投資機會和投資者保護機制對控股股東派息的影響

192

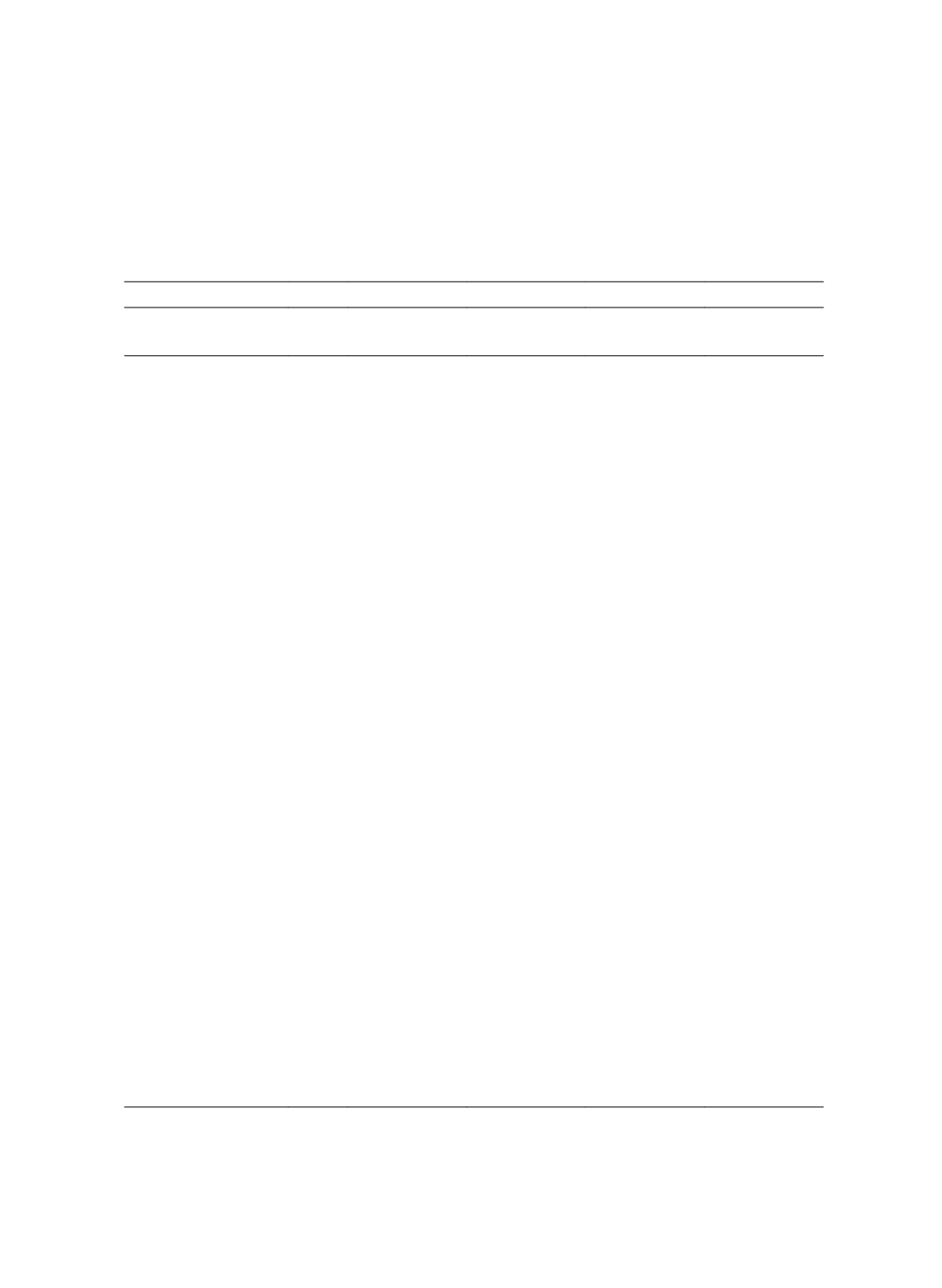

Table 4 Coefficients of the Regressions of the Industry-Adjusted Dividend Payout

on Control Divergence and Legal Institutions

PAYOUT

= β

0

+ β

1

Diverge

+ β

2

Institution

+ β

3

Diverge×Institution

+ β

4

GxDiverge

+ β

5

GxInstitution

+

β

6

GxDiverge×Institution

+ β

7

Own

+ β

8

Own×Institution

+ β

9

G

+ β

10

Size

+ β

11

Leverage

+

β

12

Ln(GNP)

+ β

13

LRes

+ β

14

Dta

+ error term

(1)

Panel A. Legal Law Origin (No. of Observations: 6,093)

Independent

Variable

Exp.

Sign

IADvd/Sales

(1)

IADvd/CFO

(2)

IADvd/MV

(3)

IADvd/E

(4)

Intercept

(?)

0.037***

(4.59)

0.067**

(1.98)

0.015***

(3.45)

-0.073

(-1.14)

Diverge

(+)

-0.003

(-1.22)

-0.006

(-0.49)

-0.003*

(-1.81)

0.014

(0.65)

Legal

(+)

0.015***

(6.86)

0.151***

(16.71)

0.017***

(15.04)

0.038**

(2.26)

Diverge*Legal

(+)

0.004

(0.81)

0.036*

(1.65)

0.006**

(2.12)

0.057

(1.38)

G*Diverge

(+)

0.002***

(3.25)

0.005**

(2.14)

0.001***

(4.51)

0.007

(1.57)

G*Legal

(-)

0.000

(0.46)

-0.007***

(-5.65)

-0.001***

(-7.22)

0.000

(0.14)

G*Diverge*Legal

(-)

-0.003***

(-2.98)

-0.013***

(-2.92)

-0.002***

(-3.14)

-0.017**

(-2.05)

Own

(?)

0.000***

(4.51)

0.000***

(3.04)

0.000***

(10.44)

0.001***

(4.28)

Own*Legal

(?)

-0.000***

(-3.25)

-0.001***

(-3.16)

-0.000***

(-6.17)

-0.001***

(-3.17)

G

(-)

-0.000**

(-2.03)

-0.004***

(-4.33)

-0.001***

(-6.24)

-0.021***

(-12.73)

Size

(?)

0.001***

(5.86)

-0.000

(-0.23)

-0.000***

(-3.52)

0.004**

(2.07)

Leverage

(-)

-0.004***

(-22.13)

-0.099***

(-11.93)

-0.001

(-0.82)

0.046***

(2.93)

Ln(GNP)

(?)

-0.006***

(-9.15)

-0.006**

(-2.40)

-0.002***

(-5.75)

0.000

(0.10)

LRes

(-)

0.004

(1.33)

-0.004

(-0.32)

-0.005***

(-3.03)

-0.055**

(-2.17)

Dta

(+)

0.019***

(5.30)

0.084***

(5.68)

0.016***

(8.25)

0.137***

(4.90)

Adjusted R

2

15.53% 23.52% 19.21%

7.01%