臺大管理論叢

第

26

卷第

3

期

165

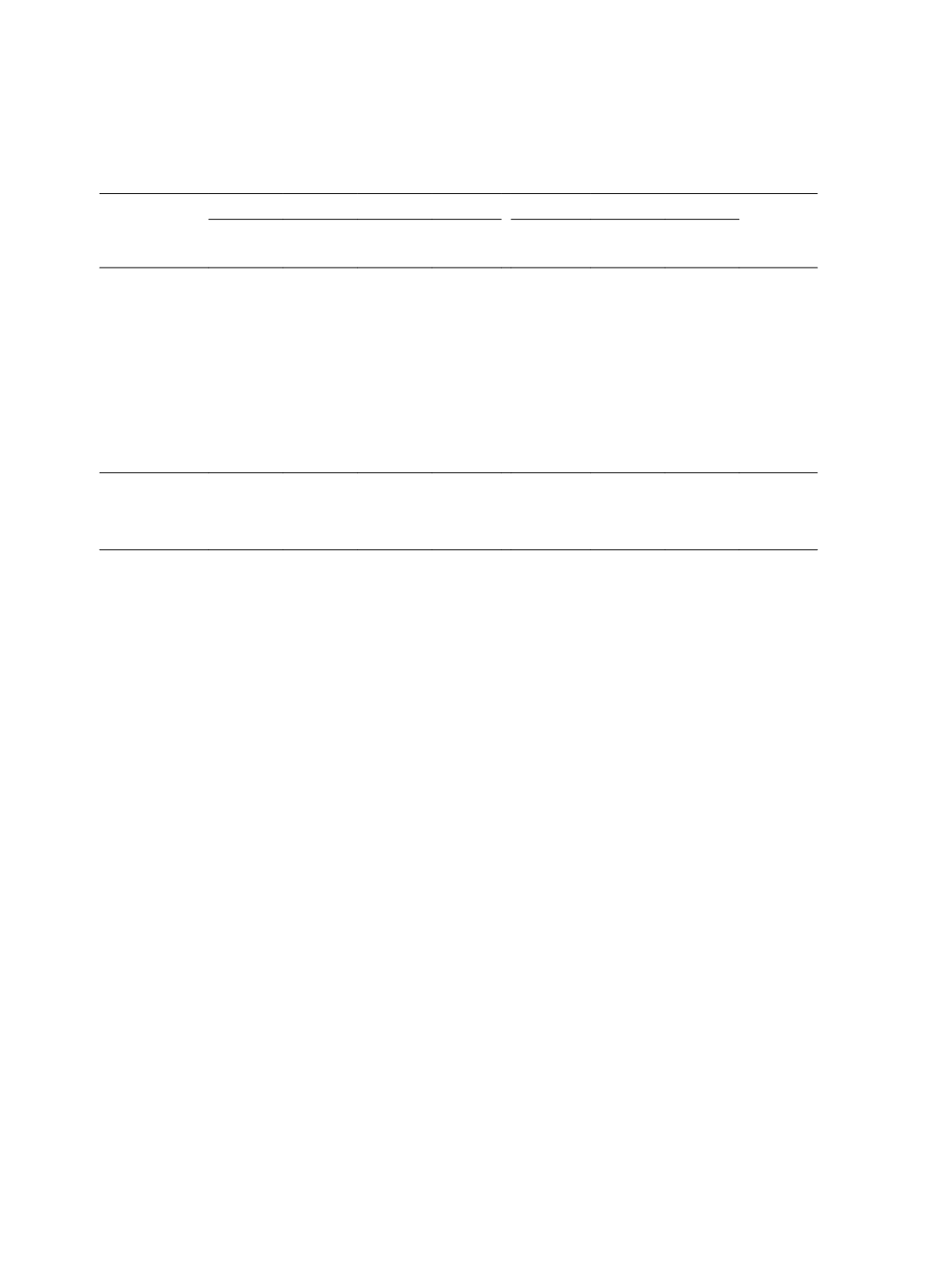

Table 2 Descriptive Statistics and Unit Root Tests

Variables

Open interest (,000)

Market depth (,000)

Volume

(,000)

OI

EOI

UOI

|

ΔOI

|

DEP

(Bid+Ask)

Bid

Ask

No. Obs.

2,226 2,205 2,205 2,225

2,226 2,226 2,226 2,226

Mean

47,631 47,807 138.82 2,097

323

161

162 63,668

Median

46,186 46,267 500 1,215

308

155

153 50,913

Std. dev.

15,429 14,967 3,701 3,217 140.09 70.84 72.27 39,349

Max.

90,765 89,539 12,475 31,192 1,046

519

700 289,303

Min.

11,636 12,098 -26,148 0

55

23

32

9,539

Skewness

0.20 0.21 -2.83 4.45

0.78

0.82 1.05 0.94

Kurtosis

2.62 2.58 17.14 27.67

3.93

4.19 5.51 3.70

Unit root tests

ADF

-9.67

a

-12.7

a

-46.89

a

-6.70

a

-5.78

a

-3.07 -5.31

a

-6.38

a

Lag number

0

18

0

24

4

14

6

9

Note:

OI

is the open interest,

EOI

is the expected component of open interest,

UOI

is the unexpected

open interest, |

ΔOI

| is the absolute of open interest changes, and market depth is the sum of

order size. All of open interest and volume variables are calculated using two near-month

contracts. The null hypothesis of unit root is tested by the ADF test with a constant term, linear

trend and lag terms suggested by the SBC. The table reports the t-statistics of ADF test, with

superscript a, b and c indicating significance at the 1%, 5% and 10% confidence levels,

respectively.

Summary statistics of market depths are reported in columns 6 through 8 of Table 2.

The ask depth series resembles the bid depth series in the first two moments of the

distribution, but with larger skewness and kurtosis. Since we do not distinguish the buy side

and sell side depth, the bid + ask depth is used in subsequent analysis. Finally, the unit root

tests in the last two rows in Table 2 suggest that each variable is a stationary series (i.e.,

I

(0)

series) except for the bid depth series. The ADF test in every variable rejects the null

hypothesis of one unit root at a 10% significance level.

4.2 Test Results of Open Interest Reflecting Participation

Table 3 presents the test results for implications (1) and (2) of Hypothesis 1 using

Model (1) and (2), respectively. For the results of Model (1), the level of open interest is

positively related to trading volume (

VOL

), depth (

DEP

), and Amivest ratio (

Amivest

) and

negatively associated with the Amihud illiquidity ratio (

ILLQ

). All coefficients of

OI

are

statistically significant except the regression for Amivest ratio. Results suggest that the

increase in open interest is accompanied by higher trading volume, greater depth provision,