以參考一籃子貨幣為名:人民幣匯率機制之驗證

88

Verifying the Renminbi Exchange Rate Regime

Purpose/Objective

There has been a world-wide focus on the global imbalance and China’s exchange rate

policy since early 2000’s. It is widely believed that the undervalued Chinese currency is the

main reason that China has had a growing current account surplus and the U.S. has

experienced the biggest rise in imports from China. Consequently, China has been pressured

by the U.S. and other countries to revalue its currency and have a more flexible exchange

rate regime. On July 21st of 2005, the long-awaited change in China’s exchange rate policy

has come. On that day, the People’s Bank of China revalued the RMB by 2.1% and adopted a

managed floating exchange rate regime with reference to a basket of currencies. China’s

announced change in exchange rate policy has led to a surge of research interest in verifying

its new currency regime. This paper uses the state space modeling to investigate the

evolution of China’s new exchange rate regime, considering all the 11 currencies disclosed

by Governor Zhou Xiaochuan of the PBC as the component currencies of the RMB basket.

In particular, we examine if there are shifts in the RMB basket weights from the US dollar to

other currencies such as the Euro, the Japanese yen, and the Korean won.

Design/Methodology/Approach

A strand of literature has focused on inferring the weights of the anchor currencies in a

country’s currency basket. These works use a linear regression model to estimate the implicit

weights of the anchor currencies. The weight-inference technique is popularized by Frankel

and Wei (1994) and has been extensively used in the literature. With the growing importance

of China’s economy, there has been a surging research interest in verifying China’s de facto

exchange rate regime, for example, Ogawa and Sakane (2006), Yamazaki (2006), Frankel

(2009), Fidrmuc (2010), and Fang et al. (2012). The majority of these studies employ the

weight-inference technique.

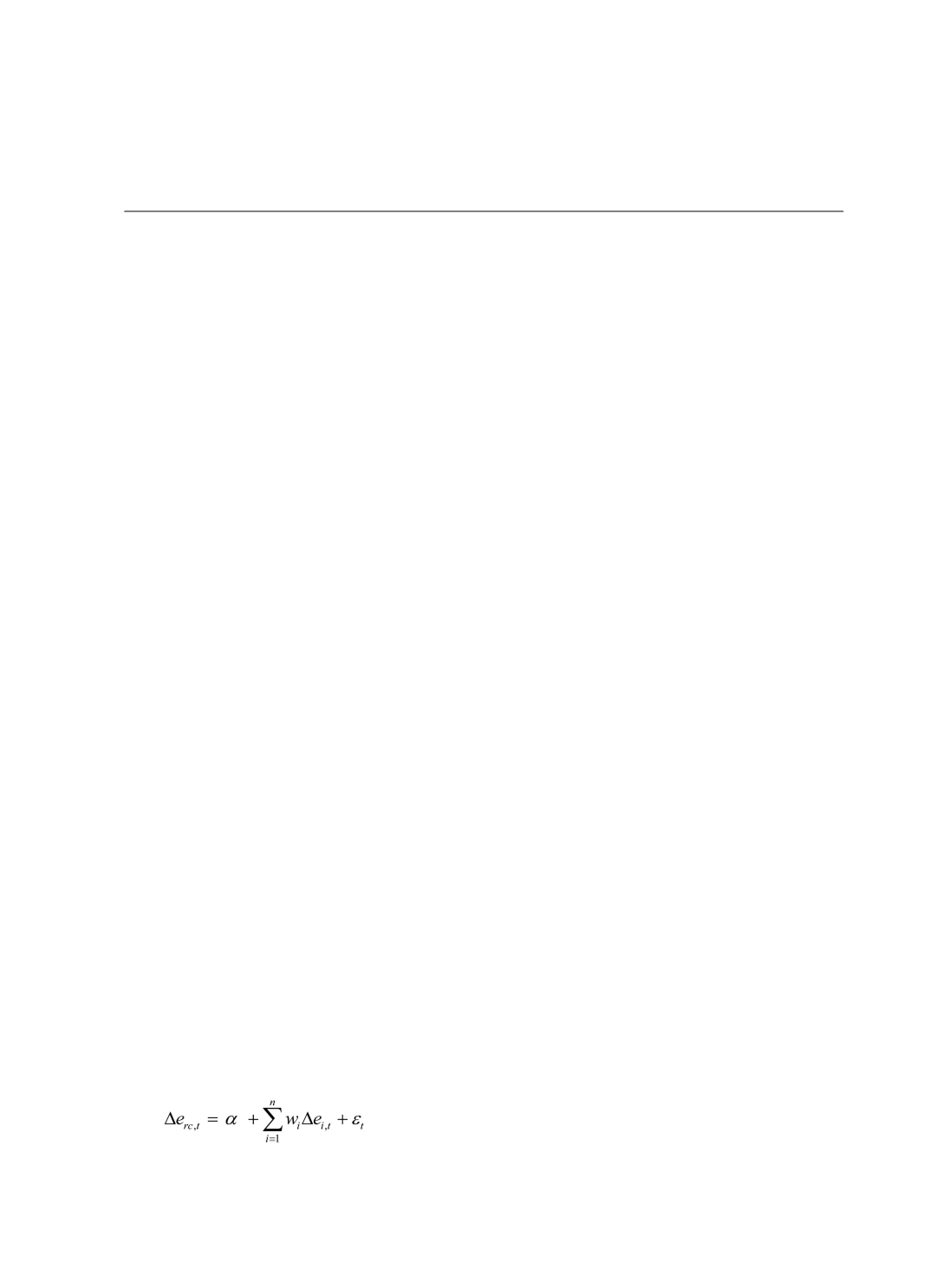

To infer the weights in the currency baskets, Frankel and Wei (1994) propose a

specification in the log differenced form:

(1)

Jyh-Dean Hwang

, Associate Professor, Department of International Business, National Taiwan University