Page 132 - 34-2

P. 132

CEO Extraversion, Management Team Characteristics, and Firm Operating Performance

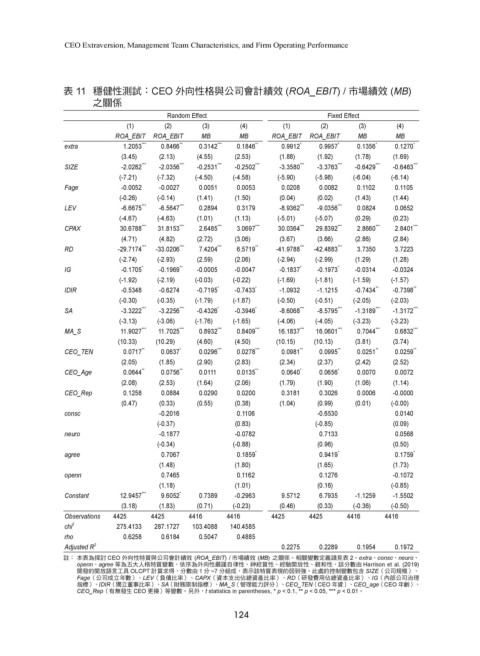

表 11 穩健性測試:CEO 外向性格與公司會計績效 (ROA_EBIT) / 市場績效 (MB)

之關係

Random Effect Fixed Effect

(1) (2) (3) (4) (1) (2) (3) (4)

ROA_EBIT ROA_EBIT MB MB ROA_EBIT ROA_EBIT MB MB

extra 1.2053 *** 0.8466 ** 0.3142 *** 0.1846 ** 0.9912 * 0.9957 * 0.1356 * 0.1270 *

(3.45) (2.13) (4.55) (2.53) (1.88) (1.92) (1.78) (1.69)

SIZE -2.0282 *** -2.0356 *** -0.2531 *** -0.2502 *** -3.3580 *** -3.3763 *** -0.6429 *** -0.6463 ***

(-7.21) (-7.32) (-4.50) (-4.58) (-5.90) (-5.98) (-6.04) (-6.14)

Fage -0.0052 -0.0027 0.0051 0.0053 0.0208 0.0082 0.1102 0.1105

(-0.26) (-0.14) (1.41) (1.50) (0.04) (0.02) (1.43) (1.44)

LEV -6.6675 *** -6.5647 *** 0.2894 0.3179 -8.9362 *** -9.0356 *** 0.0824 0.0652

(-4.67) (-4.63) (1.01) (1.13) (-5.01) (-5.07) (0.29) (0.23)

CPAX 30.6788 *** 31.8153 *** 2.6485 *** 3.0697 *** 30.0364 *** 29.8392 *** 2.8660 *** 2.8401 ***

(4.71) (4.82) (2.72) (3.06) (3.67) (3.66) (2.86) (2.84)

RD -29.7174 *** -33.0206 *** 7.4204 *** 6.5719 ** -41.9788 *** -42.4883 *** 3.7350 3.7223

(-2.74) (-2.93) (2.59) (2.06) (-2.94) (-2.99) (1.29) (1.28)

IG -0.1705 * -0.1969 ** -0.0005 -0.0047 -0.1837 * -0.1973 * -0.0314 -0.0324

(-1.92) (-2.19) (-0.03) (-0.22) (-1.69) (-1.81) (-1.59) (-1.57)

IDIR -0.5348 -0.6274 -0.7195 * -0.7433 * -1.0932 -1.1215 -0.7434 ** -0.7398 **

(-0.30) (-0.35) (-1.79) (-1.87) (-0.50) (-0.51) (-2.05) (-2.03)

SA -3.3222 *** -3.2256 *** -0.4326 * -0.3946 * -8.6068 *** -8.5795 *** -1.3189 *** -1.3172 ***

(-3.13) (-3.06) (-1.76) (-1.65) (-4.06) (-4.05) (-3.23) (-3.23)

MA_S 11.9027 *** 11.7025 *** 0.8932 *** 0.8409 *** 16.1837 *** 16.0601 *** 0.7044 *** 0.6832 ***

(10.33) (10.29) (4.60) (4.50) (10.15) (10.13) (3.81) (3.74)

CEO_TEN 0.0717 ** 0.0637 * 0.0296 *** 0.0278 *** 0.0981 ** 0.0995 ** 0.0251 ** 0.0259 **

(2.05) (1.85) (2.90) (2.83) (2.34) (2.37) (2.42) (2.52)

CEO_Age 0.0644 ** 0.0756 ** 0.0111 0.0135 ** 0.0640 * 0.0656 * 0.0070 0.0072

(2.08) (2.53) (1.64) (2.06) (1.79) (1.90) (1.06) (1.14)

CEO_Rep 0.1258 0.0884 0.0290 0.0200 0.3181 0.3026 0.0006 -0.0000

(0.47) (0.33) (0.55) (0.38) (1.04) (0.99) (0.01) (-0.00)

consc -0.2016 0.1106 -0.6530 0.0140

(-0.37) (0.83) (-0.85) (0.09)

neuro -0.1877 -0.0782 0.7133 0.0568

(-0.34) (-0.88) (0.96) (0.50)

agree 0.7067 0.1859 * 0.9419 * 0.1759 *

(1.48) (1.80) (1.65) (1.73)

openn 0.7465 0.1162 0.1276 -0.1072

(1.18) (1.01) (0.16) (-0.85)

Constant 12.9457 *** 9.6052 * 0.7389 -0.2963 9.5712 6.7935 -1.1259 -1.5502

(3.18) (1.83) (0.71) (-0.23) (0.46) (0.33) (-0.36) (-0.50)

Observations 4425 4425 4416 4416 4425 4425 4416 4416

chi 2 275.4133 287.1727 103.4088 140.4585

rho 0.6258 0.6184 0.5047 0.4885

Adjusted R 2 0.2275 0.2289 0.1954 0.1972

註: 本表為探討 CEO 外向性特質與公司會計績效 (ROA_EBIT) / 市場績效 (MB) 之關係。相關變數定義請見表 2。extra、consc、neuro、

openn、agree 等為五大人格特質變數,依序為外向性嚴謹自律性、神經質性、經驗開放性、親和性,該分數由 Harrison et al. (2019)

開發的開放語言工具 OLCPT 計算求得,分數由 1 分 ~7 分組成,表示該特質表現的弱到強。此處的控制變數包含 SIZE(公司規模)、

Fage(公司成立年數)、LEV(負債比率)、CAPX(資本支出佔總資產比率)、RD(研發費用佔總資產比率)、IG(內部公司治理

指標)、IDIR(獨立董事比率)、SA(財務限制指標)、MA_S(管理能力評分)、CEO_TEN(CEO 年資)、CEO_age(CEO 年齡)、

CEO_Rep(有無發生 CEO 更換)等變數。另外,t statistics in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01。

124