臺大管理論叢

第

27

卷第

1

期

379

members, and the value of 0 otherwise.

EQUCOMP =

α+β

1

FREE_TOBIN+β

2

OVERLAP_AUCOMP+β

3

OTHER_EXE+β

4

INGOV+β

5

EXGOV+β

6

CASHCOMP+β

7

BOARDSIZE+β

8

LNSALES+β

9

LIQ_CONSTRAINTS+β

10

STOCK_

RETURN+β

11

R&D+INDUSTRY DUMMIES+ε

(5)

Variable definitions are summarized in Table 2.

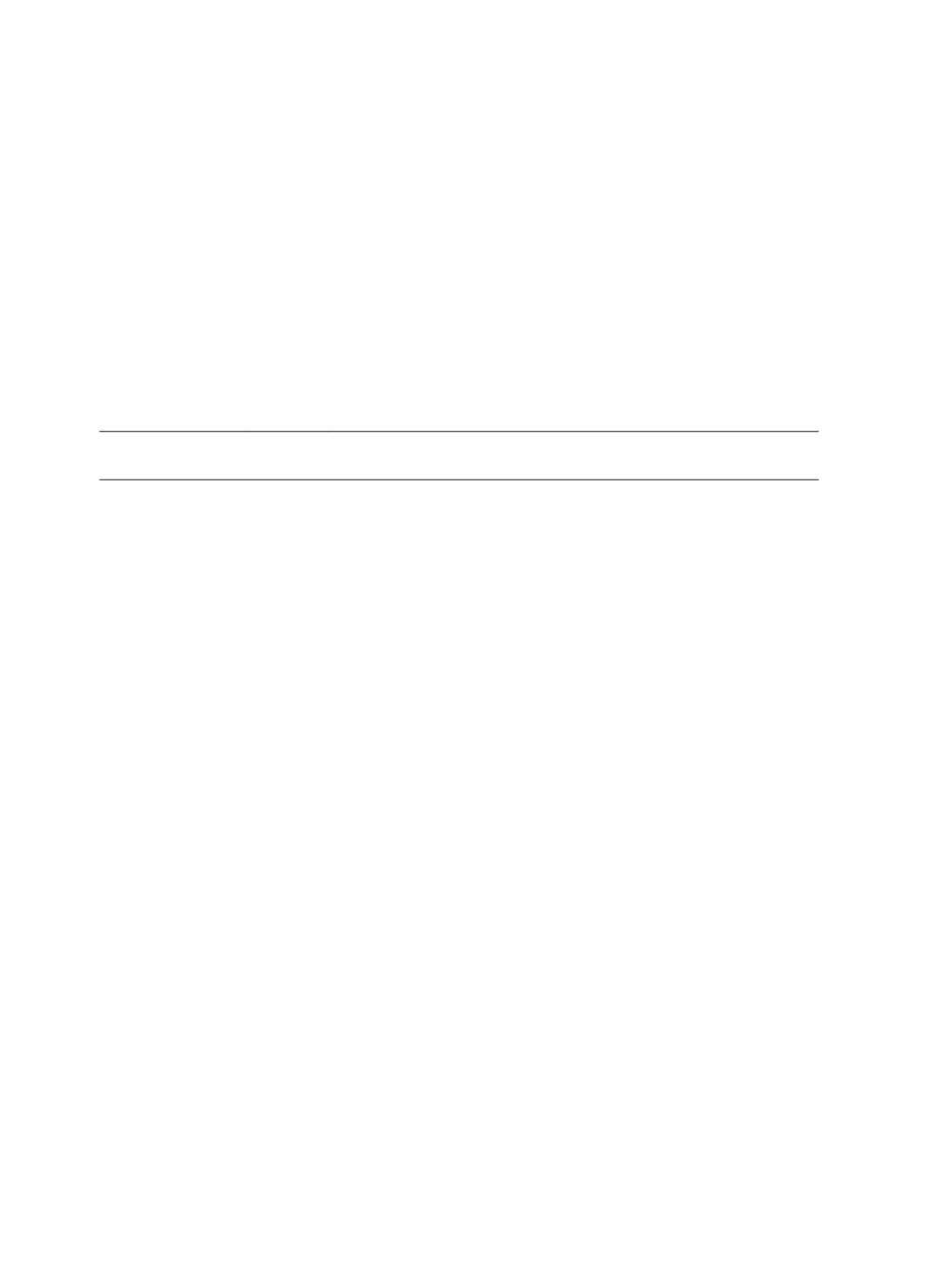

Table 2 Variable Definitions

Variable

Expected

Sign

Variable Definition

Dependent Variable

EQUCOMP

A dummy variable equal to 1 if the company grants equity-based

compensation to at least one of its audit committee members, and 0

otherwise.

Independent

Variables

FREE_TOBIN

-

Interaction between the company’s free cash flow and its growth

opportunity, proxied by

Tobin’s Q

.

Tobin’s Q

is coded to 1 if it is

smaller than the industry median in the year, and 0 otherwise

OVERLAP_

AUCOMP

+

The number of overlapping audit and compensation committee

members divided by the number of compensation members

OTHER_EXE

-

The number of audit committee members receiving compensation

from other firms divided by the number of audit committee members

INGOV

?

The sum of the

CEO chair dummy

and the

CEO ownership dummy

.

The

CEO chair dummy

is a dummy variable that equals 1 if the CEO

is not the board chair and 0 otherwise. The

CEO ownership dummy

is a dummy variable that takes the value of 1 if the CEO ownership

share is lower than the median for the year across CEOs in the

sample and 0 otherwise. A larger number means better internal

governance

EXGOV

?

The sum of the scores of

Coverage

and

InsOwn

.

Coverage

means

the natural logarithm of the number of analysts following for the fiscal

year.

InsOwn

represents the institutional holding for the firm. These

two variables are ranked, divided into ten groups, scored from 10

(highest) to 1 (lowest) and added up. Higher number means better

external governance

CASHCOMP

-

Proportion of cash retainer to total compensation of the audit

committee

BOARDSIZE

? The number of directors on the board

LNSALES

? Natural logarithm of the company sales revenue of the year