (t-1)

0.059***

0.003

0.036**

0.067

0.022***

0.002

Mutual (t-1)

-0.009

0.887

0.012

0.858

-0.021

0.370

Duality (t-1)

-0.050***

0.008

-0.041**

0.032

-0.009

0.173

∆ Board size

0.000

0.893

0.000

0.979

0.000

0.764

∆ Independent director

0.033

0.434

-0.001

0.982

0.033**

0.026

Big 4 auditor (t-1)

0.007

0.753

-0.001

0.953

0.008

0.299

∆ Ln(na)

-0.276***

0.000

-0.289***

0.000

0.012

0.395

∆ Herfindahl

0.017

0.843

0.066

0.456

-0.049

0.122

∆ Geoherfindahl

-0.479***

0.000

-0.490***

0.000

0.011

0.771

∆ Leverage

0.038

0.745

-0.168

0.154

0.206***

0.000

∆ Underwriting risk

-0.297***

0.000

-0.215***

0.008

-0.082***

0.004

∆ 2yearLossDevelopment

0.091**

0.011

0.139***

0.000

-0.048***

0.000

∆ Coastal prem

-0.365**

0.014

-0.307**

0.041

-0.058

0.281

∆ Long-tail

0.251***

0.007

0.235**

0.012

0.015

0.643

∆ Tax_ex

-0.023

0.358

-0.026

0.317

0.002

0.789

∆ ROA

0.072

0.632

-0.021

0.889

0.093*

0.086

Group (t-1)

0.011

0.741

0.026

0.446

-0.015

0.220

Intercept

0.029

0.655

0.019

0.768

0.009

0.685

Hausman Test

14.37

13.06

28.26

R-Square

0.087

0.084

0.126

N

2,772

2,772

2,772

Note: The table shows the regression results of reinsurance demand on routine CEO, non-routine CEO

vs. non CEO turnover (reference variable). “

∆

x

” means change in

x

. Specifically it sugggets that

∆

x

i,t

means

x

i,t

minus

x

i,t

-1

. Please see definition of all variables in Appendix A. ***significant at 1%,

** significant at 5%, * significant at 10%.

Table 5 shows the results of the regression of change in reinsurance demand on insurers

with forced CEO turnover, voluntary CEO turnover vs. insurers without CEO turnover

(reference variable). We find that forced CEO turnover are positively and significantly

related to changes in total reinsurance ratio, affiliated reinsurance ratio and non-affiliated

reinsurance ratio. Voluntary CEO turnover are not significantly related to changes in

reinsurance decision. This result suggests that insurers with forced CEO turnover are likely

to have more reinsurance than insurers without CEO turnover. In general, insurers with new

CEOs resulting from forced CEO turnover are likely to have more conservative strategies

and purchase more reinsurance, because they are aware of the fact that their predecessor are