期貨未平倉量的資訊內涵及其交易活動之研究

166

and smaller market impact costs. It supports the implication that open interest is positively

associated with market liquidity. Results are consistent with the hypothesis that open interest

reflects the participation of traders.

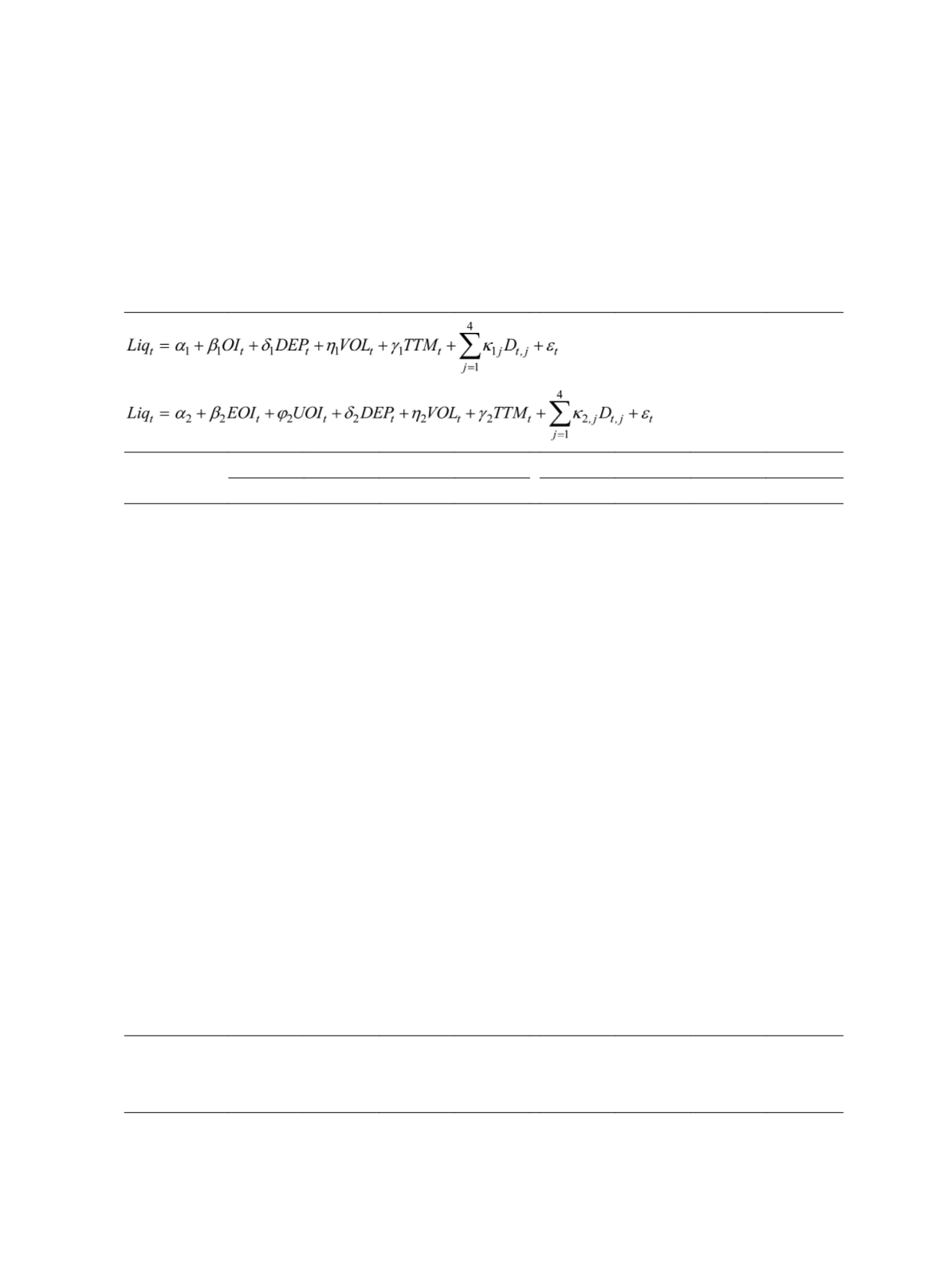

Table 3 Regressions of Liquidity Proxies on Open Interest of Index Futures

(1)

(2)

Liquidity

Proxies

Model (1)

Model (2)

VOL

DEP ILLQ Amivest

VOL

DEP ILLQ Amivest

Intercept (

α

)

-8,573

a

(-2.73)

361.50

a

(26.60)

465.63

a

(19.26)

-4,529

(-0.65)

-8,533

a

(-2.74)

361.25

a

(26.59)

465.57

a

(19.25)

-4,513

(-0.65)

OI

t

(

β

1

)

1.74

a

(45.45)

0.0006

b

(2.43)

-0.0032

a

(-7.72)

0.034

(0.29)

EOI

t

(

β

2

)

1.776

a

(46.01)

0.0006

c

(2.10)

-0.0031

a

(-7.47)

0.0223

(0.19)

UOI

t

(

φ

)

0.891

a

(5.47)

0.0018

b

(2.17)

-0.0038

b

(-3.01)

0.2104

(0.58)

DEP

t

(

δ

)

-58.64

a

(-14.23)

-0.1099

a

(-3.32)

33.40

a

(3.51)

-57.15

a

(-13.93)

-0.1094

a

(-3.30)

33.24

a

(3.49)

VOL

t

(

η

)

-0.0015

a

(-14.23)

-0.0012

a

(-7.26)

0.3456

a

(7.31)

-0.0014

a

(-13.93)

-0.0012

a

(-7.27)

0.348

a

(7.32)

TTM

t

(

γ

)

426.77

a

(6.90)

1.59

a

(5.13)

-0.5613

(-1.17)

-322.9

b

(-2.34)

356.80

a

(5.68)

1.67

a

(5.32)

-0.6112

(-1.25)

-309

b

(-2.20)

Monday (

κ

1

)

-2,204

(-1.23)

-18.10

b

(-2.03)

-2.79

(-0.20)

1,216

(0.31)

-2,511

(-1.41)

-17.62

b

(-1.97)

-3.05

(-0.22)

1,288

(0.32)

Tuesday (

κ

2

)

-466

(-0.26)

0.37

(0.04)

-14.63

(-1.08)

2,158

(0.55)

-563.96

(-0.32)

0.52

(0.06)

-14.71

(-1.08)

2,180

(0.56)

Thursday (

κ

3

)

2,977

b

(1.69)

-0.85

(-0.10)

-23.30

c

(-1.72)

-1,223

(-0.31)

337.57

(0.19)

2.72

(0.30)

-25.31

c

(-1.80)

-670

(-0.17)

Friday (

κ

4

)

1,067

(0.60)

-5.38

(-0.61)

-4.62

(-0.34)

-142.10

(-0.04)

597.22

(0.34)

-4.75

(-0.54)

-4.97

(-0.36)

-45.21

(-0.01)

H

0

: All

κ1j

= 0 1.22

1.49

1.14

0.22

1.02

1.56

1.14

0.18

H

0

:

β

2

=

ϕ

2

7.30

a

3.37

c

0.01

0.48

Adj. R

2

0.5577 0.1366 0.1468 0.0464 0.5590 0.1376 0.1464 0.0462

Note: The OLS regression Model (1) and (2) examine the implications of Hypothesis 1 by regressing

the proxies of liquidity variables on open interest. The dependent variables are

VOL

t

, (volume of