期貨未平倉量的資訊內涵及其交易活動之研究

162

would be consistent with implication (1) in Hypothesis 1.

We use Model (2) to test implication (2) that the “unexpected” component co-moves

with liquidity measures, particularly the depth measure.

EOI

and

UOI

in equation (2) are,

respectively, expected and unexpected open interest, decomposed from

OI

by the ARIMA

model as described in section 3.1. If

φ

2

, the coefficient of depth, for

DEP

regression is

significantly positive, the evidence would support implication (2) in Hypothesis 1.

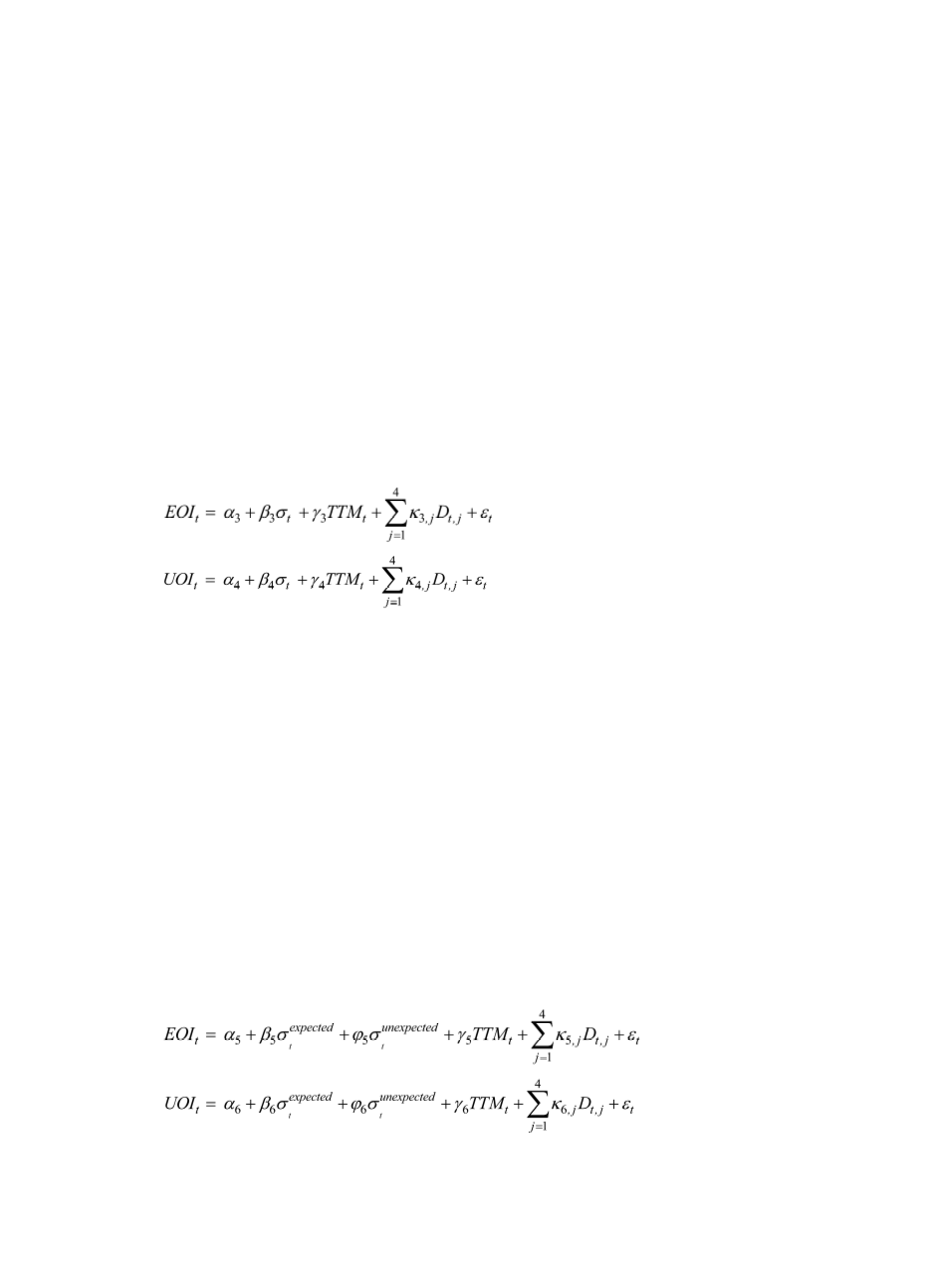

Hypothesis 2 generates implications about the relationship between open interest and

spot market volatility. To test the implication (3), we regress the expected open interest

against proxies of spot index volatility in Model (3) and the unexpected open interest against

the spot volatility in Model (4). The regression models are specified as:

(3)

(4)

where

EOI

and

UOI

, respectively, stand for expected and unexpected component of open

interest. For spot market volatility (

σ

t

), we apply measures developed by Parkinson (1980),

Garman and Klass (1980) and Rogers and Satchell (1991), respectively and perform

regression for each volatility measure independently (See footnote 7 for the definition of the

three volatility measures). Both Model (3) and (4) include days to expiration (

TTM

) and day-

of-week dummies (

D

j

) as control variables. The finding of positive and significant

β

3

and

β

4

supports the positive association between open interest and spot market volatility predicted

by implication (3).

Implication (4) stresses that open interest increases with unexpected volatility. To test it,

we perform similar regressions to Model (3) and (4) but separate the spot volatility into

expected volatility and unexpected volatility.

(5)

(6)