Page 53 - 34-3

P. 53

NTU Management Review Vol. 34 No. 3 Dec. 2024

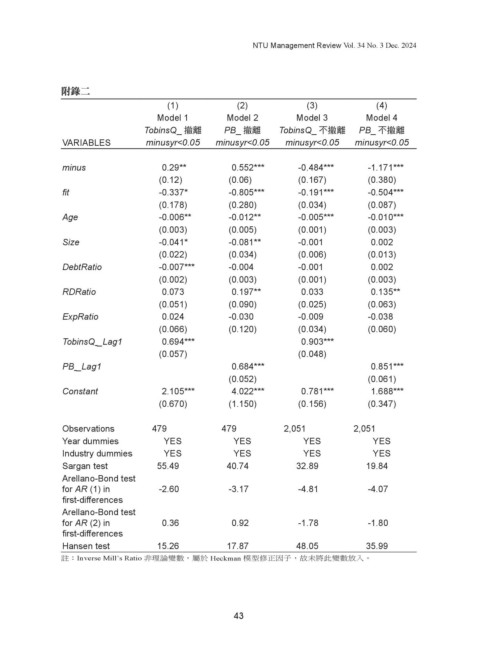

附錄二

(1) (2) (3) (4)

Model 1 Model 2 Model 3 Model 4

TobinsQ_ 撤離 PB_ 撤離 TobinsQ_ 不撤離 PB_ 不撤離

VARIABLES minusyr<0.05 minusyr<0.05 minusyr<0.05 minusyr<0.05

minus 0.29** 0.552*** -0.484*** -1.171***

(0.12) (0.06) (0.167) (0.380)

fit -0.337* -0.805*** -0.191*** -0.504***

(0.178) (0.280) (0.034) (0.087)

Age -0.006** -0.012** -0.005*** -0.010***

(0.003) (0.005) (0.001) (0.003)

Size -0.041* -0.081** -0.001 0.002

(0.022) (0.034) (0.006) (0.013)

DebtRatio -0.007*** -0.004 -0.001 0.002

(0.002) (0.003) (0.001) (0.003)

RDRatio 0.073 0.197** 0.033 0.135**

(0.051) (0.090) (0.025) (0.063)

ExpRatio 0.024 -0.030 -0.009 -0.038

(0.066) (0.120) (0.034) (0.060)

TobinsQ _Lag1 0.694*** 0.903***

(0.057) (0.048)

PB _Lag1 0.684*** 0.851***

(0.052) (0.061)

Constant 2.105*** 4.022*** 0.781*** 1.688***

(0.670) (1.150) (0.156) (0.347)

Observations 479 479 2,051 2,051

Year dummies YES YES YES YES

Industry dummies YES YES YES YES

Sargan test 55.49 40.74 32.89 19.84

Arellano-Bond test

for AR (1) in -2.60 -3.17 -4.81 -4.07

first-differences

Arellano-Bond test

for AR (2) in 0.36 0.92 -1.78 -1.80

first-differences

Hansen test 15.26 17.87 48.05 35.99

註:Inverse Mill’s Ratio 非理論變數,屬於 Heckman 模型修正因子,故未將此變數放入。

43