審計委員會權益薪酬之決定因素

376

TAX

t

= total income taxes (Compustat data item

TXT

)

INTEXP

t

= gross interest expense on short- and long-term debt (Compustat data item

XINT

)

PFDDIV

t

= total amount of preferred dividend requirement on cumulative preferred

stock and dividends paid on noncumulative preferred stock (Compustat

data item

PDVC

)

COMDIV

t

= total dollar amount of dividends declared on common stock (Compustat

data item

CDVC

)

TA

t-1

= book value of total assets in the beginning of the fiscal year (Compustat data

item

AT

)

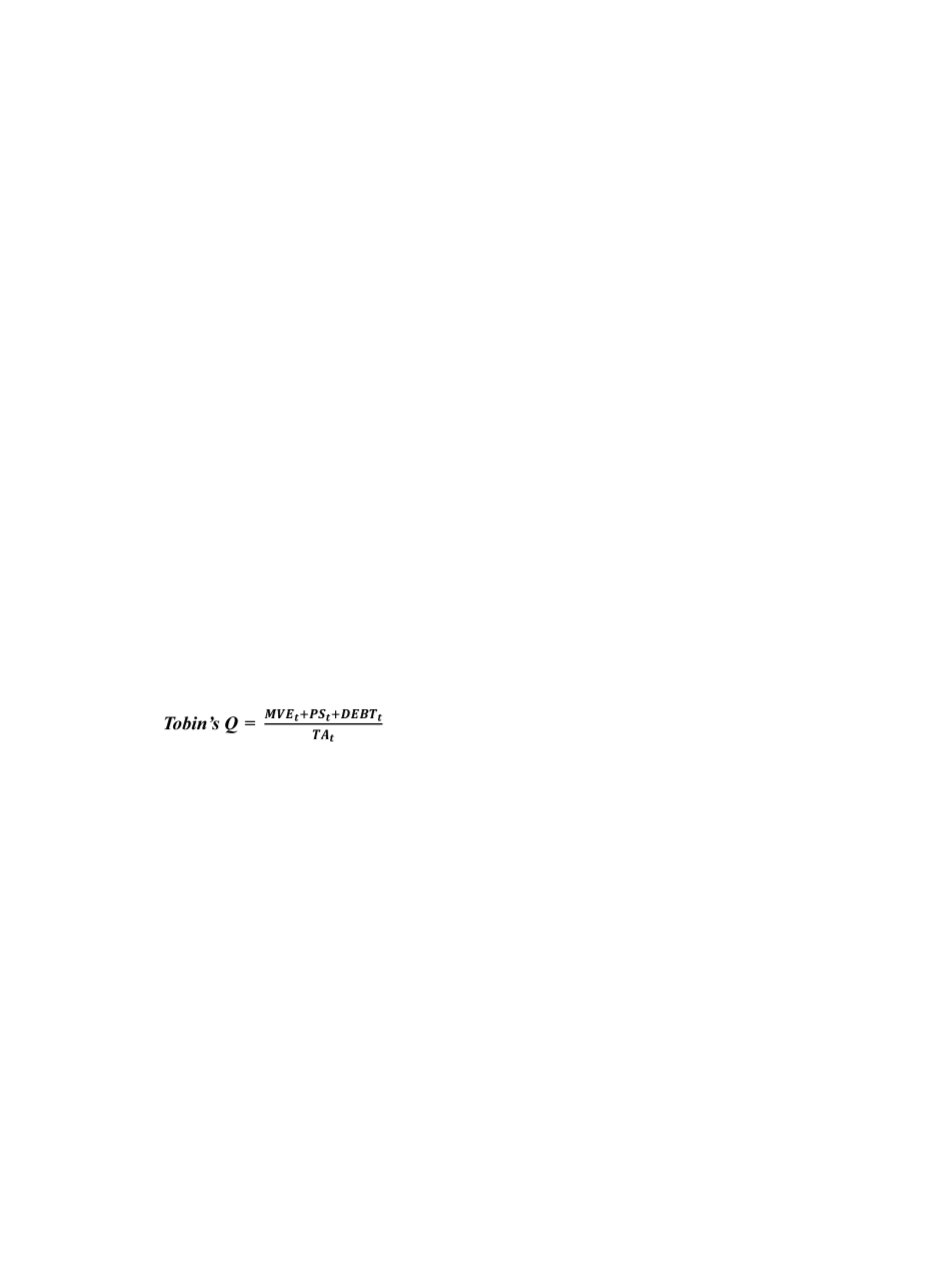

Opler and Titman (1993) argue that firms with higher growth prospects are less likely to

have excess free cash flow because the available cash will be spent on positive net present

value projects. Therefore, these firms have less agency conflict. On the other hand, firms

with low growth prospects are susceptible to having more agency conflict since these

companies are more likely to waste free cash flow in projects with negative net present

value. We use Tobin’s Q to proxy for growth opportunity, following the computational

procedures of Chung and Pruitt (1994):

(2)

where

MVE

t

= the product of share price and number of common shares outstanding

(Compustat data item

MKVALT

)

PS

t

= the liquidating value of outstanding preferred stock (Compustat data item

PSTKL

)

DEBT

t

= the value of short-term liabilities net of short-term assets, plus book value of

long-term debt (Compustat data item

LT

)

TA

t

= the book value of total assets (Compustat data item

AT

)

The Tobin’s Q of the firm is compared to the median of its industry (classified by

2-digit SIC codes) in that year. If the Tobin’s Q of the firm is smaller than the industry

median, the indicator

TOBIN

takes the value of 1, representing lower growth opportunity,

and the value of 0, otherwise.

Our agency conflict proxy,

FREE_TOBIN

, is the interaction between

FCF

and

TOBIN.