期貨未平倉量的資訊內涵及其交易活動之研究

170

(1991) on trading date

t

, respectively. All of the spot volatility proxies are multiplied by 10

6

.

TTM

t

is the time-to-maturity (in days) of the highest open interest futures contracts.

D

j

(

j

= 1, 2, 3, 4)

are the four daily dummies for the day-of-the-week effect. Numbers in parentheses for

regression coefficients are t-values. The statistics of H

0

are the F-values. The superscript a, b

and c indicate significance at the 1%, 5% and 10% confidence levels, respectively.

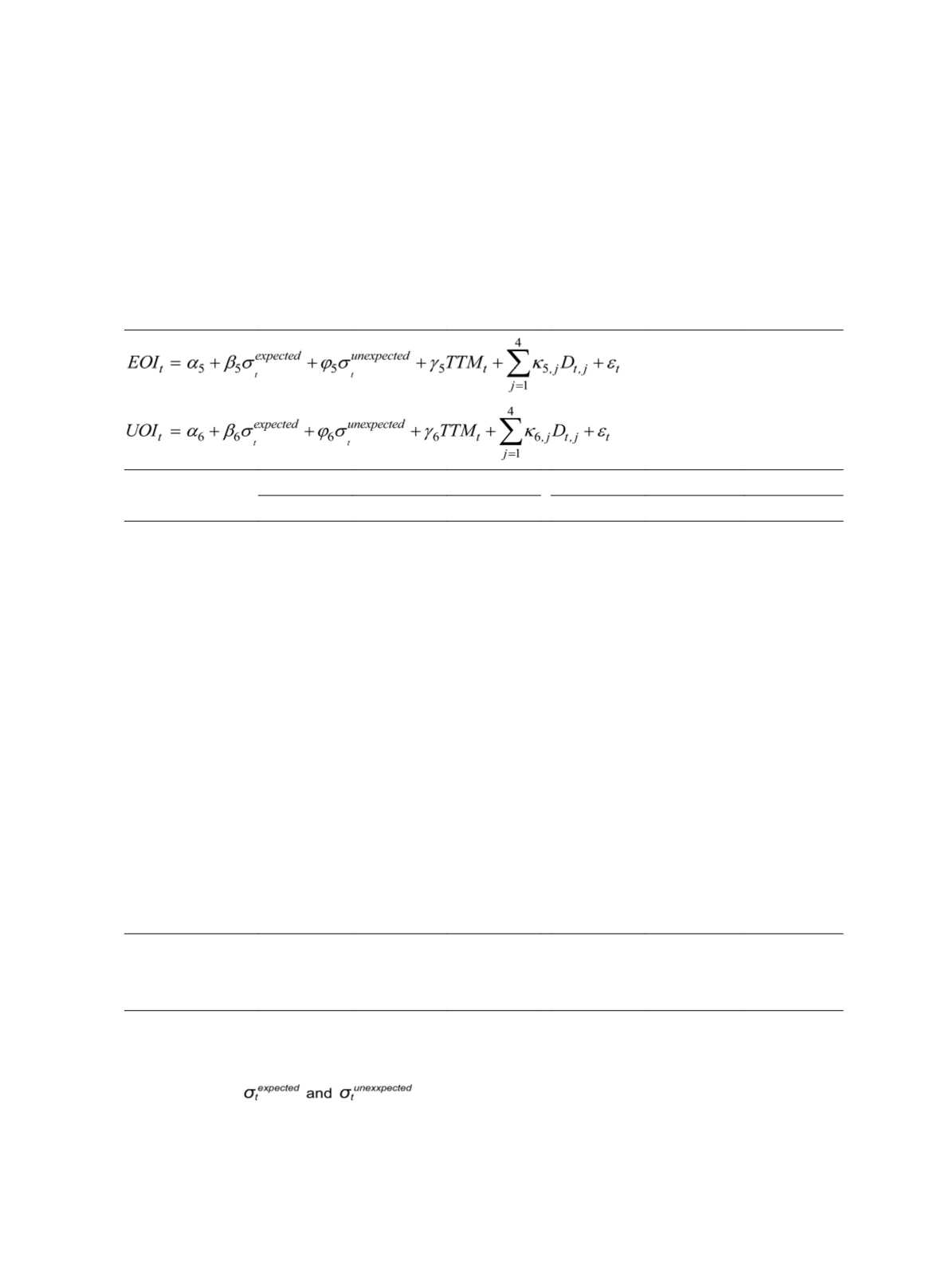

Table 5 Regressions of Open Interest on Expected and Unexpected Spot Volatility

(5)

(6)

Volatility Proxies

Model (5)

Model (6)

Parkinson

t

GK

t

RS

t

Parkinson

t

GK

t

RS

t

Intercept (

α

)

49,047

a

(45.23)

49,083

a

(44.61)

49,243

a

(45.35)

2,735

a

(10.90)

2,814

a

(11.06)

2,778

a

(11.06)

Volatility

Expected (

β

)

14.20

a

(4.58)

17.59

a

(4.44)

16.75

a

(4.21)

-1.03

(-1.44)

-1.98

b

(-2.16)

-2.10

b

(-2.28)

Unexpected (

φ

)

6.28

b

(2.35)

9.06

a

(2.79)

8.13

b

(2.58)

0.26

(0.42)

-0.036

(-0.05)

-0.60

(-0.82)

TTM

t

(

γ

)

-121.17

a

(-3.50)

-123.32

a

(-3.56)

-123.98

b

(-3.58)

-83.97

a

(-10.48)

-83.71

a

(-10.45)

-83.66

a

(-10.44)

Monday (

κ

1

)

-2,461

a

(-2.43)

-2,506

b

(-2.47)

-2,523

b

(-2.48)

-472.18

c

(-2.01)

-456.14

c

(-1.94)

-455.53

c

(-1.94)

Tuesday (

κ

2

)

-669.43

(-0.67)

-761.11

(-0.76)

-781.73

(-0.78)

-138.34

(-0.60)

-119.52

(-0.52)

-118.86

(-0.51)

Thursday (

κ

3

)

299.80

a

(0.30)

185.26

(0.19)

158.04

(0.16)

-3,095

a

(-13.41)

-3,080

a

(-13.35)

-3,073

a

(-13.32)

Friday (

κ

4

)

-2,216

b

(-2.21)

-2,251

b

(-2.25)

-2,274

b

(-2.27)

-641.85

a

(-2.77)

-639.76

a

(-2.76)

-633.64

a

(-2.74)

H

0

:

β

i

=

ϕ

i

7.74

a

5.31

b

5.94

b

3.86

b

5.16

b

3.38

c

H

0

: All

κ

= 0

3.10

b

3.03

b

3.03

b

59.66

a

59.44

a

59.17

a

Adj. R

2

0.0159

0.0155

0.0145

0.1406

0.1414

0.1412

Note: Regressions (5) and (6) are used to examine the implications of Hypothesis 2. The dependent

variables are

EOI

t

and

UOI

t

are, respectively, the expected and unexpected component of open

interest partitioned from

OI

t

using ARIMA model, where

OI

t

is the two nearest expiration futures

contracts.

are, respectively, the expected and unexpected component

of spot volatility proxy, which is measured by Parkinson (1980), Garman and Klass (1980) and

Rogers and Satchell (1991) in different regressions. All of the spot volatility proxies are multiplied

by 10

6

, and each spot volatility proxy is partitioned into the expected and unexpected volatilities