155

臺大管理論叢

第

28

卷第

2

期

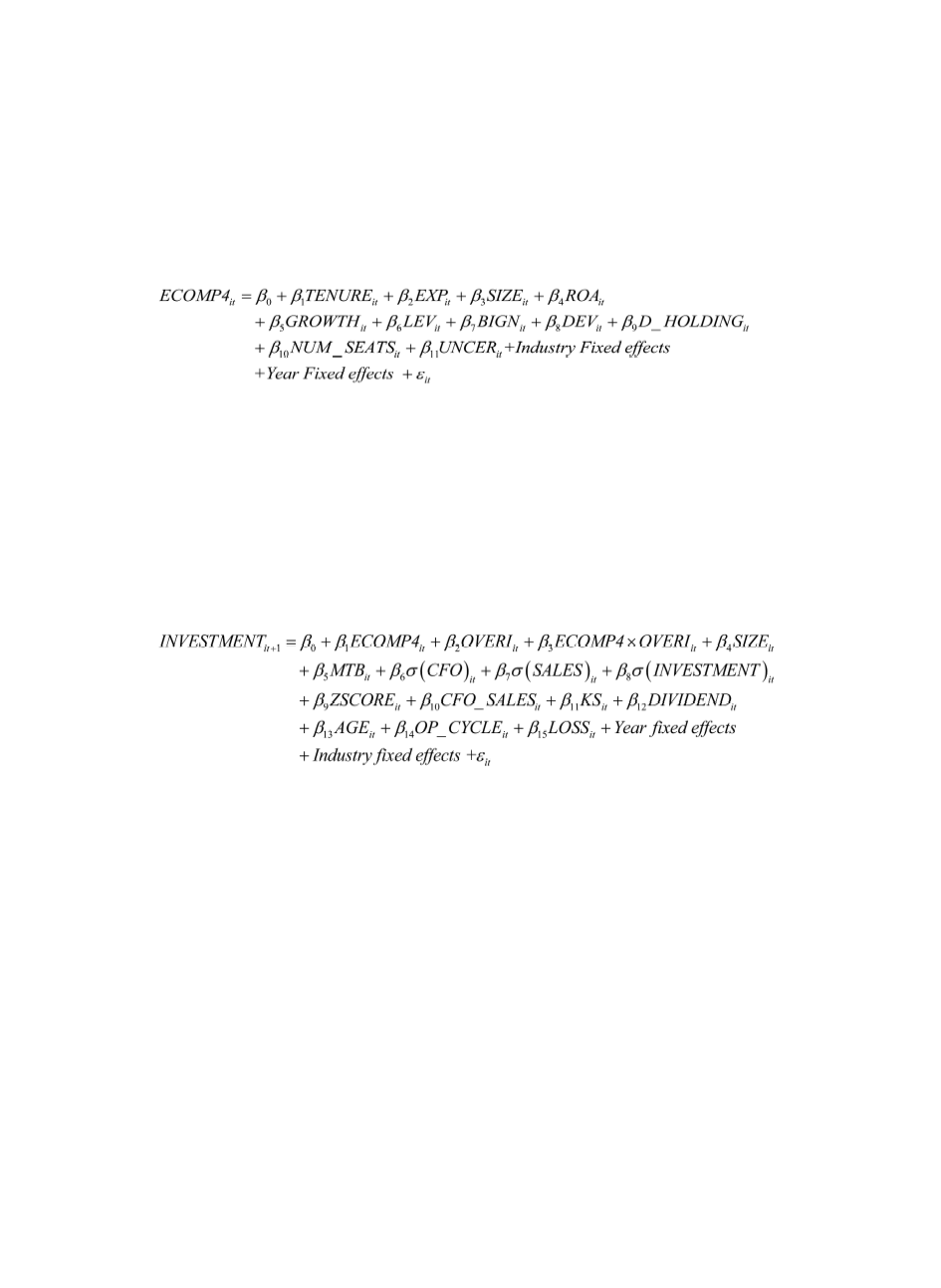

This paper employs the firm-level comparability measure developed by De Franco,

Kothari, and Verdi (2011) to test hypotheses 1a and 1b. The empirical model was as

follows (see Table 1 for the definition of variables):

(1)

If hypothesis 1a (1b) is supported, the direction of the coefficients on

TENURE

(EXP)

should be positive.

In this paper I test hypotheses 2a and 2b by examining whether the association

between the level of investment and comparability is negative (positive) for firms that are

prone to overinvest (underinvest). The following regression is used (see Table 1 for the

definition of variables):

(2)

I test hypothesis 2a by investigating if the coefficient on

ECOMP4

is greater than

zero and then test hypothesis 2b by examining if the sum of the coefficients on

ECOMP4

and

ECOMP4*OVERI

is less than zero.

Additional tests were also used to check the robustness of the results. First, I

examined the comparability-experience association for short-, medium-, and long-tenured

group. Second, I analyzed not only the effect of industry specialization on comparability at

the firm level and partner level but also the role of auditor industry experience, instead of

auditor experience, in the determinants of comparability. Third, I decomposed total

investment into capital and noncapital investment and then re-ran the model (2). Finally, I

used the deviation from normal level investment as an alternative proxy for investment

inefficiency.