反向房屋抵押貸款商品結構分析

162

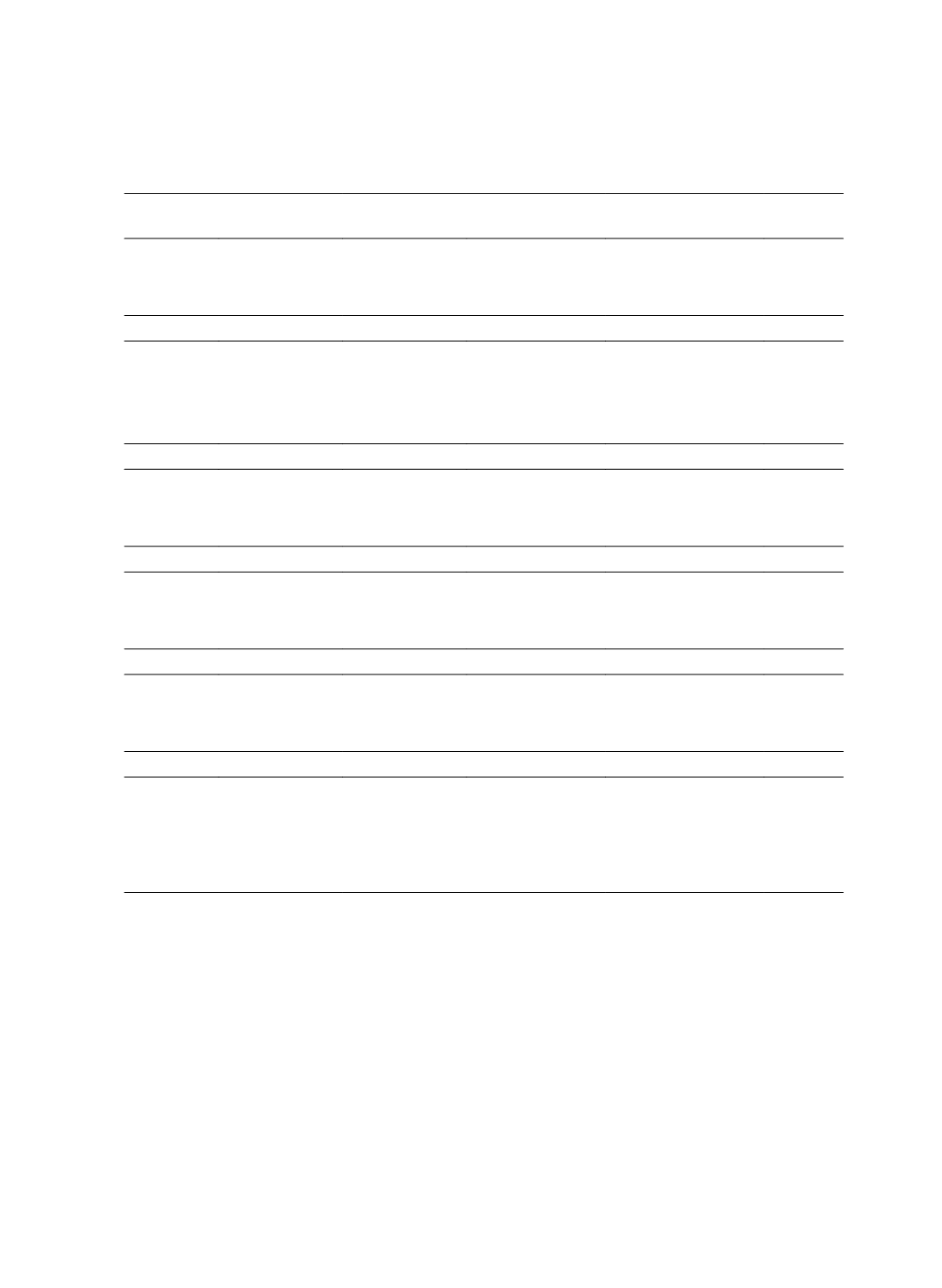

Table 3 Sensitivity Analysis for Maximum Loan Amounts

Rental Rate

Loan

Amounts

Rental

Income

Remaining

Value

Insurance

Expenses

Profits

1.0%

503,967

137,883

201,409

141,572

156,741

2.0%

414,290

252,204

203,591

120,765

129,915

3.0%

340,018

347,448

204,837

103,532

107,697

Loan Interest Spread

0%

610,796

252,204

136,999

144,747

0

0.5%

539,570

252,204

158,089

136,577

50,137

1.5%

414,290

252,204

203,591

120,765

129,915

2.5%

311,934

252,204

250,725

106,190

185,137

Upfront Premium Charge Rate

1.0%

404,480

252,204

219,326

106,169

123,989

2.0%

414,290

252,204

203,591

120,765

129,915

3.0%

422,577

252,204

189,833

135,008

135,386

Annual Premium Rate

0.50%

365,147

252,204

275,897

53,226

106,752

1.25%

414,290

252,204

203,591

120,765

129,915

2.00%

438,385

252,204

161,081

203,458

148,330

Housing Price Volatility

2.5%

489,422

252,204

105,983

138,197

152,390

7.5%

452,058

252,204

154,524

129,528

141,213

12.5%

383,384

252,204

243,741

113,594

120,670

Mortality

L-C

(1.4 times)

462,557

217,707

202,591

109,736

117,145

Lee-Carter

414,290

252,204

203,591

120,765

129,915

L-C

(0.8 times)

383,819

275,665

202,706

127,603

137,810

According to the HECM program, an upper limit exists on the actual loan amount,

known as the maximum loan amount, and the issuer can determine the actual LTV ratio,

provided that it does not exceed this limit. As a result, this study analyzes the profitability of

the mortgage issuer and insurance provider against the potential LTV ratios. Figure 1 shows

the relationship for a borrower aged 70 years old.

In practice, the loan amount is fixed when the loan is set up. The issuer must assess the

mispricing risk owing to the uncertainty of parameter values. For a scenario that assumes

maximum loan amount ($414,290 for a 70-year-old male borrower), the effect of rental rate,