臺大管理論叢

第

27

卷第

1

期

375

in Table 1, yields a final sample of 5,259 observations. Financial statement data are from

Compustat, internal governance and audit committee and director compensation data are

from ExecuComp, stock return data are from CRSP, and external governance data are from I/

B/E/S and Thomson Reuters.

Table 1 Sample Selection Procedure

Firm-Year

Initial Sample from ExecuComp for 2006-2012

13,245

Missing GMI Ratings Data

(1,482)

Financial Firms

(2,486)

Utilities

(1,250)

Government Sectors

(34)

Missing Value in Variables

(2,734)

Final Sample

5,259

4.2 Variable Definition

4.2.1 Proxy for Agency Conflict (

FREE_TOBIN

)

We follow Liang, Stulz, and Walkling (1991), Doukas, Kim, and Pantzalis (2000), and

McKnight and Weir (2009) and use the interaction between the company’s free cash flow

and its growth opportunity (Tobin’s Q) to proxy for agency conflict. Agency conflict exists

when managers have the incentives and the ability to engage in activities that maximize their

own utility at the cost of shareholders. Free cash flow is cash flow in excess of cash that is

required to fund all projects that have positive net present values when discounted at the

relevant cost of capital. Jensen (1986) claims that conflicts are especially severe when

substantial free cash flow is generated in the organization, since the manager has more power

over using the cash. Agency conflicts grow when shareholders have to find a way to

motivate managers to disgorge the cash rather than waste it on organization inefficiencies or

invest it below the cost of capital (Lehn and Poulsen, 1989). In our study, free cash flows are

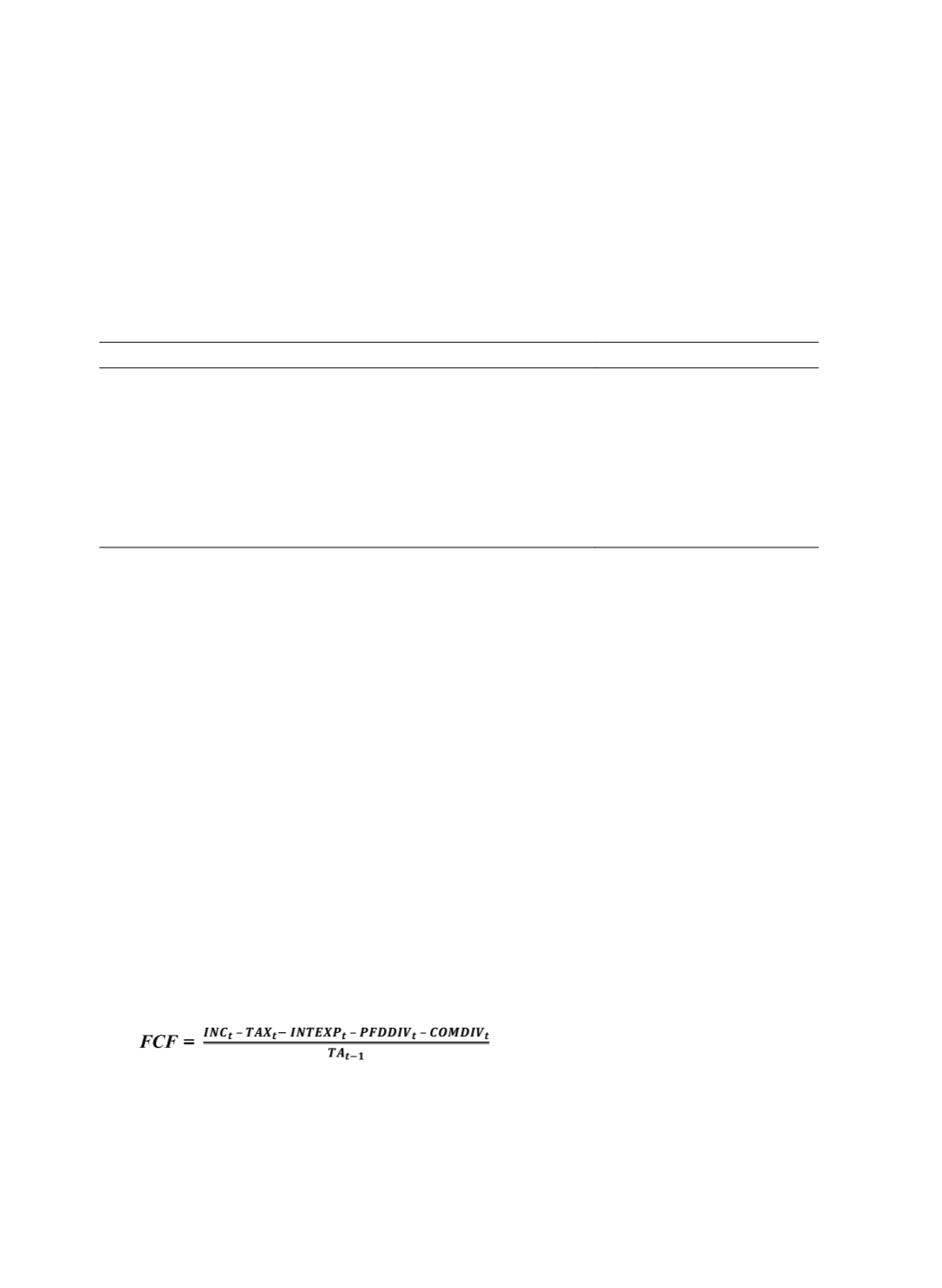

calculated by the equation below, based on the definition of Lehn and Poulsen (1989):

(1)

where

INC

t

= operating income before depreciation (Compustat data item

OIBDP

)