臺大管理論叢

第

26

卷第

2

期

163

housing price volatility, and mortality assumption should be examined in terms of the value

of each component. Table 4 shows that an unexpected loss will occur for the insurance

provider when the rental rate and/or housing price volatility are underestimated, and when

the mortality (decremental) rate is overestimated. Owing to the existence of RM insurance,

the profit of mortgage issuer is independent of the rental rate and the housing price volatility.

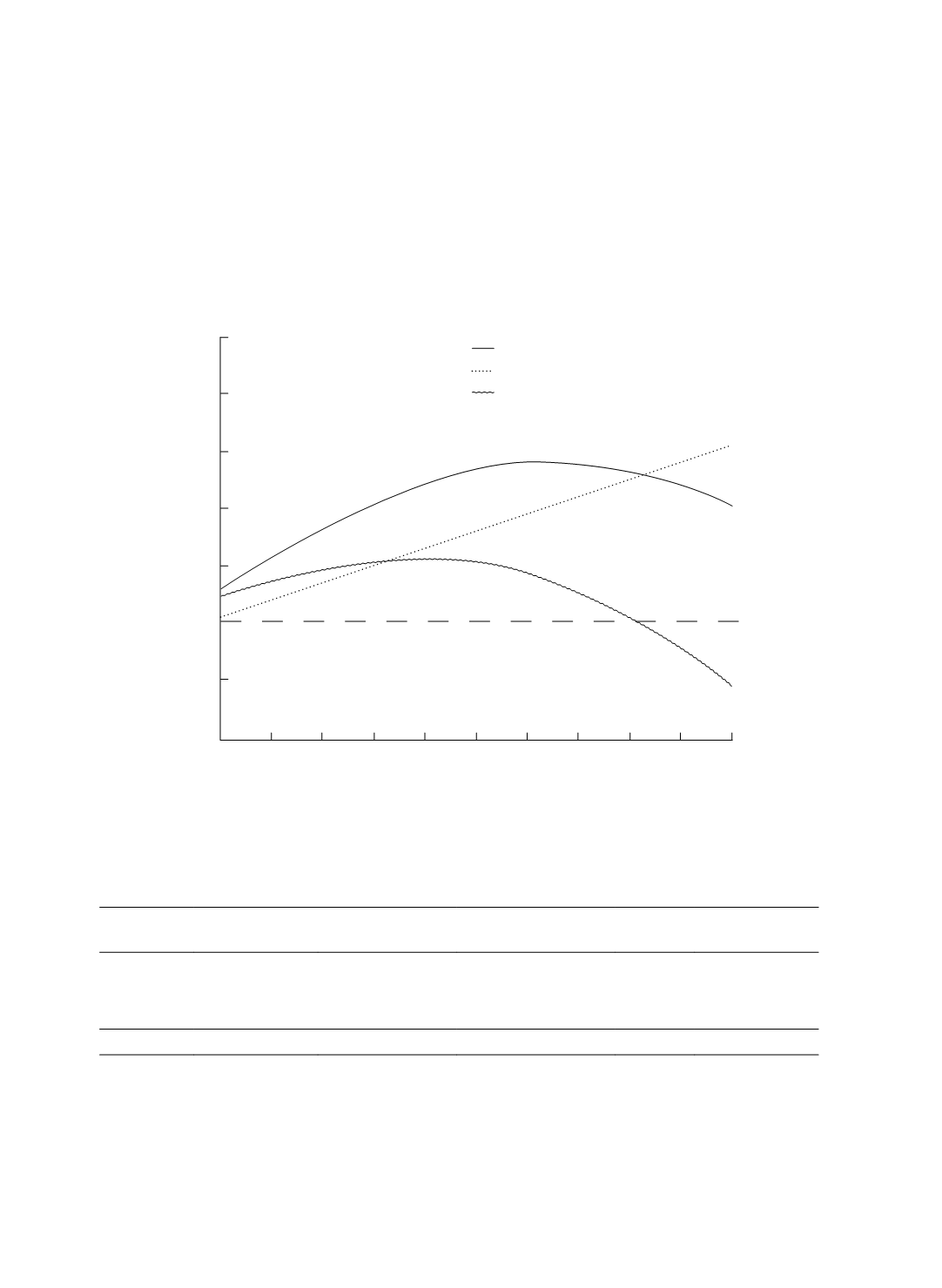

Figure 1 The Profitability versus the Loan to Value Ratio

loan to value ratio (%)

0.25

0.2

0.15

0.1

0.05

0

-0.05

-0.1

total profitability (%)

profitability of mortgage issuer (%)

profitability of insurance issuer (%)

0

5

10

15

20

25

30

35

40

45

50

Table 4 Sensitivity Analysis for a Specific Loan Amount

Rental Rate

Rental

Income

Remaining

Value

Insurance

Expenses

Profits

Cost of

Insurance

1.0%

137,883

277,664

120,765

129,915

80,517

2.0%

252,204

203,591

120,765

129,915 120,765

3.0%

347,448

152,880

120,765

129,915 165,297

Housing Price Volatility

2.5%

252,204

158,208

120,765

129,915

75,382

7.5%

252,204

182,908

120,765

129,915 100,082

12.5%

252,204

219,654

120,765

129,915 136,828