Page 209 - 33-2

P. 209

NTU Management Review Vol. 33 No. 2 Aug. 2023

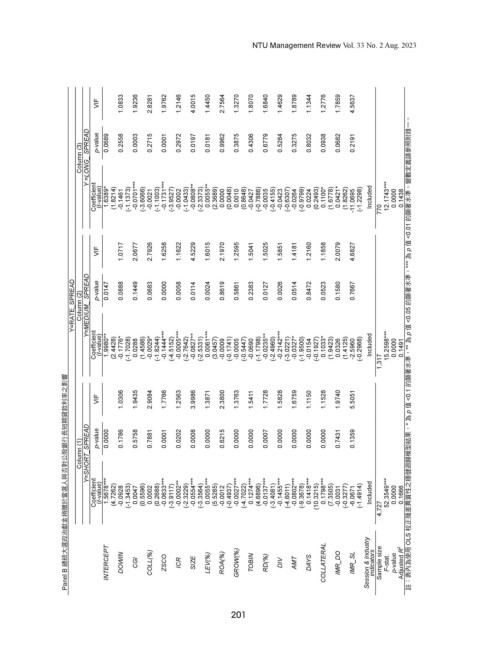

VIF 1.0833 1.9236 2.8281 1.9762 1.2146 4.0015 1.4450 2.7564 1.3270 1.8070 1.6840 1.4629 1.8789 1.1344 1.2776 1.7859 4.5637

Column (3) Y =LONG_ SPREAD p-value 0.0689 0.2558 0.0003 0.2715 0.0001 0.2972 0.0197 0.0181 0.9962 0.3875 0.4306 0.6779 0.5284 0.3275 0.8032 0.0938 0.0682 0.2191

Coefficient (t-value) 1.6389* (1.8214) -0.1461 (-1.1373) -0.0701*** (-3.6066) -0.0021 (-1.1003) -0.1731*** (-3.9527) -0.0002 (-1.0433) -0.0808** (-2.3373) 0.0055** (2.3689) 0.0000 (0.0048) 0.0010 (0.8648) -0.0427 (-0.7886) -0.0035 (-0.4155) -0.0423 (-0.6307) -0.0264 (-0.9799) 0.0224 (0.2493) 0.1100* (1.6778) 0.0421* (1.8262) -11.0695 (-1.2298) Included 770 12.1743**

VIF 1.0717 2.0677 2.7926 1.6258 1.1622 4.5229 1.6015 2.1970 1.2595 1.5041 1.5025 1.5851 1.4181 1.2160 1.1858 2.0079 4.6827

Y=RATE_SPREAD Column (2) Y=MEDIUM_ SPREAD p-value 0.0147 0.0888 0.1449 0.0683 0.0000 0.0058 0.0114 0.0024 0.8619 0.5861 0.2383 0.0127 0.0026 0.0514 0.8472 0.0523 0.1580 0.7667

Coefficient (t-value) 1.9980** (2.4428) -0.1776* (-1.7028) 0.0288 (1.4586) -0.0029* (-1.8244) -0.1444*** (-4.5152) -0.0005*** (-2.7642) -0.0827** (-2.5331) 0.0061*** (3.0457) -0.0009 (-0.1741) -0.0005 (-0.5447) -0.0690 (-1.1798) -0.0235** (-2.4960) -0.2142*** (-3.0221) -0.0327* (-1.9500) -0.0154 (-0.1927) 0.1033* (1.9423) 0.0326 (1.4125) -2.5960 (-0.2968) Included 15

1,317 註:表內為使用 OLS 校正殘差異質性之穩健迴歸模型結果,* 為 p 值 <0.1 的顯著水準,** 為 p 值 <0.05 的顯著水準,*** 為 p 值 <0.01 的顯著水準。變數定義請參照附錄一。

Panel B 總統大選政治獻金捐贈於當選人與否對公股銀行長短期貸款利率之影響

VIF 1.0306 1.9435 2.9084 1.7766 1.2563 3.9986 1.3871 2.3800 1.3763 1.5411 1.7728 1.5828 1.6759 1.1150 1.1528 1.9740 5.5051

Column (1) Y=SHORT_SPREAD p-value 0.0000 0.1786 0.5758 0.7881 0.0001 0.0202 0.0008 0.0000 0.6215 0.0000 0.0000 0.0007 0.0000 0.0000 0.0000 0.0000 0.7431 0.1359

Coefficient (t-value) 1.5678*** (4.7262) -0.0928 (-1.3453) 0.0047 (0.5596) 0.0002 (0.2688) -0.0633*** (-3.9117) -0.0002** (-2.3229) -0.0554*** (-3.3564) 0.0055*** (5.5285) -0.0012 (-0.4937) -0.0027*** (-4.7022) 0.1274*** (4.6896) -0.0137*** (-3.4081) -0.1455*** (-4.6011) -0.0802*** (-9.3678) 0.1418*** (10.3215) 0.1798*** (7.3505) -0.0031 (-0.3277) -6.0671 (-1.4914) In

INTERCEPT DOWIN CGI COLL(%) ZSCO ICR SIZE LEV(%) ROA(%) GROW(%) TOBIN RD(%) DIV AMT DAYS COLLATERAL IMR_DO IMR_SL Session & Industry indicators Sample size F-stat. p-value Adjusted R 2

201