臺大管理論叢

第

27

卷第

2S

期

275

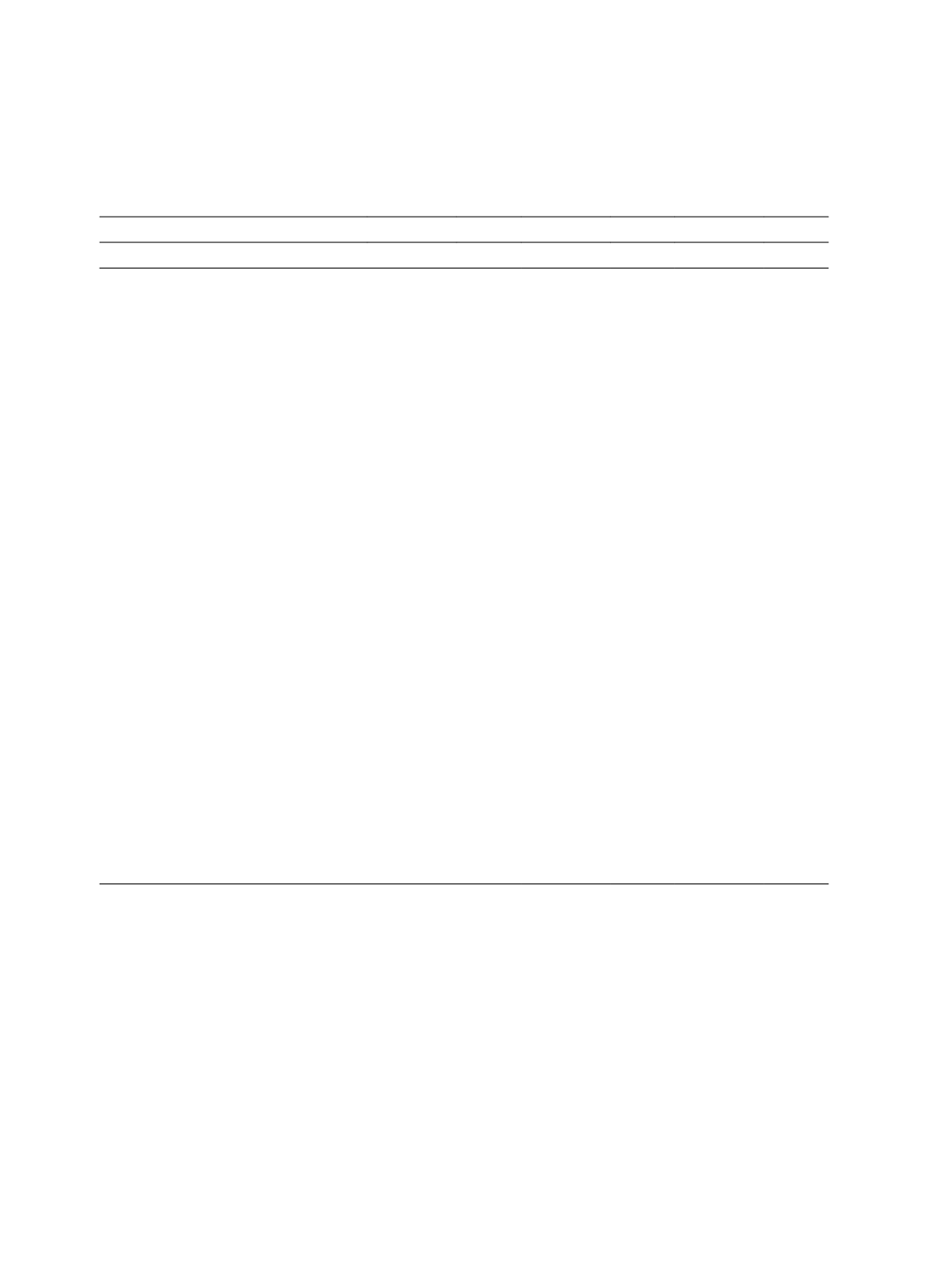

Table 8 Regressions of Reinsurance Demand on Voluntary CEO, Forced CEO vs.

Non CEO Turnover with Interaction Effect of Organizational Structure

Dependent variables

∆

Reins ratio

∆

Reins_aff_ratio

∆

Reins_nonaff_ratio

Independent Variables

Estimate P value Estimate P value Estimate P value

Voluntary CEO (t-1)

0.003

0.932 -0.004

0.925

0.007

0.620

Voluntary CEO (t-1)

×

Mutual (t-1)

0.004

0.943

0.006

0.915 -0.002

0.918

Forced CEO (t-1)

0.087*** 0.000

0.071*** 0.002

0.016**

0.050

Forced CEO (t-1)

×

Mutual (t-1)

-0.079**

0.032 -0.070*

0.061 -0.009

0.497

Mutual (t-1)

0.026

0.701

0.042

0.543 -0.016

0.520

Duality (t-1)

-0.049*** 0.010 -0.039**

0.040 -0.010

0.158

∆ Board size

0.001

0.855

0.000

0.946

0.000

0.753

∆ Independent director

0.031

0.453 -0.001

0.988

0.032**

0.034

Big 4 auditor (t-1)

0.006

0.772 -0.002

0.923

0.008

0.284

∆ Ln(na)

-0.277*** 0.000 -0.288*** 0.000

0.011

0.460

∆ Herfindahl

0.021

0.813

0.068

0.439 -0.048

0.129

∆ Geoherfindahl

-0.467*** 0.000 -0.482*** 0.000

0.015

0.690

∆ Leverage

0.018

0.879 -0.184

0.120

0.202*** 0.000

∆ Underwriting risk

-0.296*** 0.000 -0.214*** 0.008 -0.083*** 0.004

∆ 2yearLossDevelopment

0.084**

0.018

0.133*** 0.000 -0.049*** 0.000

∆ Coastal prem

-0.361**

0.015 -0.304**

0.043 -0.057

0.291

∆ Long-tail

0.247*** 0.007

0.233*** 0.013

0.014

0.670

∆ Tax_ex

-0.019

0.451 -0.022

0.394

0.003

0.755

∆ ROA

0.056

0.710 -0.033

0.827

0.089

0.101

Group (t-1)

0.013

0.695

0.027

0.422 -0.014

0.242

Intercept

0.033

0.613

0.025

0.708

0.008

0.729

Hausman Test

10.56

11.94

24.95

R-Square

0.090

0.087

0.123

N

2,772

2,772

2,772

Note: The table shows the regression results of reinsurance demand on voluntary CEO, forced CEO

vs. non CEO turnover (reference variable) with interaction terms of organizational structure. “

∆

x

”

means change in

x

. Specifically it sugggets that

∆

x

i,t

means

x

i,t

minus

x

i,t

-1

. Please see definition of

all variables in Appendix A. ***significant at 1%, ** significant at 5%, * significant at 10%.