Page 208 - 33-2

P. 208

The Relationship between Corporate Political Donations and Government-Controlled Banks’ Loan Rates:

Evidence from Presidential Elections of Taiwan

1.0342 1.8974 2.6625 1.7130 1.2045 3.9106 1.3672 2.3126 1.3097 1.5103 1.6879 1.5393 1.6117 1.1114 1.1681 1.9500 4.9478

VIF

Column (3) Y =GB0_ SPREAD p-value 0.0000 0.0040 0.3485 0.9530 0.0001 0.0000 0.0001 0.0000 0.5383 0.0034 0.0085 0.0017 0.0000 0.0000 0.0000 0.0000 0.4961 0.4738

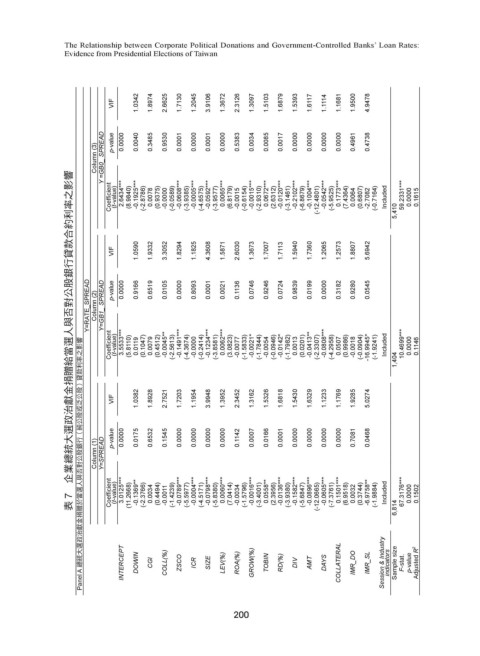

7 企業總統大選政治獻金捐贈給當選人與否對公股銀行貸款合約利率之影響

Coefficient (t-value) 2.6434*** (8.9840) -0.1925*** (-2.8786) 0.0078 (0.9375) -0.0000 (-0.0589) -0.0608*** (-3.9385) -0.0005*** (-4.6575) -0.0592*** (-3.9577) 0.0065*** (6.8179) -0.0015 (-0.6154) -0.0015*** (-2.9310) 0.0672*** (2.6312) -0.0120*** (-3.1461) -0.2102*** (-6.8679) -0.1004*** (-12.4801) -0.0542*** (-5.9525) 0.1773*** (7.4364) 0.0064 (0.6807) -2.7082 (-0

VIF 1.0590 1.9332 3.3052 1.8294 1.1825 4.3608 1.5871 2.6030 1.3673 1.7007 1.7113 1.5940 1.7360 1.2065 1.2573 1.8807 5.6942

Y=RATE_SPREAD Column (2) Y=GB1_ SPREAD p-value 0.0000 0.9166 0.6519 0.0105 0.0000 0.8093 0.0001 0.0021 0.1136 0.0746 0.9246 0.0724 0.9839 0.0199 0.0000 0.3182 0.9280 0.0545

Coefficient (t-value) 3.5533*** (5.8110) 0.0119 (0.1047) 0.0079 (0.4512) -0.0045** (-2.5613) -0.1491*** (-4.3674) -0.0000 (-0.2414) -0.1234*** (-3.8581) 0.0062*** (3.0823) -0.0077 (-1.5833) -0.0021* (-1.7844) -0.0054 (-0.0946) -0.0142* (-1.7982) 0.0013 (0.0201) -0.0413** (-2.3307) -0.0808*** (-4.2958) 0.0507 (0.9986) -0.0018 (-0.0904) -16.9945* (-1.9241) Included

Panel A 總統大選政治獻金捐贈於當選人與否對公股銀行(純公股或泛公股)貸款利率之影響

VIF 1.0382 1.8928 2.7521 1.7203 1.1954 3.9948 1.3952 2.3452 1.3162 1.5326 1.6818 1.5430 1.6329 1.1233 1.1769 1.9285 5.0274

Column (1) Y=SPREAD p-value 0.0000 0.0175 0.6532 0.1545 0.0000 0.0000 0.0000 0.0000 0.1142 0.0007 0.0166 0.0001 0.0000 0.0000 0.0000 0.0000 0.7081 0.0468

Coefficient (t-value) 3.0125*** (11.2668) -0.1369** (-2.3766) 0.0034 (0.4494) -0.0011 (-1.4239) -0.0789*** (-5.5977) -0.0004*** (-4.5171) -0.0798*** (-5.8380) 0.0060*** (7.0414) -0.0034 (-1.5796) -0.0016*** (-3.4001) 0.0558** (2.3956) -0.0136*** (-3.9380) -0.1582*** (-5.6847) -0.0896*** (-12.0665) -0.0605*** (-7.3761) 0.1501*** (6.9518) 0.0032 (0.3744) -6.9758** (-

表 6,814

INTERCEPT DOWIN CGI COLL(%) ZSCO ICR SIZE LEV(%) ROA(%) GROW(%) TOBIN RD(%) DIV AMT DAYS COLLATERAL IMR_DO IMR_SL Session & Industry indicators Sample size F-stat. p-value Adjusted R 2

200