臺大管理論叢

第

27

卷第

1

期

381

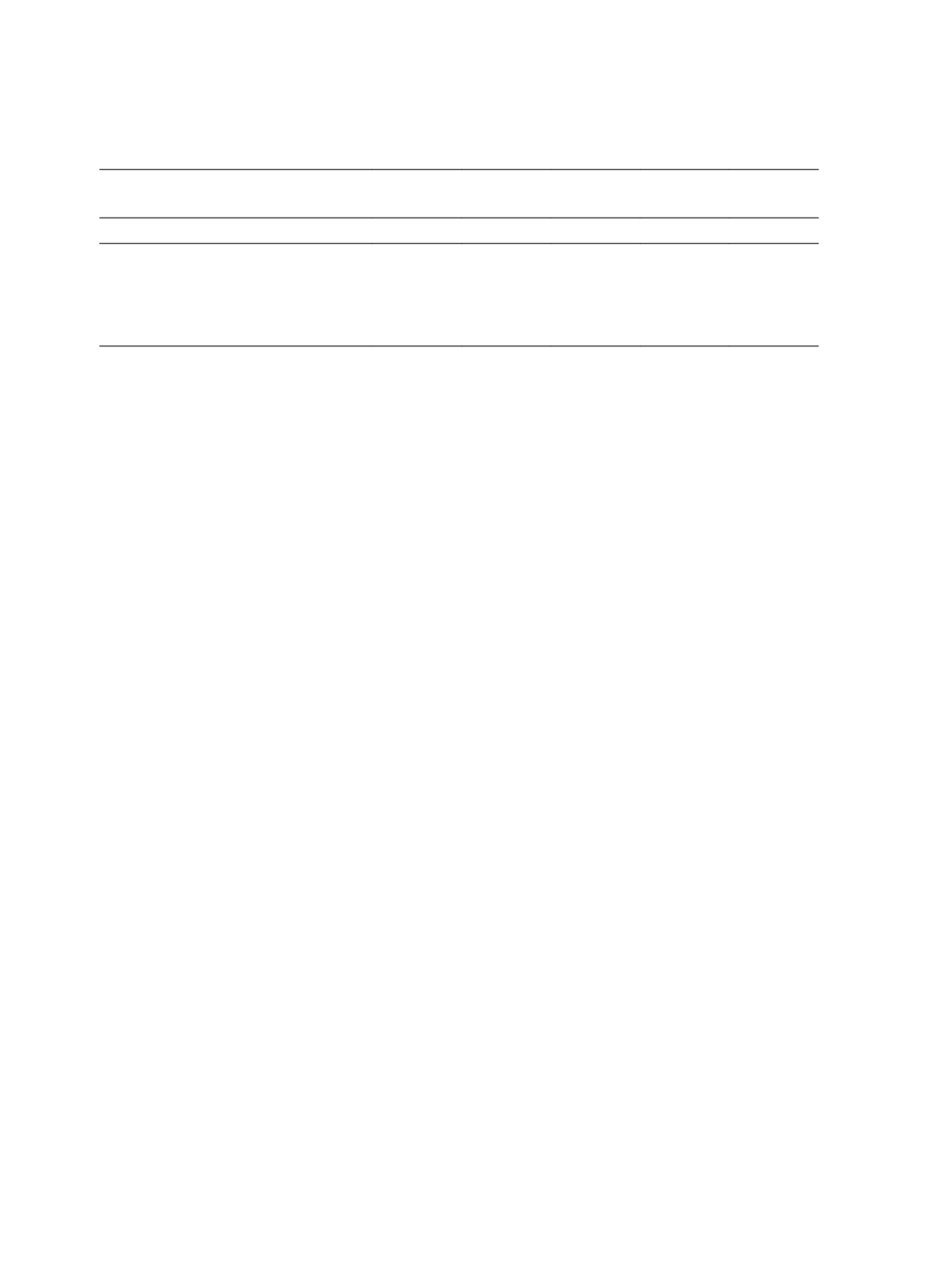

Variable

Mean Std. Dev.

25

Percentile

Median

75

Percentile

Financial-Control Variables

Sales (in millions)

7286.68 25574.64 608.17 1596.14 4803

Interest expense to sales

0.015

0.022

0.002

0.008

0.020

Stock return

0.010

0.036

0.008

0.011

0.029

R&D expense to sales

0.000

0.002

0

0

0

Table 4 shows the complete correlation matrix between the variables in the regression.

There is a significant positive correlation between the incidence of equity-based

compensation and board size, which suggests that if there are more directors on the board,

firms tend to compensate audit committee members with stock and options. The correlation

between the occurrence of equity-based compensation and the proportion of cash fees to total

compensation is negative, suggesting that if a company gives directors more cash, given a

fixed total compensation, the proportion of compensation in stock and options is less.

Internal corporate governance is significantly negatively correlated with equity-based

compensation, while external governance is significantly positively correlated with equity-

based compensation. The correlation between equity-based compensation (

EQUCOMP

) and

the proportion of audit committee members receiving compensation from other firms

(

OTHER_EXE

) is significantly positive, which is different from our expectation. The

insignificance of the correlation between

EQUCOMP

and

FREE_TOBIN

and

OVERLAP_

AUCOMP

and the contradictory results on the correlation between

OTHER_EXE

and

EQUCOMP

may result from the influence of omitted factors on the univariate correlation

test. In section 5.2, we conduct a multivariate regression analysis to control for other factors

that might affect audit committee members’ equity-based compensation.

We also compare characteristics of firms that compensate their audit committee

members with stocks and options to those of firms that do not. Table 5 presents the results of

this univariate analysis. The first and the second column present mean estimates of board,

governance, and firm characteristics for the two subsamples respectively. The third column

presents the absolute differences between the two subsamples and their significance.

The result shows that firms without equity pay tend to compensate their audit

committee members with cash. Also, CEOs in firms without equity-based compensation tend

to own more shares and have higher probability to be the chairman of the board than those in

firms with equity-based compensation. Stock return seems to be higher in firms that do not

pay equity-based compensation to audit committee members.