211

臺大管理論叢

第

28

卷第

2

期

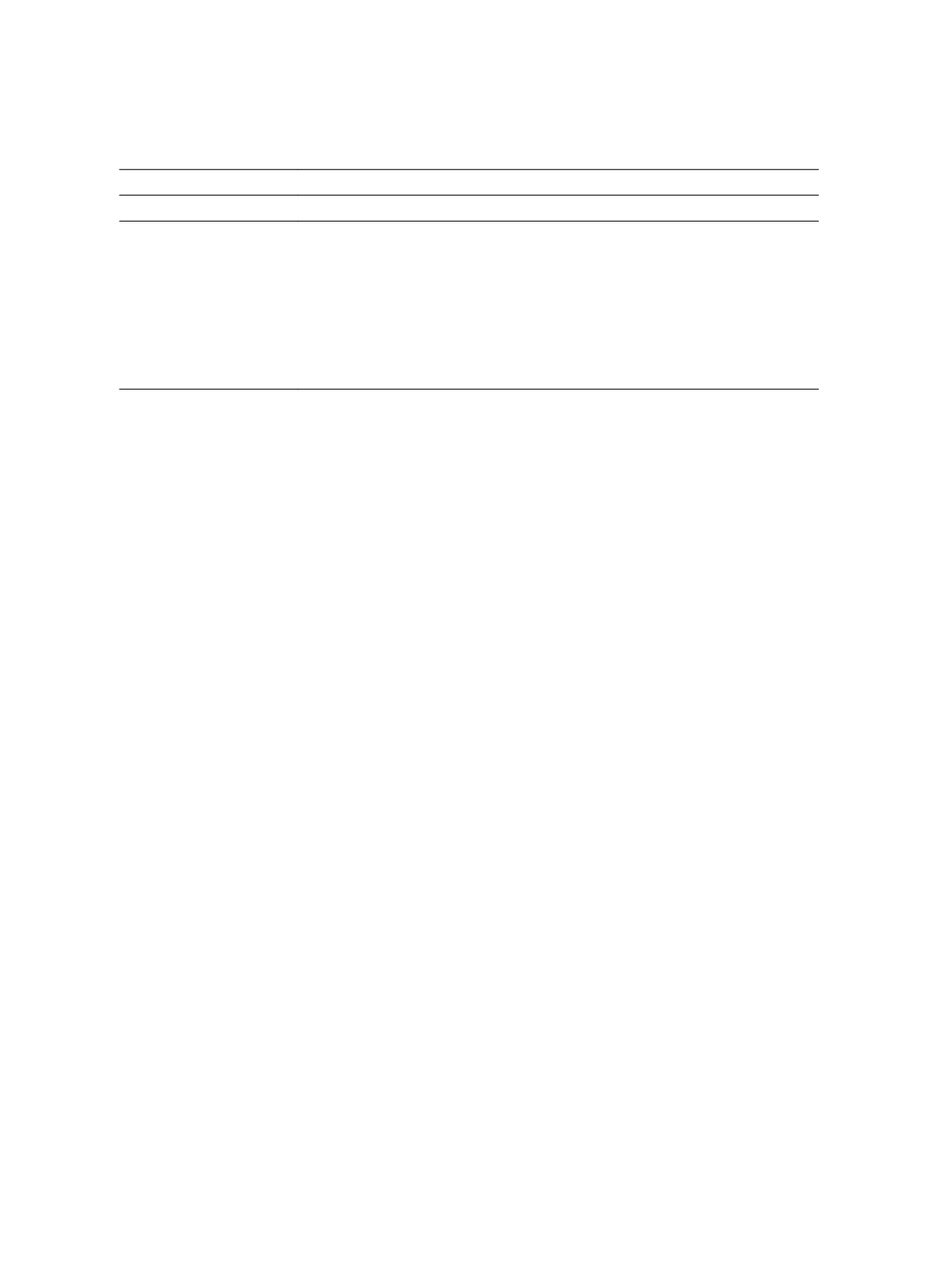

Dimension/Criteria

Content

D. Learning and Growth

D1. Management Risk

Risk caused by failure to fully communicate expectations regarding

performance, to establish relevant operational indicators, and to achieve

agreement on performance management

D2. Leadership Risk

Risk related to negative influences caused by changes in policies,

criteria, and the execution of procedures

D3. Intellectual

Property Risk

Risk related to company penalty and punishment caused by intellectual

property violation

Note: revised according to Tseng et al. (2011)

2.2 The Basel Committee on Banking Supervision and Key Risk Factors

To enhance the stability of the financial system, in July 1988, the Basel Committee

on Banking Supervision (BCBS) released

International Convergence of Capital

Measurement and Capital Standards

(i.e., the accord), called Basel I, which laid the

foundation for capital adequacy, with risks as its benchmark. The BCBS recommended

that its members regulate financial organizations operating in their countries, and that they

conduct credit risk measurements before the end of 1992 to ensure that their preparation

for operational risks was adequate. The minimum capital standard was 8%. The total

amount of risk assets for market risk provisions was increased in 1996. The New Capital

Adequacy Framework, released in June 1996, was intended to replace Basel I, which was

released in July 1988. The Basel I regulations target both member and nonmember

countries.

Basel II is divided into three dimensions. The first dimension is the framework of the

accord (i.e., minimum capital requirements), which contains credit, market, and

operational risks. Regarding the calculation of various risk capital provisions, the primary

goals for overall capital provision are to reflect banks’ risk sensitivity, to prepare banks for

risks, and to maintain the current standards for capital control limits. The second

dimension requires supervisory organizations to guarantee the completeness of procedures

for evaluating the internal banking capital adequacy ratio. The third dimension involves

the importance of strengthening market disciplines. Information disclosure regulations are

used to fulfill the basic requirements of market disciplines (BCBS, 2001, 2006).

Since Taiwan’s financial industry implemented Basel II at the beginning of 2007,

capital-adequacy-related ratios have decreased substantially. At the end of March 2007,

the capital adequacy ratio as calculated according to Basel II was 10.14%, which is 0.73%