分析台灣金控公司之關鍵風險因子:以風險平衡計分卡結合決策分析實驗室法為基礎之分析網路法

230

credit and operational risk as well as other forms of risk-taking (Hirtle, 2016; Ellul and

Yerramilli, 2013; Barakat et al., 2014; Minton et al., 2014; Buston, 2016). The service and

security risks were less likely to be relevant at BHCs, and credit, profitability, cost,

reputational, trust, operational, and competitive risks were found to be influenced

primarily by the other types of risk.

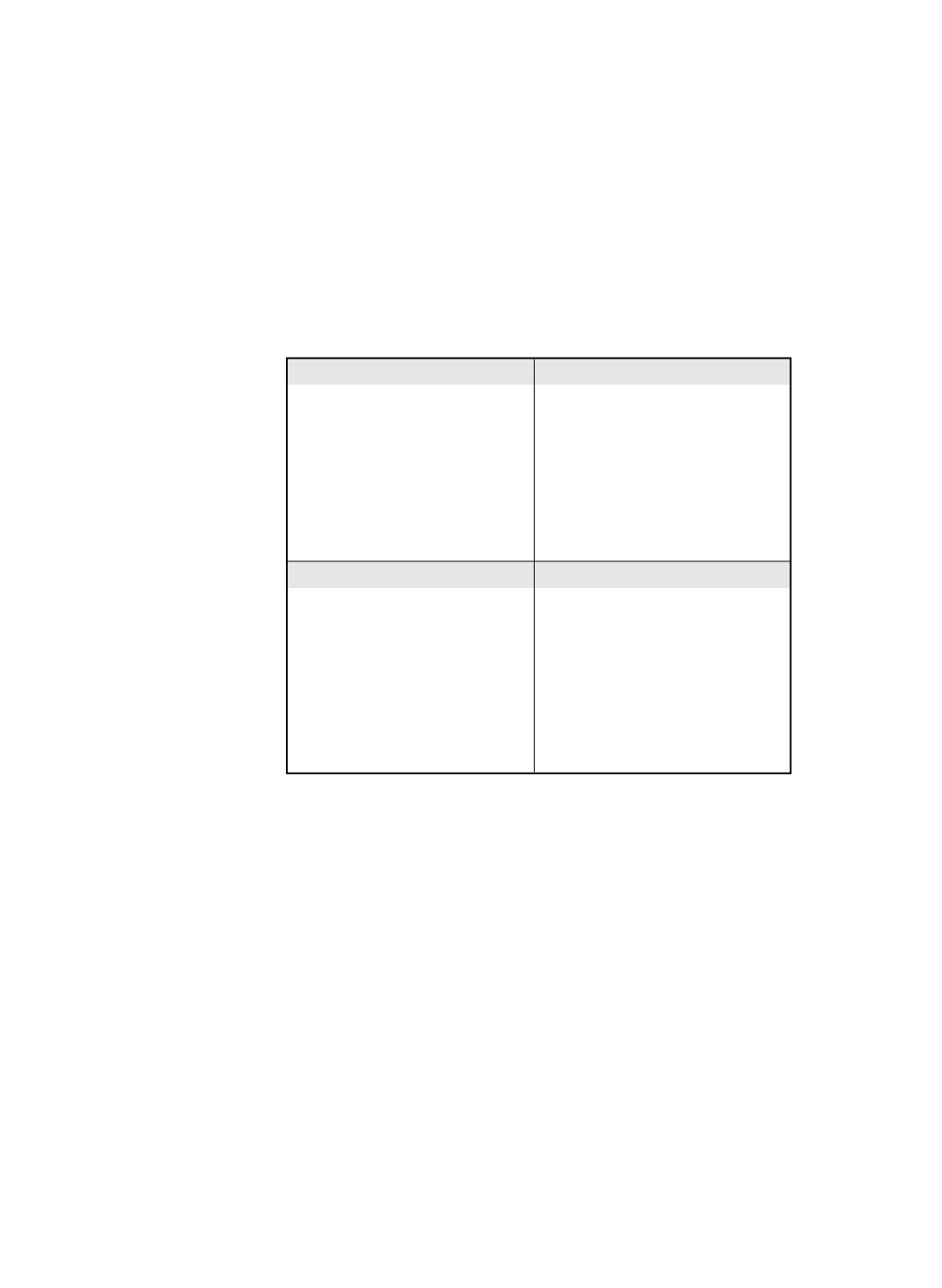

Positive:Cause

Factors

II: Driving Factor Zone

A4 Legal Risk

B3 Liquidity Risk

B4 Privacy Risk

C1 Information Risk

C2 Cultural Risk

C3 Transactional Risk

C8 Transition Risk

D3 Intellectual Property Risk

III: Independent Factor Zone

C6 Service risk

C7 Security risk

I: Core Factor Zone

A3 Strategic Risk

B1 Integration Risk

D1 Management Risk

D2 Leadership Risk

IV: Influenced Factor Zone

A1 Credit Risk

A2 Profitability Risk

A5 Cost Risk

B2 Reputational Risk

B5 Trust Risk

C4 Operational Risk

C5 Competitive Risk

Relation (D−R)

Negative:Effect

Factors

Low

Prominence (D+R) (Average = 9.1)

High

Figure 3 Relationship Diagram of Risk Management Criteria

The final results of the DANP are listed in Table 13, which shows how the experts of

the FHCs and subsidiary corporations prioritized the 21 risk management evaluation

criteria. The weights of management, leadership, and intellectual property risks were

higher than those of the other types of risks. The risk factor with the highest weight

(0.0934) was management risk, and that with the second highest weight (0.0932) was

leadership risk; both belonged to the dimension of learning and growth and exhibited

weights that were two times those of the risk factors in the customer dimension.

Conversely, the risk factor with the lowest weight (0.0287) was transactional risk, and that

with the second lowest weight (0.0298) was cultural risk; both belonged to the business

process dimensions.