分析台灣金控公司之關鍵風險因子:以風險平衡計分卡結合決策分析實驗室法為基礎之分析網路法

216

10.When a new business operation is developed, how does your company categorize

and manage its future risk?

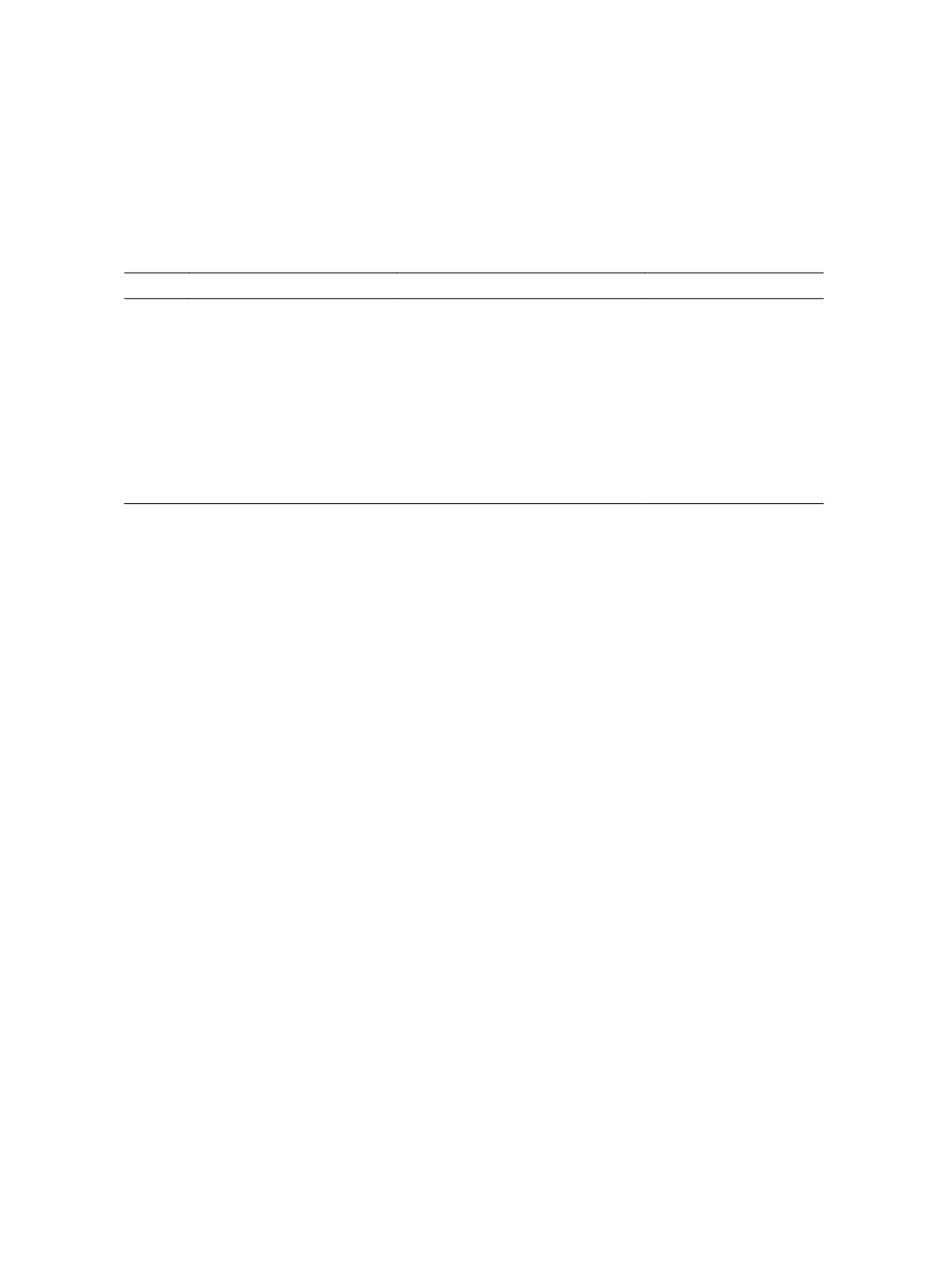

Table 2 Profile of The Interviewees (n = 8)

No.

Type of Organization

Title

Experience Years

1 FHC

Deputy General Manager

15

2 Bank

Manager

12

3 Bank

Director

12

4 FHC

Manager

8

5 Bank

Deputy Manager

10

6 Bank

Section Manager

9

7 Security

Director

10

8 Insurance

Director

10

According to the interviews with eight current professional managers in the FHCs

and subsidiary corporations, risk management is essential for the financial industry. The

eight professional managers’ opinions on the four dimensions were highly consistent and

positive. They confirmed that these dimensions conformed to the operational

characteristics of FHCs. However, the descriptions were refined to ensure agreement with

the common language in practice. The degree of risk affects earnings volatility. A high

degree of risk increases the probability of operational risks in FHCs. Therefore, risk must

be controlled and managed appropriately. Effective risk management reduces losses in the

operational process, thus contributing to the achievement of operational goals.

The second stage of this study involved a survey of 30 employees in FHCs and

subsidiary corporations. The profile of the respondents (Table 3) was consistent with the

objectives of this study, because all of the respondents were employed in the central, bank,

insurance, securities, or securities investment trust divisions of FHCs. Twenty-five

(83.33%) of them had more than 5 years of experience, and 11 of them had more than 10

years (36.67%) of experience with risk management.

The questionnaire was divided into two sections. A preface was used to explain the

definitions of the indicators for participants to understand the purposes of this study. In the

first section, to confirm the correlations between the strengths of influence of the four

dimensions in the performance evaluations conducted by employees in the risk

management departments, the dimensions were paired for comparison. In the second

section, the strength of mutual influence among the 21 criteria was measured to determine

the effectiveness of the performance evaluation criteria in the FHCs.