97

臺大管理論叢

第

28

卷第

1

期

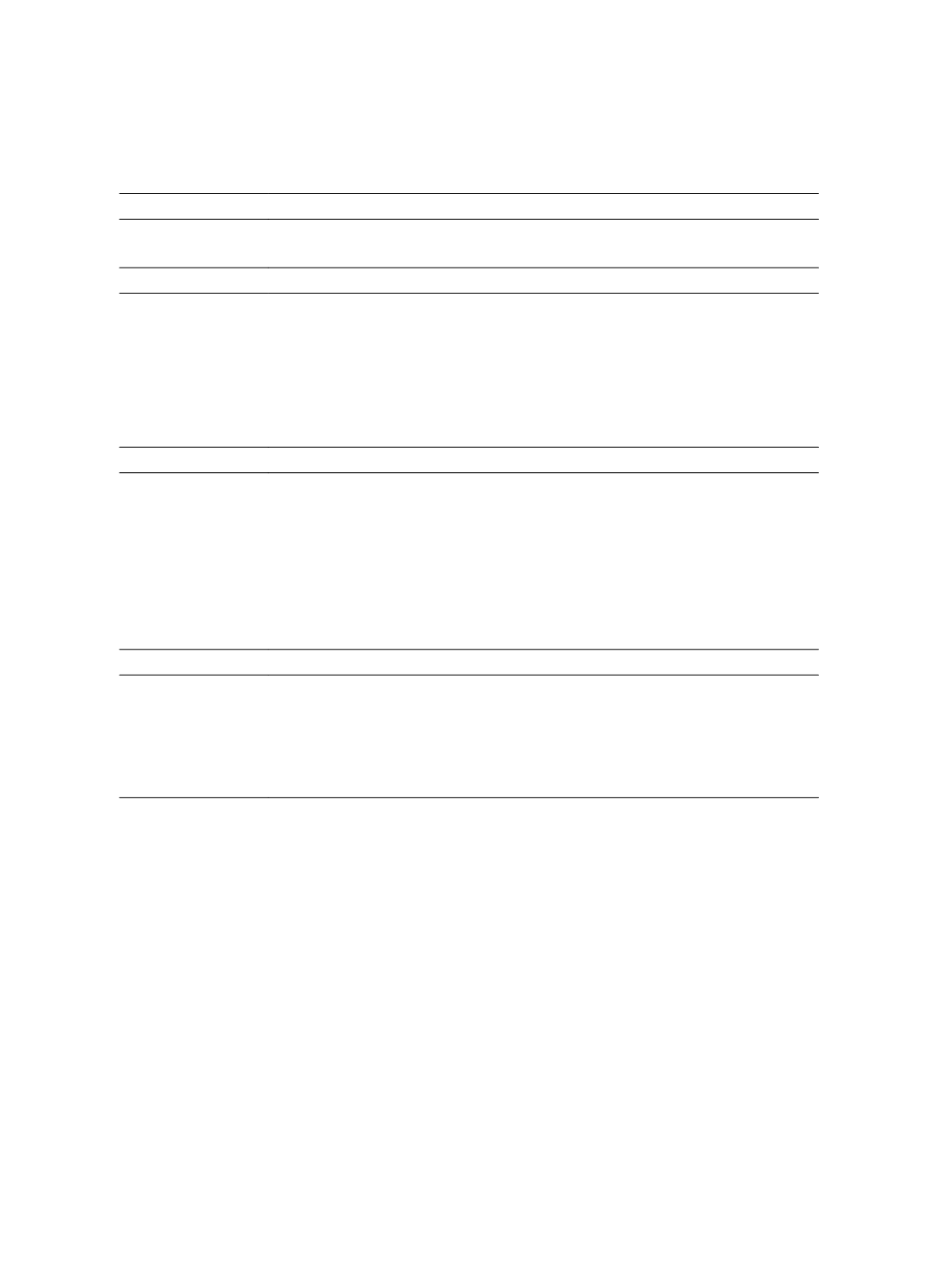

Table 2 Variable Definitions

Variables

Definitions

CSR

CSR dummy which is equal to 1 if the firm wins CSR awards; equal to 0 for

non-CSR firms (pair-samples).

Performance Variables

ROA

Return on Assets (%): EBIT/Average Asset

×

100

ROE

Return on Equity (%): Net Income/Average Equity

×

100

GPM

Gross Profit Margin (%): Gross Profit/Net Sales

×

100

EPS

Net Income/Outstanding Shares

RET

Stock returns of ex-rights and ex-dividends in the Taiwan stock market.

CAR

Cumulative Abnormal Returns: Calculated by event study method.

Control Variables

TAT

Total Asset Turnover: Revenue/Average Assets

TA

Total Assets: ln(Current Assets + Long-term Investment + Fixed Assets +

Other Assets)

DR

Debt Ratio (%): Total Debt/Total Asset

×

100

TURN

Turnover: Volume/Outstanding Shares

MV

Market Value: ln(Outstanding Shares

×

Stock Price)

P/B

Price to Book Ratio: Market value per share/Book value per share

Media Proxies

MEDIA

Media Coverage: The average media coverage for individual firms (firms

mentioned in news reports).

SRso

Sentiment Ratio: The average sentiment ratio for individual firms by semantic

orientation (firms mentioned in news reports).

MR

Media Reputation:

MEDIA × SRso

Our examination in this study focuses on different periods in the relationships

between financial performance, equity market returns, and CSR performance.