231

臺大管理論叢

第

28

卷第

2

期

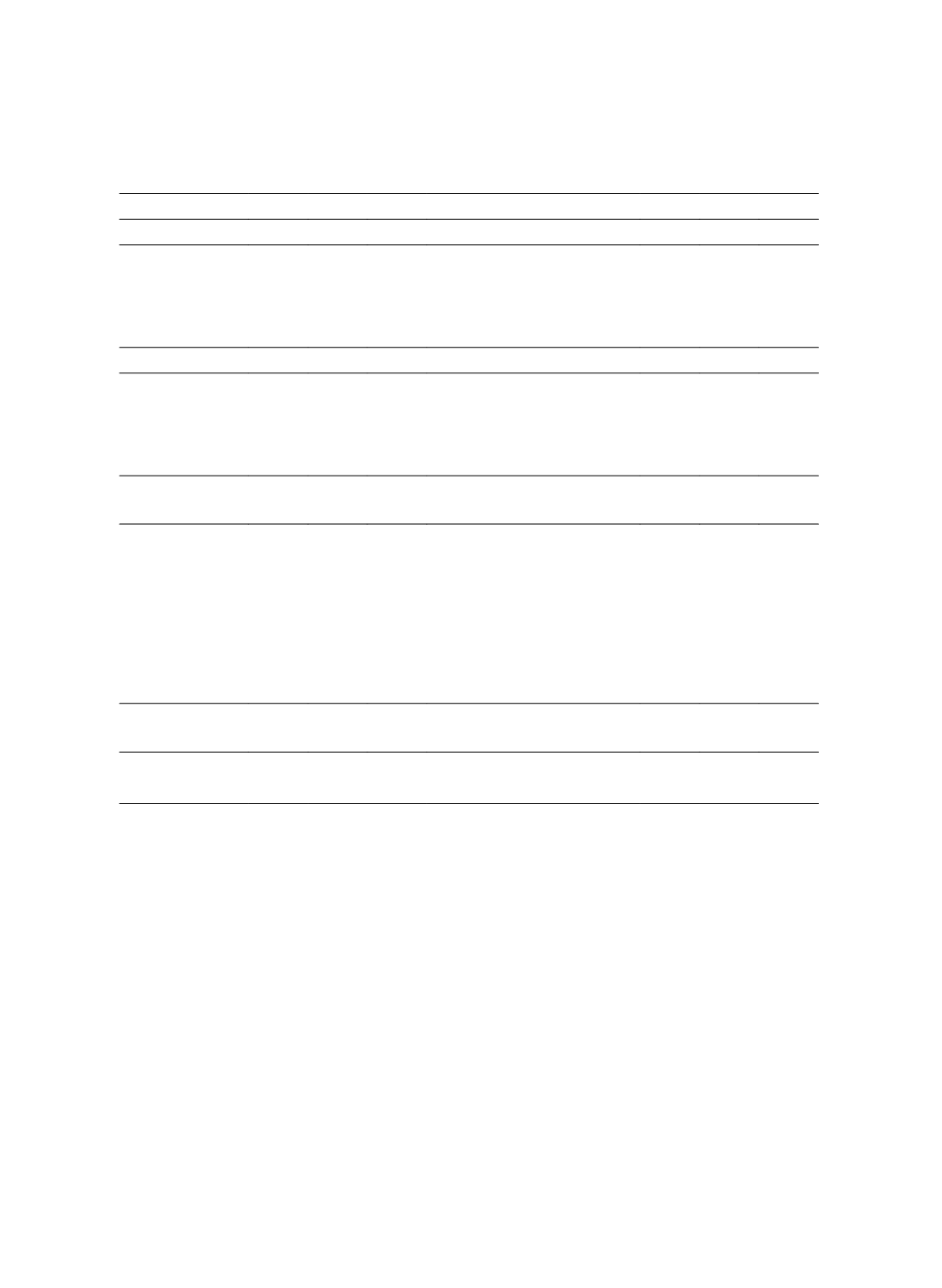

Table 13 Strengths of Importance for Dimensions and Criteria

Dimension Weight Rank Rank

a

Criteria

Weight Rank Rank

b

A. Financial

.2385 4

1 A1 Credit Risk

.0449 11

1

A2 Profitability Risk

.0503 8

2

A3 Strategic Risk

.0540 5 18

A4 Legal Risk

.0447 12 14

A5 Cost Risk

.0445 13

9

B. Customer

.2587 1

3 B1 Integration Risk

.0579 4 16

B2 Reputational Risk

.0526 6 19

B3 Liquidity Risk

.0511 7 20

B4 Privacy Risk

.0468 10 13

B5 Trust Risk

.0503 9 10

C. Business

Process

.2528 2

2 C1 Information Risk

.0310 18 12

C2 Cultural Risk

.0298 20 21

C3 Transactional Risk

.0287 21

7

C4 Operational Risk

.0362 14

8

C5 Competitive Risk

.0336 15

6

C6 Service Risk

.0300 19

5

C7 Security Risk

.0319 16

3

C8 Transition Risk

.0317 17 11

D. Learning and

Growth

.2500 3

4 D1 Management Risk

.0934 1 15

D2 Leadership Risk

.0932 2

4

D3 Intellectual Property Risk .0634 3 17

Note:

a

Dimension ranks of Tseng et al. (2011);

b

Criteria ranks of Tseng et al. (2011)

Significant differences between the DANP and AHP results are shown in Table 13,

particularly regarding the financial and customer dimensions, the criteria of the business

process, and learning and growth dimensions. From the viewpoint of the research

methods, the DANP, as a generalization of the AHP, can be used for managing complex

interrelated and interdependent dimensions and criteria in the RM-BSC (Saaty, 2001). The

RM-BSC is the BSC in the context of risk management, implying causal relationships

among the four dimensions and their underlying criteria (Kaplan and Norton, 1992). The

ignorance of their interdependencies eventually misleads the evaluation of the importance

of dimensions and criteria. The results of this study were in agreement with those of the

review conducted by Sipahi and Timor (2010), which stated the following: “Compared to

AHP, the ANP methodology makes it possible to consider all kinds of dependence and