媒體聲譽對企業社會責任得獎企業其股市表現與財務績效之影響

98

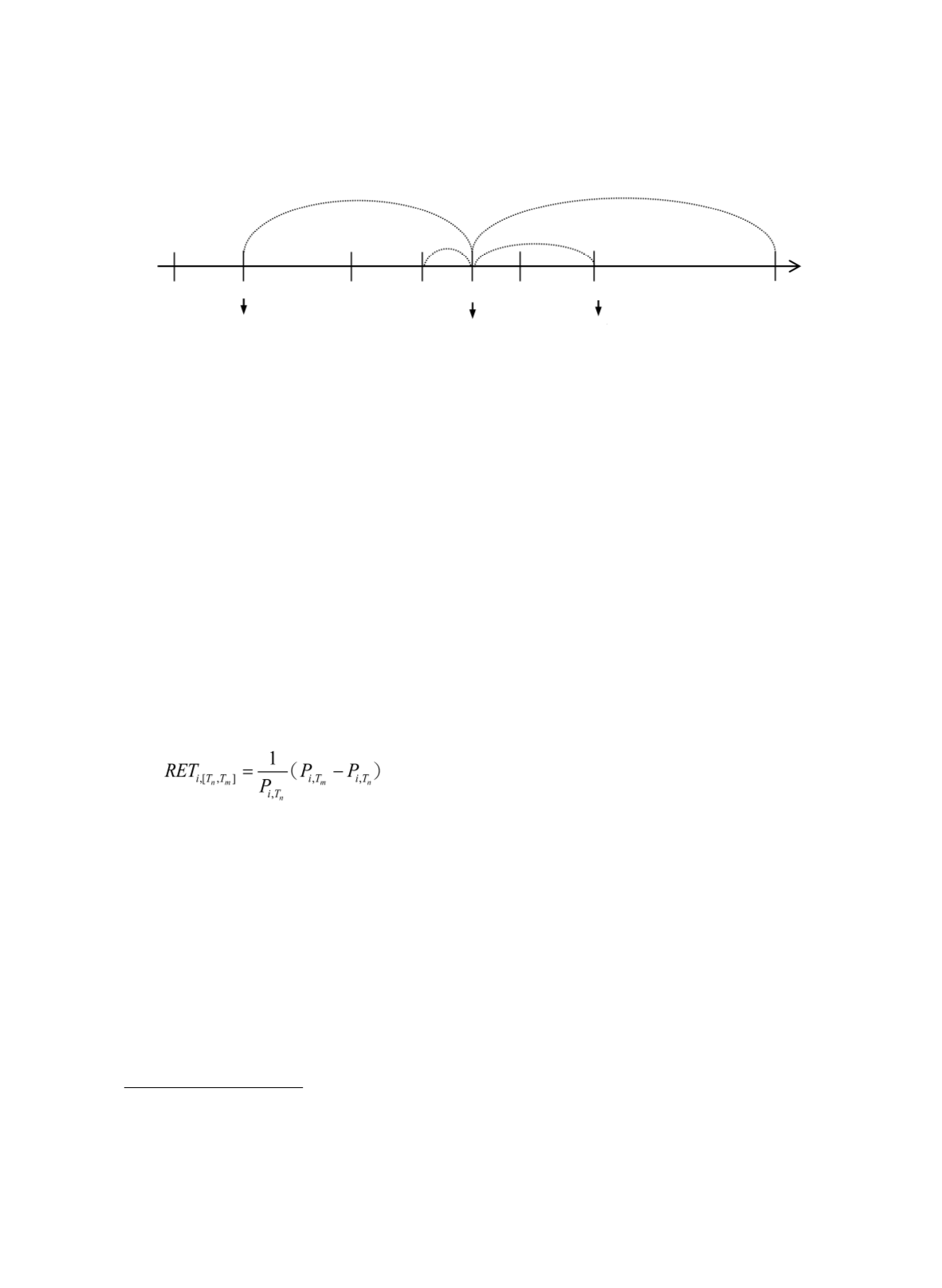

3.2 Stock Return and Cumulative Abnormal Return Measures

In addition to financial performance, we also examine the relationships between CSR

and stock market performance. The stock returns are calculated by Equation (1):

(1)

where

P

i,Tn

and

P

i,Tm

are the stock price of the

i

th

firm on day

T

n

and

T

m

adjusted for the

problems of ex-rights and ex-dividends;

13

and

RET

i

are the stock returns of the

i

th

firm

around the CSR announcement date period [

T

n

,

T

m

].

Abnormal returns (AR) are constructed based upon the ordinary least-squares risk-

adjusted returns model (Shen and Lee, 2000) with the event date being the CSR award

announcement date.

14

Following the ordinary least-squares risk-adjusted returns model, the

expected returns of firm

i

are the market returns on day

t

.

t

3

= 68

Quarterly Financial

Statement Announcement

(prior to CSR awards)

Quarterly Financial

Statement Announcement

(after CSR awards)

CSR Awards

Announcement

-T

4

-T

3

-T

2

-T

1

T

0

T

1

T

2

T

4

t

1

= 5

t

2

= 29

t

4

= 90

Figure 1 CSR Announcement Timeline

Note:

T

0

refers to the CSR award announcement in the current year; –

T

1

and

T

1

refer to the pre- and

post-CSR award short-term periods, which are about five trading days (

t

1

);

T

2

refers to the

quarterly financial statement announcement period following the CSR announcement, which is

an average of about 29 trading days (

t

2

); –

T

3

refers to the quarterly financial statement

announcement period prior to the CSR announcement, which is an average of about 68 trading

days (

t

3

); and –

T

4

and

T

4

refer to the long-term period, which is about 90 trading days (

t

4

).

13 Refer to the TEJ database:

(http://www.tej.com.tw/webtej/tej_doc/a_tejmain/g_wprcd4.htm#_top) for

the detailed calculation of the stock returns adjusted for ex-rights and ex-dividends.

14 The abnormal returns and cumulative abnormal returns are calculated based upon the TEJ event study

(http://www.tej.com.tw/twsite/Default.aspx?TabId=358)