臺大管理論叢

第

27

卷第

1

期

385

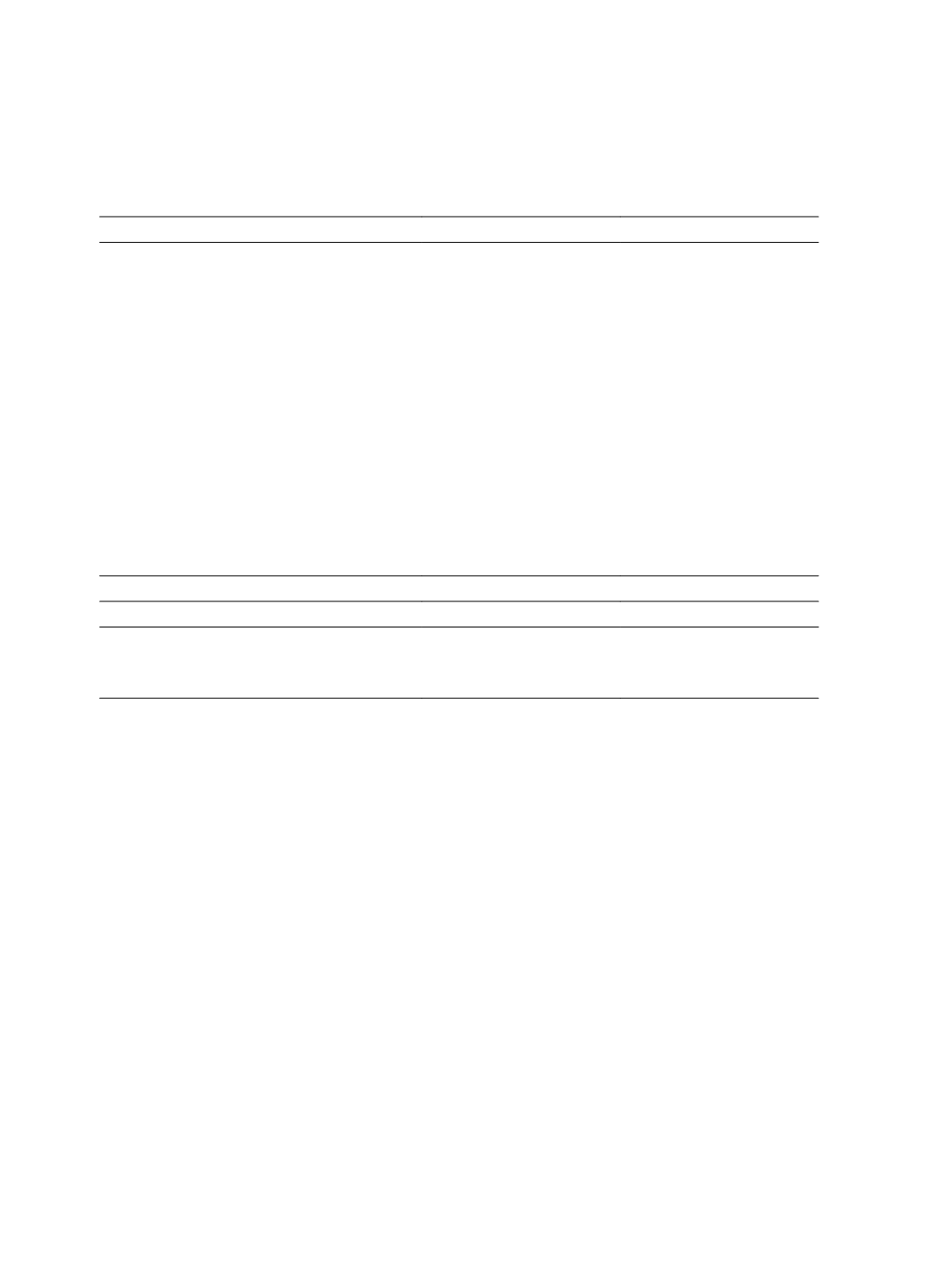

Table 6 Logistic Regression for the Occurrence of Equity-based Compensation for

Audit Committee

Variable

Coefficient

Z-statistic

FREE_TOBIN

-0.001***

(-3.26)

OVERLAP_AUCOMP

1.956***

(6.00)

OTHER_EXE

-0.405***

(-2.68)

INGOV

-0.450***

(-4.14)

EXGOV

0.060***

(2.87)

CASHCOMP

-10.414***

(-17.29)

BOARDSIZE

-0.008**

(-2.02)

LNSALES

0.062

(0.37)

LIQ_CONSTRAINTS

6.936*

(1.45)

STOCK_RETURN

-6.556***

(-3.17)

R&D

27.905

(0.49)

Intercept

6.235***

(5.42)

Industry Indicator Included

Yes

Pseudo-R

2

25%

Number of Observations

5,259

Note: The table presents model coefficients, with the following indicators of significance of the

Z-statistic: *: significant at the 10% level; **: significant at the 5% level; ***: significant at the 1%

level. Variables are as defined in Table 2.

Most of the other control variables also reveal a significant association with the

dependent variable. The results of the corporate governance variables (

INGOV

and

EXGOV

)

are mixed.

INGOV

shows a significantly negative association (Coefficient = -0.450

Z-statistics = -4.14), suggesting that better internal governance structure leads firms to give

their audit committees cash retainers instead of stocks and options. On the other hand, the

results of

EXGOV

(Coefficient = 0.06, Z-statistics = 2.87) indicate that a better external

governance structure makes firms more likely to compensate audit committee members with

stocks and options. Because our external governance measure is constructed using

institutional ownership and analyst following, the results might suggest that these external

monitors, including institutional investors and analysts, prefer equity-based compensation for

audit committee members because stocks and options better align committee members’

interests with those of investors.

BOARDSIZE

and

STOCK RETURN

are significant and

negatively associated with equity-based compensation for audit committee members

(Coefficient = -0.008 and -6.556, Z-statistics = -2.02 and, -3.17, respectively). Not

surprisingly,

CASHCOMP

shows a significantly negative (Coefficient = -10.414, Z-statistics