207

臺大管理論叢

第

28

卷第

2

期

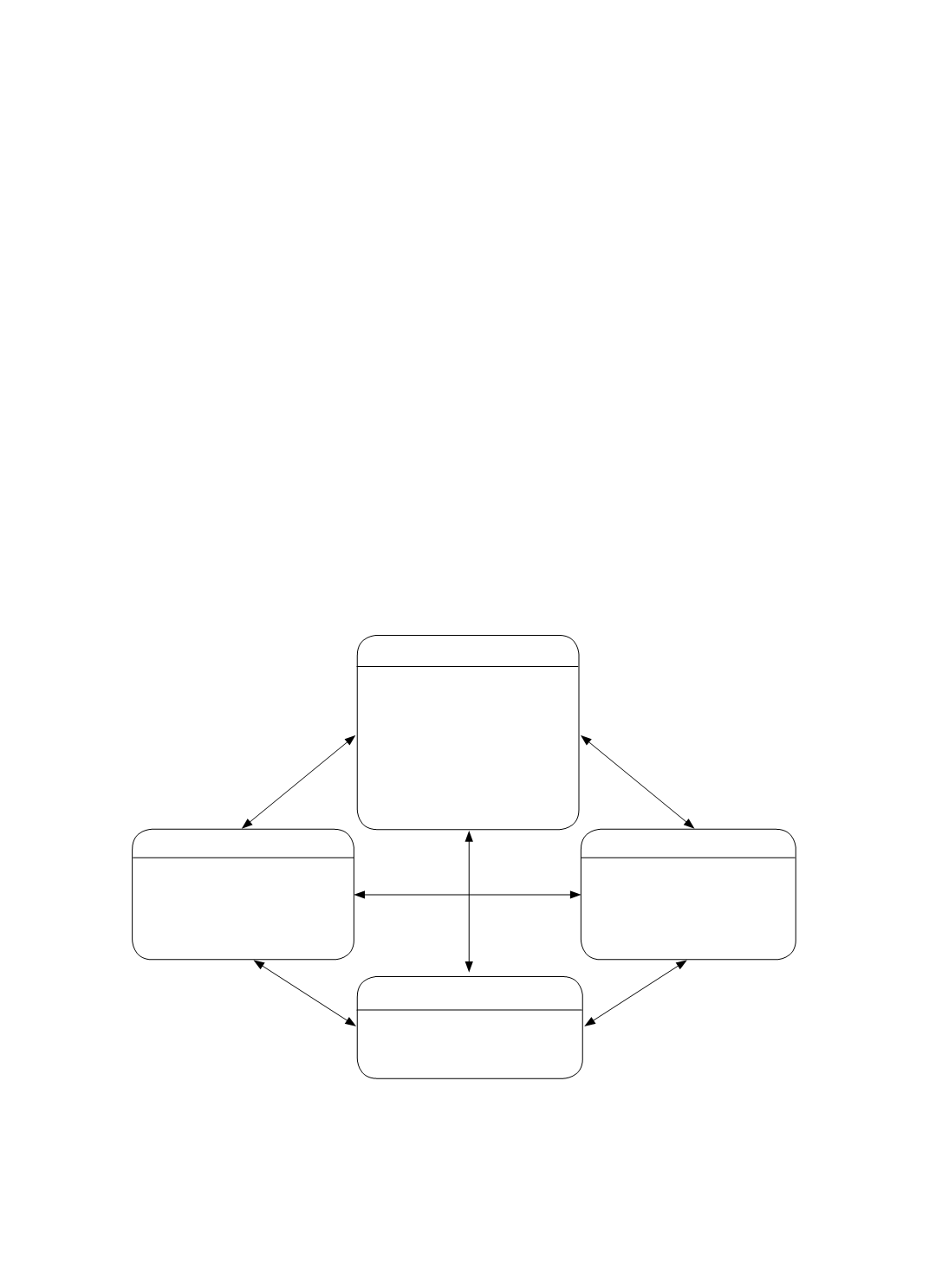

objectives and risk management for establishing key risk indicators for business-to-

business (B2B) Internet banking. Their results indicated that after the application of risk

management strategies to plan operational procedures, each dimension of the BSC had

sufficient discriminant ability and significant paths for key risk factors. In applying the

analytic hierarchy process (AHP) to evaluate the relative importance of key risk factors,

they ignored the apparent interdependencies among the risk factors, in contrast to the

analytic network process (ANP), which reflects these interdependencies. This study filled

a methodological gap by examining the influential relationships among the risk factors

shown in Figure 1 in the RM–BSC based on the advanced DEMATEL-based ANP

(DANP).

In aiming to fulfill the two mentioned objectives, this study examined four

dimensions of risk management with 21 criteria for the BSC (Figure 1), which enabled us

to analyze the correlation between risk management and financial performance in FHCs in

Taiwan.

Figure 1 Interrelated RM–BSC Model with Dimensions and Criteria

C. Business Process

C1 Information Risk

C2 Cultural Risk

C3 Transactional Risk

C4 Opereational Risk

C5 Competitive Risk

C6 Service Risk

C7 Security Risk

C8 Transition Risk

D. Learning and Growth

D1 Management Risk

D2 Leadership Risk

D3 Intellectual Property Risk

A. Financial

A1 Credit Risk

A2 Profitability Risk

A3 Strategic Risk

A4 Legal Risk

A5 Cost Risk

B. Customer

B1 Integration Risk

B2 Reputational Risk

B3 Liquidity Risk

B4 Privacy Risk

B5 Trust Risk