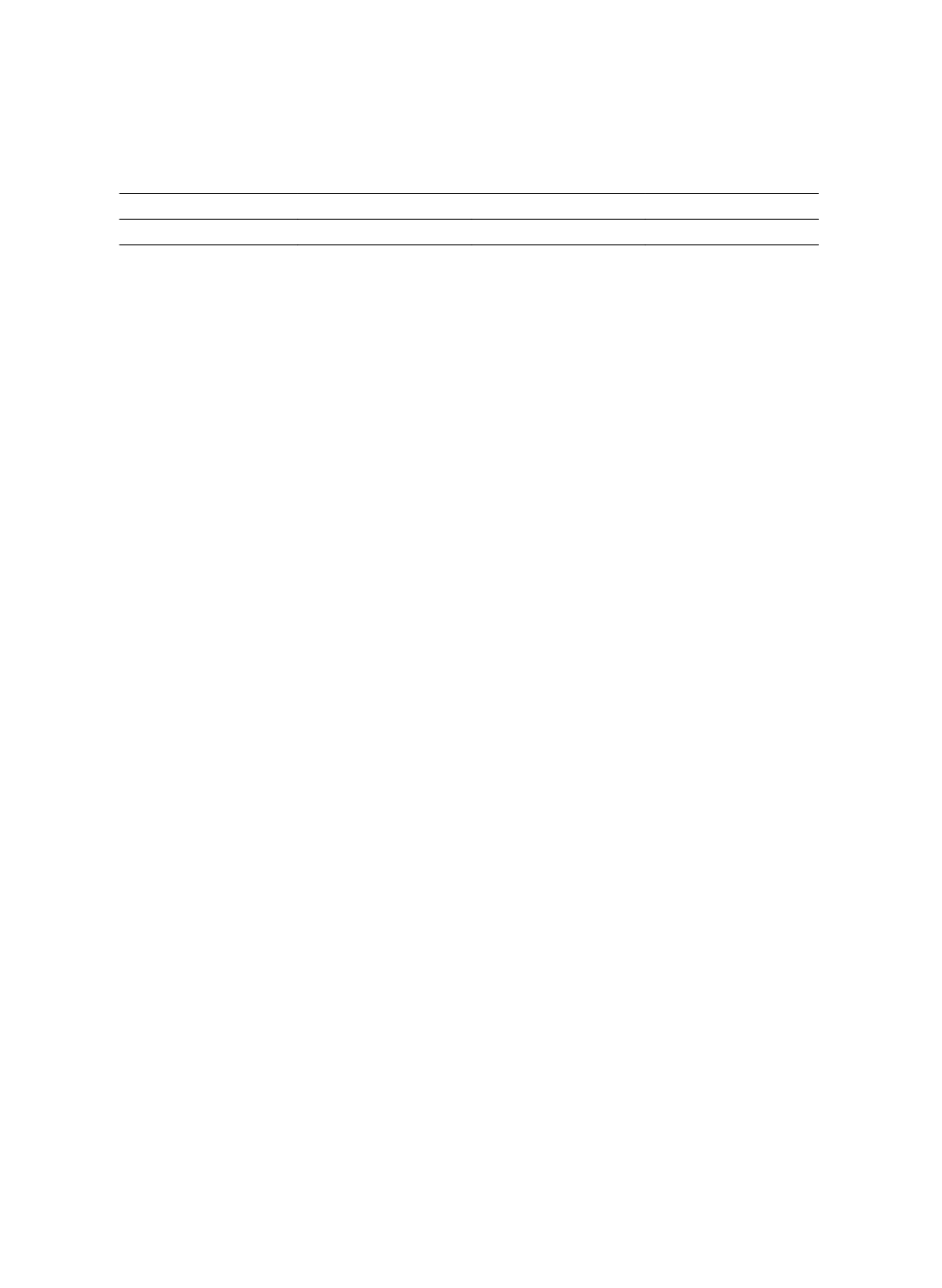

149

臺大管理論叢

第

28

卷第

2

期

表

4

次期投資與可比較性之關聯性

應變數:

INVESTMENT

t

+1

[1]

[2]

[3]

截距項

-0.036

0.047

0.468

(-0.01)

(0.02)

(0.18)

ECOMP4

t

0.108

0.108

0.087

(3.50)***

(3.46)***

(2.76)***

OVERI

t

-2.425

-2.274

-2.092

(-1.83)*

(-1.71)*

(-1.58)

ECOMP4

t

× OVERI

t

-0.141

-0.138

-0.123

(-2.37)**

(-2.33)**

(-2.08)**

SIZE

t

0.349

0.398

0.369

(2.22)**

(2.43)**

(2.28)**

MTB

t

0.651

0.646

0.666

(3.58)***

(3.59)***

(3.77)***

σ(CFO)

t

-1.462

-1.515

-0.060

(-0.37)

(-0.38)

(-0.01)

σ(SALES)

t

-2.691

-2.630

-1.716

(-2.18)**

(-2.12)**

(-1.37)

σ(INVESTMENT)

t

13.665

13.862

15.821

(3.25)***

(3.37)***

(3.87)***

ZSCORE

t

0.205

0.207

0.195

(1.84)*

(1.88)*

(1.80)*

CFO_SALES

t

1.398

1.379

1.285

(1.62)

(1.62)

(1.54)

KS

t

-0.105

-0.179

-0.408

(-0.11)

(-0.19)

(-0.44)

DIVIDEND

t

1.448

1.455

1.244

(4.75)***

(4.73)***

(4.19)***

AGE

t

-0.041

-0.043

-0.042

(-2.63)***

(-2.64)***

(-2.62)***

OP_CYCLE

t

-0.000

-0.001

-0.000

(-1.60)

(-1.73)*

(-1.61)

LOSS

t

-1.207

-1.183

-1.065

(-4.07)***

(-3.98)***

(-3.57)***

DEV

t

-0.021

-0.020

(-1.11)

(-1.06)

D_HOLDING

t

-0.057

-0.059

(-1.03)

(-1.09)