187

臺大管理論叢

第

28

卷第

1

期

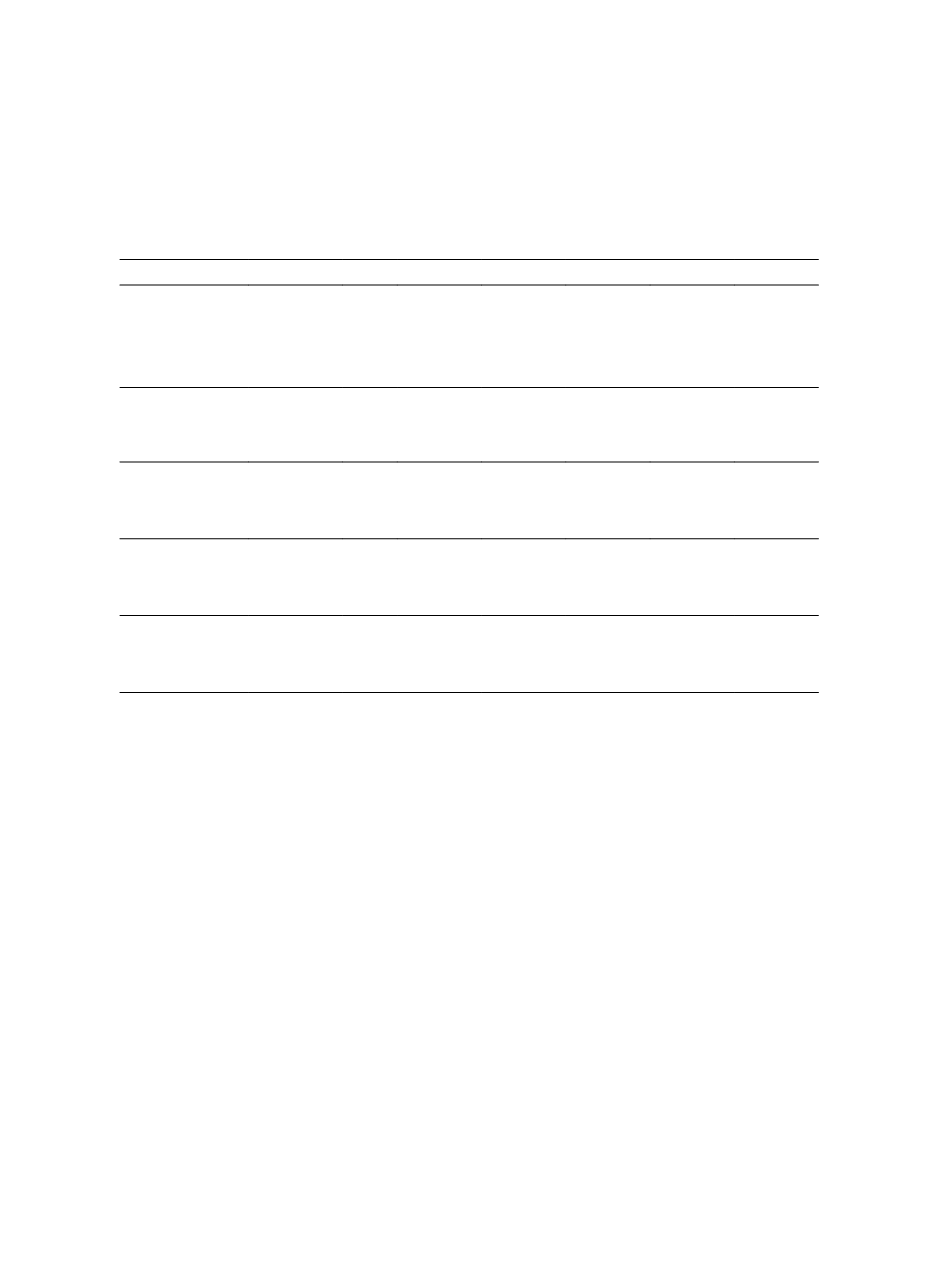

Table 2 Descriptive Statistics of the Firm-Level Dividend Payout Ratios, Ultimate

Owner’s Control and Cash Flow Rights, Legal Institutions, and Country-

and Firm-Specific Characteristics

Refer to Appendix A for the definitions of the variables.

Variables N Mean Median Std. dev.

Min.

Max.

Dividend Payout

Ratios

Dvd/Sales

6,093 2.39% 1.42% 3.35% 0

55.81%

Dvd/CFO

6,093 19.94% 16.45% 14.41% 0

101.80%

Dvd/MV

6,093 2.42% 2.01% 1.78% 0

15.78%

Dvd/E

6,093 39.43% 34.64% 24.38% 0

211.75%

Ownership

Diverge

(% positive)

6,093

0.19

(39.59%)

0

0.30

0

1

Own

6,093 23.54

16.00

22.32

0

100

Legal Institutions

Legal

6,093 0.40

0

0.49

0

1

Right

6,093 3.56

4

1.40

0

5

Disclosure

5,926 70.25

69

7.53

36

83

Country-specific

Characteristics

Ln(GNP)

6,093 9.81

9.90

0.69

6.61

10.48

LRes

6,093 0.12

0.10

0.16

0

1

Dta

6,093 0.79

0.83

0.12

0.56

1.08

Firm-specific

Characteristics

G

6,093 4.50

5

2.87

0

9

Size

6,093 19.66

19.49

1.85

14.46

25.58

Leverage

6,093 0.55

0.55

0.20

0.02

5.12

Table 3 presents the Spearman Rank and Pearson correlations between the industry-

adjusted dividend payout ratios and the independent variables. Other than the industry-

adjusted dividends/earnings ratio, all of the dividend payout ratios are significantly and

negatively correlated with control divergence (

Diverge

), suggesting that ultimate owners

with a large control divergence pay lower dividends, which is inconsistent with the

findings of Faccio et al. (2001). However, as other determinants may influence dividend

payouts, this issue is examined further in the multivariate analyses. Most of the dividend

payout ratios are significantly and negatively correlated with the firm-specific control

variables, such as growth, size, and leverage, which is generally consistent with previous

studies.