Page 206 - 33-2

P. 206

The Relationship between Corporate Political Donations and Government-Controlled Banks’ Loan Rates:

Evidence from Presidential Elections of Taiwan

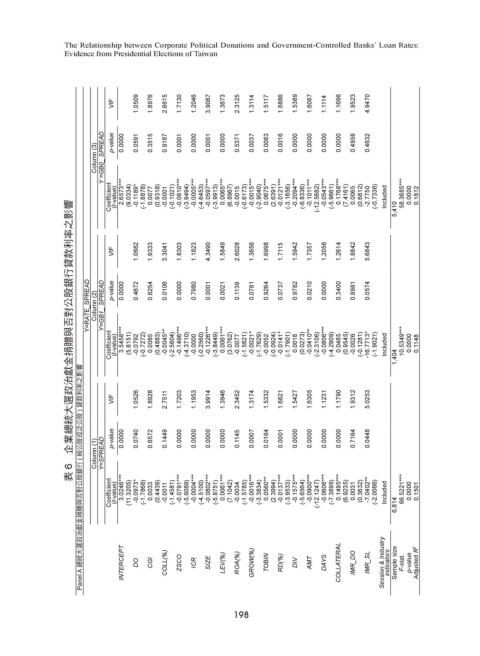

VIF 1.0509 1.8976 2.6615 1.7130 1.2046 3.9087 1.3673 2.3125 1.3114 1.5117 1.6886 1.5389 1.6087 1.1114 1.1696 1.9523 4.9470

Column (3) Y =GB0_ SPREAD p-value 0.0000 0.0591 0.3515 0.9187 0.0001 0.0000 0.0001 0.0000 0.5371 0.0037 0.0083 0.0016 0.0000 0.0000 0.0000 0.0000 0.4958 0.4632

Coefficient (t-value) 2.6573*** (9.0334) -0.1189* (-1.8878) 0.0077 (0.9318) -0.0001 (-0.1021) -0.0610*** (-3.9494) -0.0005*** (-4.6453) -0.0597*** (-3.9913) 0.0065*** (6.8967) -0.0015 (-0.6173) -0.0015*** (-2.9040) 0.0675*** (2.6391) -0.0121*** (-3.1656) -0.2094*** (-6.8336) -0.1011*** (-12.5682) -0.0543*** (-5.9661) 0.1768*** (7.4161) 0.0065 (0.6812) -2.7750 (-0.7

6 企業總統大選政治獻金捐贈與否對公股銀行貸款利率之影響

VIF 1.0682 1.9333 3.3041 1.8303 1.1823 4.3490 1.5849 2.6028 1.3656 1.6998 1.7115 1.5942 1.7357 1.2056 1.2614 1.8842 5.6843

Y=RATE_SPREAD Column (2) Y=GB1_ SPREAD p-value 0.0000 0.4672 0.6254 0.0106 0.0000 0.7980 0.0001 0.0021 0.1139 0.0781 0.9264 0.0737 0.9782 0.0210 0.0000 0.3400 0.8981 0.0574

Coefficient (t-value) 3.5458*** (5.8151) -0.0792 (-0.7272) 0.0085 (0.4883) -0.0045** (-2.5604) -0.1496*** (-4.3710) -0.0000 (-0.2560) -0.1226*** (-3.8449) 0.0061*** (3.0762) -0.0077 (-1.5821) -0.0021* (-1.7629) -0.0052 (-0.0924) -0.0141* (-1.7901) 0.0018 (0.0273) -0.0410** (-2.3106) -0.0806*** (-4.2909) 0.0485 (0.9545) -0.0026 (-0.1281) -16.7713* (-1.9021) Include

VIF 1.0526 1.8928 2.7511 1.7203 1.1953 3.9914 1.3946 2.3452 1.3174 1.5332 1.6821 1.5427 1.6305 1.1231 1.1790 1.9312 5.0253

Column (1) Y=SPREAD p-value 0.0000 0.0740 0.6572 0.1449 0.0000 0.0000 0.0000 0.0000 0.1145 0.0007 0.0164 0.0001 0.0000 0.0000 0.0000 0.0000 0.7164 0.0448

表 Panel A 總統大選政治獻金捐贈與否對公股銀行 ( 純公股或泛公股 ) 貸款利率之影響

Coefficient (t-value) 3.0246*** (11.3205) -0.0973* (-1.7868) 0.0033 (0.4439) -0.0011 (-1.4581) -0.0791*** (-5.6089) -0.0004*** (-4.5100) -0.0802*** (-5.8751) 0.0061*** (7.1042) -0.0034 (-1.5785) -0.0016*** (-3.3834) 0.0560** (2.3994) -0.0137*** (-3.9533) -0.1575*** (-5.6564) -0.0900*** (-12.1247) -0.0606*** (-7.3899) 0.1495*** (6.9235) 0.0031 (0.3632) -7.0402** (-2

INTERCEPT DO CGI COLL(%) ZSCO ICR SIZE LEV(%) ROA(%) GROW(%) TOBIN RD(%) DIV AMT DAYS COLLATERAL IMR_DO IMR_SL Session & Industry indicators Sample size F-stat. p-value Adjusted R 2

198