分析台灣金控公司之關鍵風險因子:以風險平衡計分卡結合決策分析實驗室法為基礎之分析網路法

210

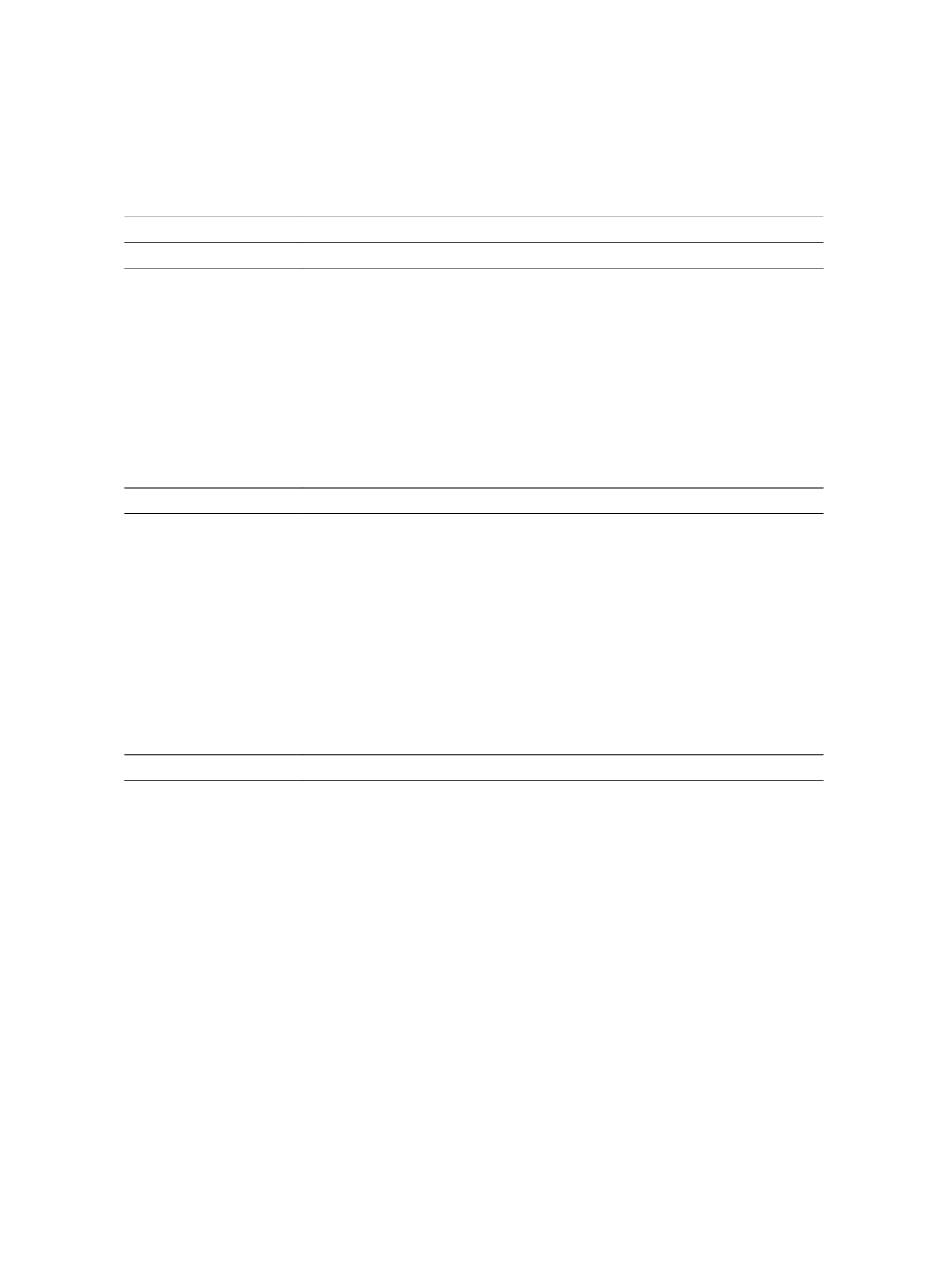

Table 1 Contents of Dimensions and Criteria for Evaluating Risk Management by

Using The Balanced Scorecard

Dimension/Criteria

Content

A. Financial

A1. Credit Risk

Risk that the counterparty breaks a contract or that the enterprise’s

evaluation level increases

A2. Profitability Risk

The uncertainty in future financial results caused by changes in operating

decisions or the environment

A3. Strategic Risk

Risk in the overall management decisions that determine long-term

organizational performance and actions

A4. Legal Risk

Risk caused by procedures and systems that do not conform to laws and

risk of being litigated and contract breaching

A5. Cost Risk

Risk of direct or indirect losses in activities and other negative influences

B. Customer

B1. Integration Risk Risk involving the integration of M&A policies and enterprise goals

B2. Reputational Risk

Risk caused by nonbusiness behaviors (i.e., human factors and

management process factors), such as negative media reports or

punishment records that leave poor impressions on customers

B3. Liquidity Risk

Risk caused by improper use of capital or poor turnover and dispatching

B4. Privacy Risk

Risk caused by illegal access to customer transaction information and

demographic data

B5. Trust Risk

Risk involving gaps in expectation and investment caused by customers’

inappropriate expectations, which originate from insufficient supervision

and poor information disclosure

C. Business Process

C1. Information Risk

Risk of business interruption caused by information loss, disclosure, and

unavailability

C2. Cultural Risk

Risk involving cultural differences caused by diversities in enterprises’

internal and external development, operational philosophy, and methods

C3. Transactional Risk

Foreign exchange risk caused by foreign exchange rate changes during

the operation process

C4. Operational Risk Risk of operational changes caused by variations in laws or employees

C5. Competitive Risk

Risk of confusing service authority division caused by competition in

performance evaluations

C6. Service Risk

Risk of customer service quality decline caused by operational risk

incidents

C7. Security Risk

Risk of being corrected by supervisory authorities, banking license being

revoked, or operation execution limitations caused by financial

supervision law and regulation violation

C8. Transition Risk

Risk of credit changes caused by a predictable crisis of evaluation

targets