臺大管理論叢

第

26

卷第

3

期

169

The effect of either expected volatility or unexpected volatility on the unexpected open

interest (

UOI

) is not confirmed. The coefficients for the unexpected volatility (

ϕ

6

) in the

three regressions for Model (6) are not statistically significant. It is consistent with Model (4)

that volatility is less correlated with unexpected open interest.

In sum, we find that the expected open interest is significant correlated with the

predicted volatility and volatility shock, whereas the unexpected open interest is not. Results

in general support Hypothesis 2, that open interest contains information about the latent

hedging demand.

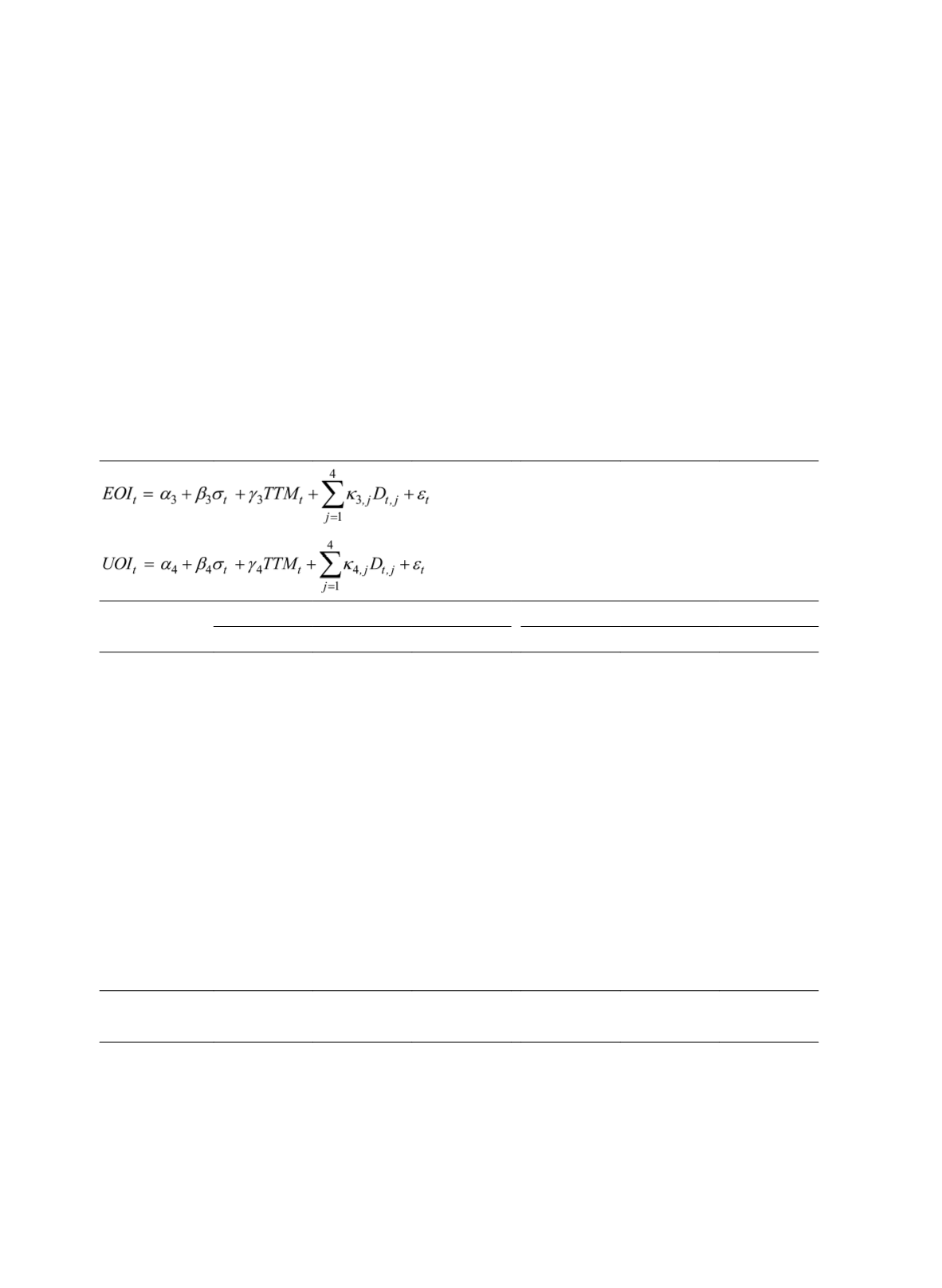

Table 4 Regressions of Open Interest on Spot Index Volatility

(3)

(4)

Volatility

Proxies

Model (3)

Model (4)

Parkinson

t

GK

t

RS

t

Parkinson

t

GK

t

RS

t

Intercept (

α

)

50,170

a

(49.77)

50,101

a

(49.67)

50,247

a

(49.96)

2,551

a

(10.95)

2,582

a

(11.07)

2,603

a

(11.20)

Volatility (

β

)

9.05

a

(3.63)

11.71

a

(3.86)

10.42

a

(3.45)

-0.19

(-0.33)

-0.64

(-0.91)

-0.996

(-1.43)

TTM

t

(

γ

)

-119.61

a

(-3.45)

-121.42

a

(-3.50)

-121.65

b

(-3.51)

-84.23

a

(-10.50)

-84.15

a

(-10.49)

-84.07

a

(-10.49)

Monday (

κ

1

)

-2,459b

(-2.42)

-2,431

b

(-2.39)

-2,413

b

(-2.37)

-472.57

b

(-2.01)

-473.03

b

(-2.01)

-474.66

b

(-2.02)

Tuesday (

κ

2

)

-691.29

(-0.69)

-698.12

(-0.70)

-704.15

(-0.70)

-134.77

(-0.58)

-133.88

(-0.58)

-132.38

(-0.57)

Thursday (

κ

3

)

251.00

(0.25)

198.66

(0.20)

174.70

(-0.70)

-3,087

a

(-13.37)

-3,083

a

(-13.35)

-3,076

a

(-13.32)

Friday (

κ

4

)

-2,230

b

(-2.23)

-2,262

b

(-2.26)

-2,268

b

(-2.26)

-639.51

a

(-2.76)

-637.21

a

(-2.75)

-634.66

a

(-2.74)

H

0

: All

κ

= 0

3.03

b

2.97

b

2.92

b

59.33

a

59.16

a

58.92

a

Adj. R

2

0.0128

0.0136

0.0122

0.1395

0.1398

0.1402

Note: The OLS regression Model (3) and (4) examine the implications of Hypothesis 2 by regressing

open interest on proxies of spot index volatility.

EOI

t

, and

UOI

t

are, respectively, the expected

and unexpected component of open interest partitioned from

OI

t

using ARIMA model, where

OI

t

is the open interest of the two nearest expiration futures contracts.

σ

is the spot volatility proxy,

which is measured by Parkinson (1980), Garman and Klass (1980) and Rogers and Satchell